Top Cash Back Credit Cards of 2025: Maximize Your Rewards and Savings

Introduction to Cash Back Credit Cards

Cash back credit cards have gained immense popularity among consumers looking to maximize their rewards and savings. These cards offer a straightforward way to earn money back on everyday purchases, making them appealing to a wide range of individuals. As we step into 2025, the options available in the market have expanded significantly, providing consumers with more opportunities to earn cash back on their spending. This article explores the top cash back credit cards of 2025, highlighting their features, benefits, and how you can leverage them to maximize your rewards.

What to Look for in a Cash Back Credit Card

Before diving into the specific cards, it's essential to understand what makes a cash back credit card worthwhile. Here are key factors to consider:

- Cash Back Rates: Look for cards that offer higher cash back percentages on categories where you spend the most, such as groceries, gas, or dining out.

- Sign-Up Bonuses: Many cards offer attractive sign-up bonuses for new customers, which can significantly boost your cash back earnings in the first few months.

- Annual Fees: Some cash back cards come with annual fees. Calculate whether the benefits outweigh the costs based on your spending habits.

- Redemption Options: Consider how easy it is to redeem your cash back rewards. Some cards offer flexible options, while others might have restrictions.

- Introductory Offers: Look for cards that offer 0% introductory APR on purchases and balance transfers, which can help you save on interest if you carry a balance.

Top Cash Back Credit Cards of 2025

1. Chase Freedom Flex

The Chase Freedom Flex is a standout choice for those who want a versatile cash back card. It offers 5% cash back on rotating categories each quarter, which can include categories like grocery stores, gas stations, and online shopping. Additionally, cardholders earn 3% on dining and 1% on all other purchases. The card also features a generous sign-up bonus, making it an excellent option for new users looking to maximize their rewards.

2. Discover it Cash Back

The Discover it Cash Back card is unique in that it matches all the cash back you earn in your first year as a new cardholder. This makes it an attractive option for those looking to earn a significant bonus. The card offers 5% cash back on rotating categories, similar to the Chase Freedom Flex, and 1% on all other purchases. Discover also has no annual fee, making it a cost-effective choice for savvy consumers.

3. Citi Double Cash Card

If you're looking for a straightforward cash back card with no rotating categories, the Citi Double Cash Card is an excellent choice. It offers 2% cash back on every purchase—1% when you buy and another 1% when you pay your bill. Additionally, there are no annual fees, making it a hassle-free option for anyone wanting to earn cash back consistently.

4. Capital One Quicksilver Cash Rewards Credit Card

The Capital One Quicksilver card is a great option for those who prefer simplicity. It offers a flat 1.5% cash back on all purchases, with no rotating categories or annual fees. Plus, new cardholders can earn a one-time cash bonus after spending a certain amount in the first few months. This card is perfect for individuals who want to earn cash back without keeping track of specific spending categories.

5. American Express Blue Cash Preferred Card

The American Express Blue Cash Preferred Card is ideal for families or individuals who spend heavily on groceries. It offers a whopping 6% cash back at supermarkets (up to a certain limit), 3% on gas stations and transit, and 1% on all other purchases. While it does have an annual fee, the high cash back rate on groceries can quickly offset the cost for regular shoppers.

Maximizing Your Cash Back Rewards

Simply having a cash back credit card is not enough; you need to strategize to maximize your rewards. Here are some tips to help you earn the most cash back possible:

1. Use the Right Card for the Right Purchase

Different cards offer varying cash back rates based on categories. Always use the card that offers the highest cash back rate for your purchases. For instance, use the Chase Freedom Flex for groceries during the quarter when that category earns 5% cash back, and switch to the Citi Double Cash for all other purchases.

2. Keep Track of Rotating Categories

For cards with rotating categories, such as the Chase Freedom Flex or Discover it Cash Back, keep a calendar or set reminders for when the categories change. This will ensure you don’t miss out on earning higher cash back rates.

3. Take Advantage of Sign-Up Bonuses

Many cash back cards offer lucrative sign-up bonuses for new customers. Make sure to meet the spending requirements to earn these bonuses, as they can provide a significant boost to your cash back earnings in the first few months.

4. Pay Your Balance in Full

To truly benefit from cash back cards, it’s crucial to pay your balance in full each month. Carrying a balance can lead to high-interest charges that may negate the benefits of your cash back rewards.

5. Use Cash Back for Essential Purchases

Consider using your cash back rewards for essential purchases or bills. Some cards allow you to apply your cash back toward your statement balance, making it a practical way to save on everyday expenses.

Conclusion: Choosing the Right Cash Back Credit Card for You

As we navigate through 2025, the landscape of cash back credit cards continues to evolve, offering consumers more opportunities to earn rewards and save money. The right card for you will depend on your spending habits, lifestyle, and financial goals. Whether you prefer a card with rotating categories, a flat-rate cash back option, or one that rewards your grocery shopping, there’s a card out there to meet your needs.

By carefully considering the features and benefits of each card, as well as employing strategies to maximize your rewards, you can make the most of your cash back credit card in 2025. Start comparing your options today and take the first step toward boosting your savings!

Explore

Maximize Your Savings in 2025: The Ultimate Guide to 0% Interest Credit Cards

Best Travel Credit Cards of 2025: Top Picks for Earning Rewards on Your Adventures

Maximize Savings in 2025: The Ultimate Guide to 0% APR Credit Card Balance Transfers

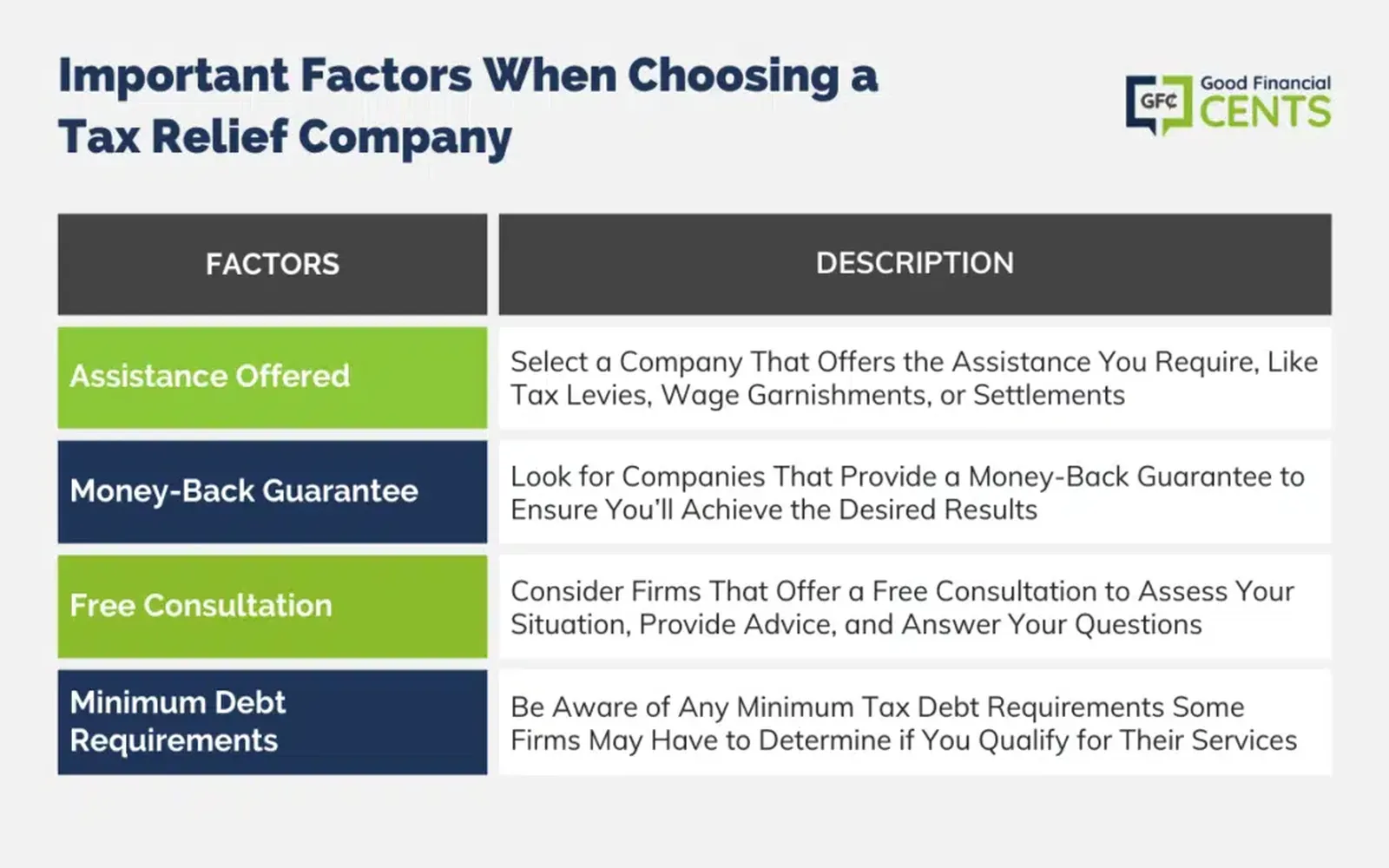

Discover Top Tax Relief Services Near You in 2025: Maximize Your Savings Today!

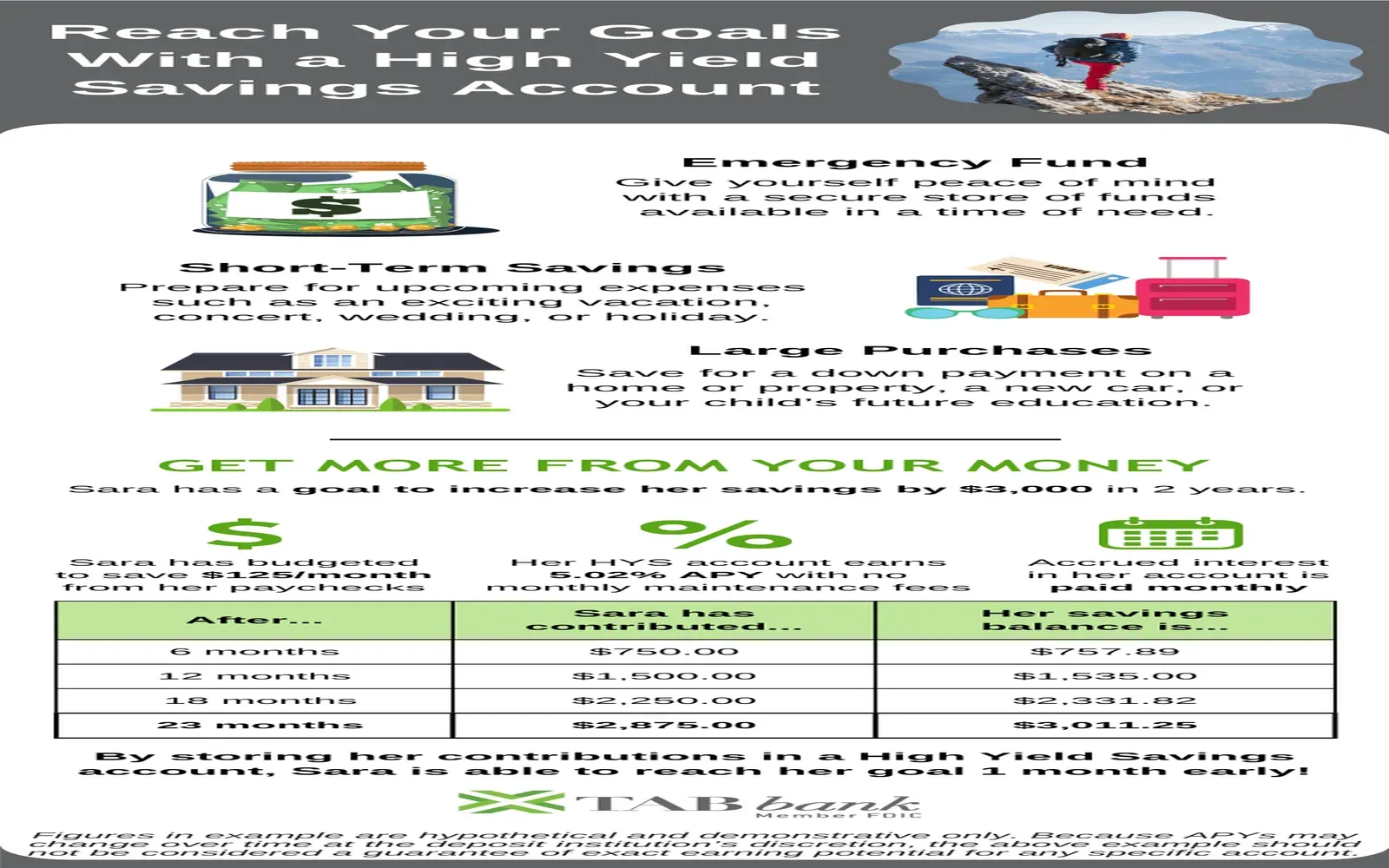

Best High-Yield Savings Accounts of 2025: Maximizing Your Savings Potential

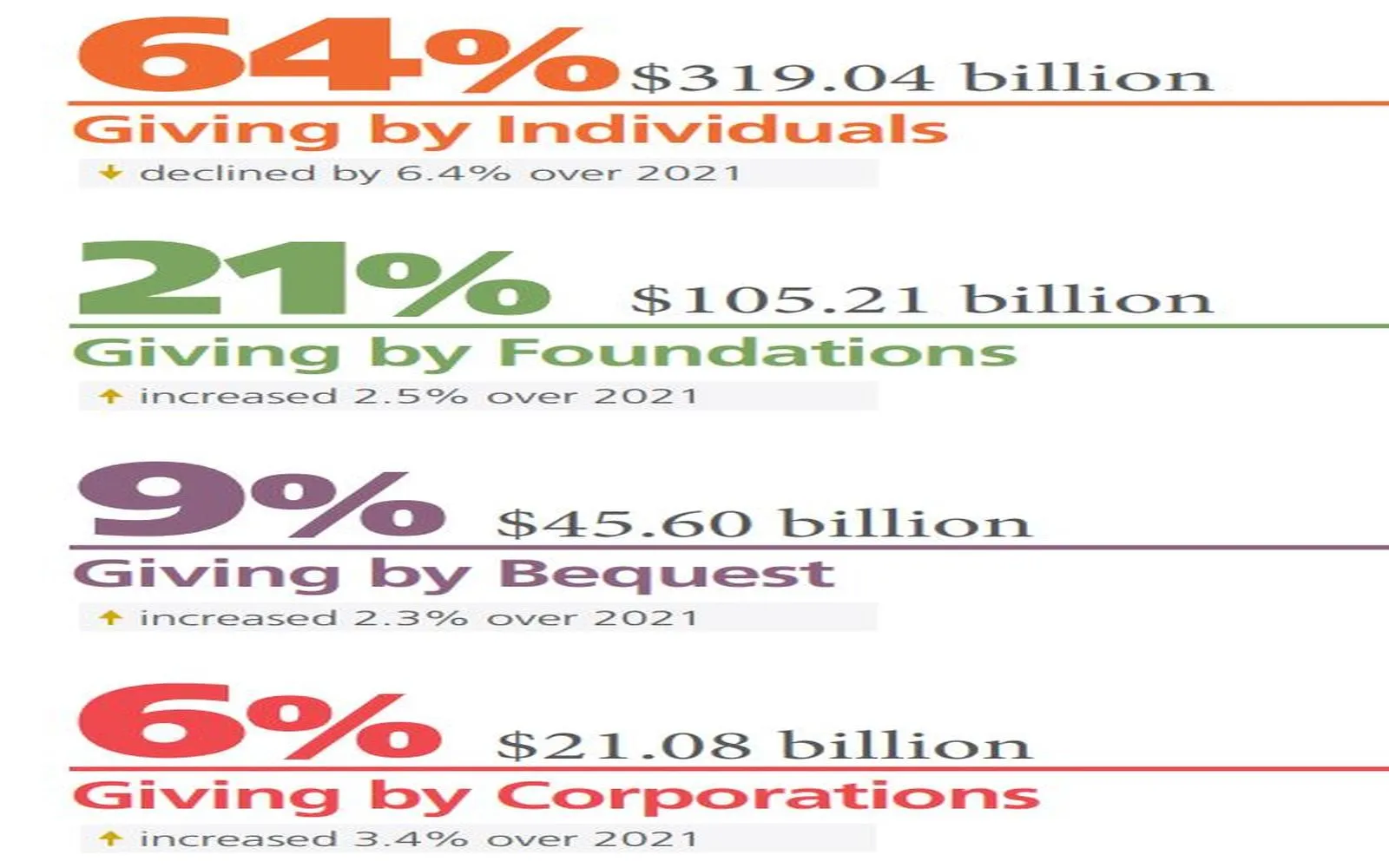

Donating in the USA: A Guide to Giving Back

Best Small Business Cash Advances in 2025: A Comprehensive Guide

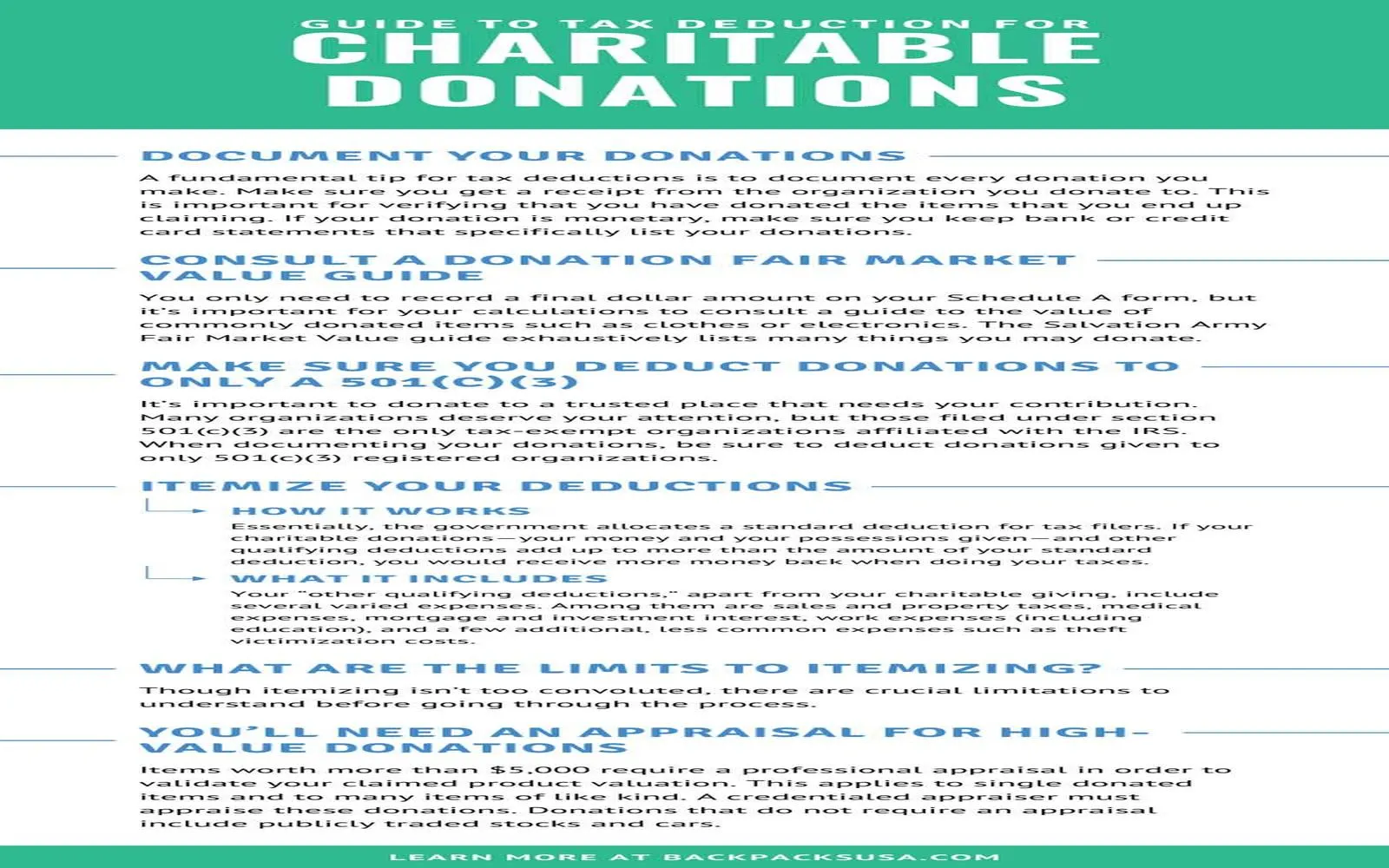

Maximize Your Tax Deductions in 2025: The Ultimate Guide to Charitable Donations