Discover Top Tax Relief Services Near You in 2025: Maximize Your Savings Today!

Understanding Tax Relief Services

As we approach the year 2025, the financial landscape continues to evolve, and so do the complexities surrounding taxation. Individuals and businesses alike often find themselves overwhelmed by tax obligations, leading many to seek professional assistance. Tax relief services have emerged as a vital resource for those looking to alleviate their tax burdens. But what exactly are tax relief services, and how can they help you maximize your savings?

What Are Tax Relief Services?

Tax relief services encompass a range of professional offerings designed to assist taxpayers in managing, reducing, or eliminating their tax liabilities. These services can include negotiation with tax authorities, representation in audits, and assistance with tax settlement programs. Whether you are facing an unexpected tax bill or struggling with past due taxes, tax relief services aim to provide relief and peace of mind.

Types of Tax Relief Services

In 2025, various tax relief services are available, each tailored to meet specific needs. Here are some common types:

- Tax Negotiation Services: Professionals negotiate directly with tax authorities on your behalf to reduce your tax liability or establish manageable payment plans.

- Offer in Compromise: This program allows taxpayers to settle their tax debts for less than the full amount owed, under certain conditions.

- Audit Representation: If you're selected for an audit, professionals can represent you, ensuring your rights are protected and helping to navigate the audit process.

- Tax Preparation Services: Expert tax preparers ensure that your returns are accurate and maximize deductions, minimizing your tax liability for the current year.

- Back Taxes Solutions: For individuals who owe back taxes, services focus on negotiating settlements or payment plans to eliminate outstanding debts.

How to Choose the Right Tax Relief Service

With numerous tax relief services available, selecting the right one can be daunting. Here are some critical factors to consider:

- Experience and Expertise: Look for firms with a proven track record in tax relief. Experienced professionals are more likely to navigate complex tax situations effectively.

- Reviews and Testimonials: Research online reviews and client testimonials to gauge the satisfaction of previous clients. This can provide insights into the service quality and success rates.

- Free Consultation: A reputable tax relief service often offers a free initial consultation. This meeting allows you to discuss your situation and understand the potential strategies available.

- Transparent Fees: Ensure the service provider is upfront about their fees. Look for companies that provide clear pricing structures without hidden costs.

- Professional Credentials: Check for certifications and qualifications. Professionals with CPA (Certified Public Accountant) or EA (Enrolled Agent) designations have specialized knowledge in tax matters.

Local Tax Relief Services: Finding Support Near You

In 2025, many taxpayers are turning to local tax relief services for personalized assistance. Finding a local provider can offer the advantage of face-to-face consultations and a better understanding of regional tax regulations. Here’s how to discover top tax relief services near you:

Online Searches

Utilize search engines to find tax relief services in your area. Enter phrases like “tax relief services near me” or “local tax professionals” to generate relevant results. Pay attention to proximity and service offerings.

Social Media and Community Forums

Social platforms and community forums can be valuable resources for recommendations. Platforms like Facebook, LinkedIn, and Reddit often have groups focused on finance and taxes where individuals share their experiences and suggestions for local tax relief services.

Word of Mouth

Don’t underestimate the power of personal recommendations. Ask friends, family, or colleagues if they have worked with tax relief services and whether they would recommend them. First-hand experiences can guide you to trustworthy professionals.

Local Chamber of Commerce

Your local Chamber of Commerce may have information on reputable tax relief services in your community. They often maintain directories of local businesses, including financial services.

Better Business Bureau (BBB)

The BBB provides ratings and reviews of businesses, including tax relief services. Checking their website can help you identify well-rated firms and those to avoid.

Benefits of Using Tax Relief Services

Choosing to work with tax relief services can provide numerous benefits:

- Expert Guidance: Tax professionals possess in-depth knowledge of tax laws and regulations, ensuring you receive accurate advice tailored to your situation.

- Stress Relief: Dealing with tax issues can be stressful. Professionals can handle communications with tax authorities, allowing you to focus on other priorities.

- Maximized Savings: Tax experts know how to identify deductions and credits, ensuring you pay the least amount possible.

- Time-Saving: Navigating tax forms and regulations can be time-consuming. Professionals streamline the process, saving you valuable time.

- Peace of Mind: Knowing you have an expert on your side can alleviate anxiety related to tax obligations and potential audits.

Common Misconceptions About Tax Relief Services

As with any industry, misconceptions about tax relief services can lead to misunderstandings. Here are a few common myths debunked:

- Only for the Wealthy: Many believe tax relief services are only for high-income individuals or businesses. In reality, anyone facing tax issues can benefit from their expertise.

- Guaranteed Results: While tax relief services can significantly improve your situation, no reputable service can guarantee a specific outcome due to the complexities of tax laws.

- Services Are Too Expensive: While there are costs associated with hiring professionals, the potential savings from their expertise often outweigh the fees.

- Tax Relief Services Are Scams: While there are fraudulent companies, many legitimate tax relief services operate ethically and effectively. Researching and verifying credentials can help you avoid scams.

Preparing for Your Consultation

If you decide to engage a tax relief service, preparing for your consultation can maximize the effectiveness of your meeting. Here are some steps to consider:

- Gather Documentation: Collect all relevant tax documents, including W-2s, 1099s, previous tax returns, and any correspondence from tax authorities.

- List Your Concerns: Write down specific issues you want to address during the consultation. This ensures you don’t forget important points.

- Be Honest: Transparency is critical. Provide accurate information about your financial situation and tax history to receive the best advice.

- Ask Questions: Prepare questions to ask the tax professional. Understanding their approach and fees will help you make informed decisions.

Conclusion

As we move into 2025, the importance of tax relief services cannot be overstated. Whether you are an individual facing tax challenges or a business navigating complex tax obligations, professional assistance can significantly improve your financial situation. By understanding the types of services available and how to choose the right one, you can take control of your tax liabilities and maximize your savings. Don’t hesitate to explore local options and seek the expert guidance you need. Your financial well-being is worth the investment.

Explore

Tax Debt Relief Service: A Comprehensive Guide to Managing Your Tax Debt

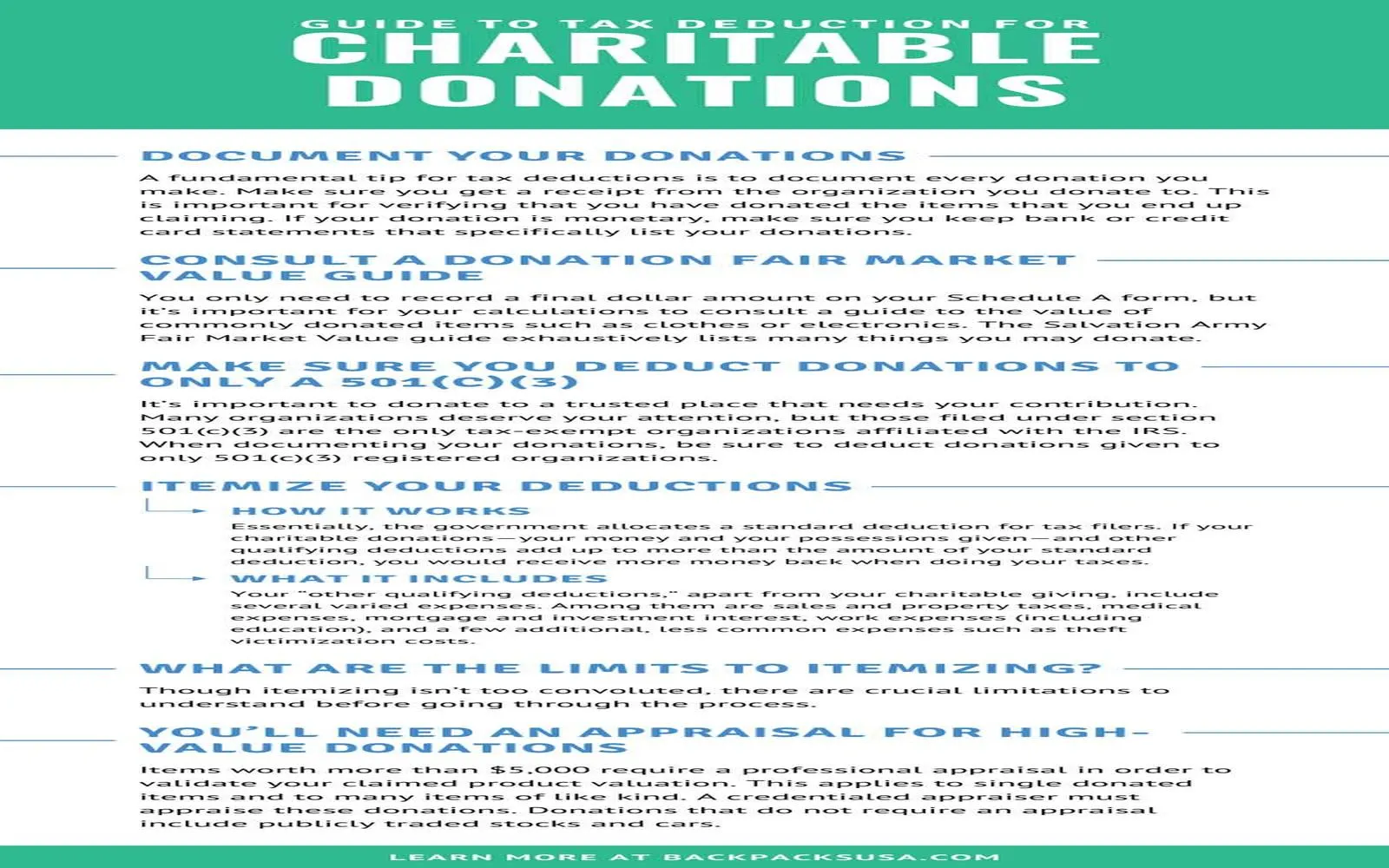

Maximize Your Tax Deductions in 2025: The Ultimate Guide to Charitable Donations

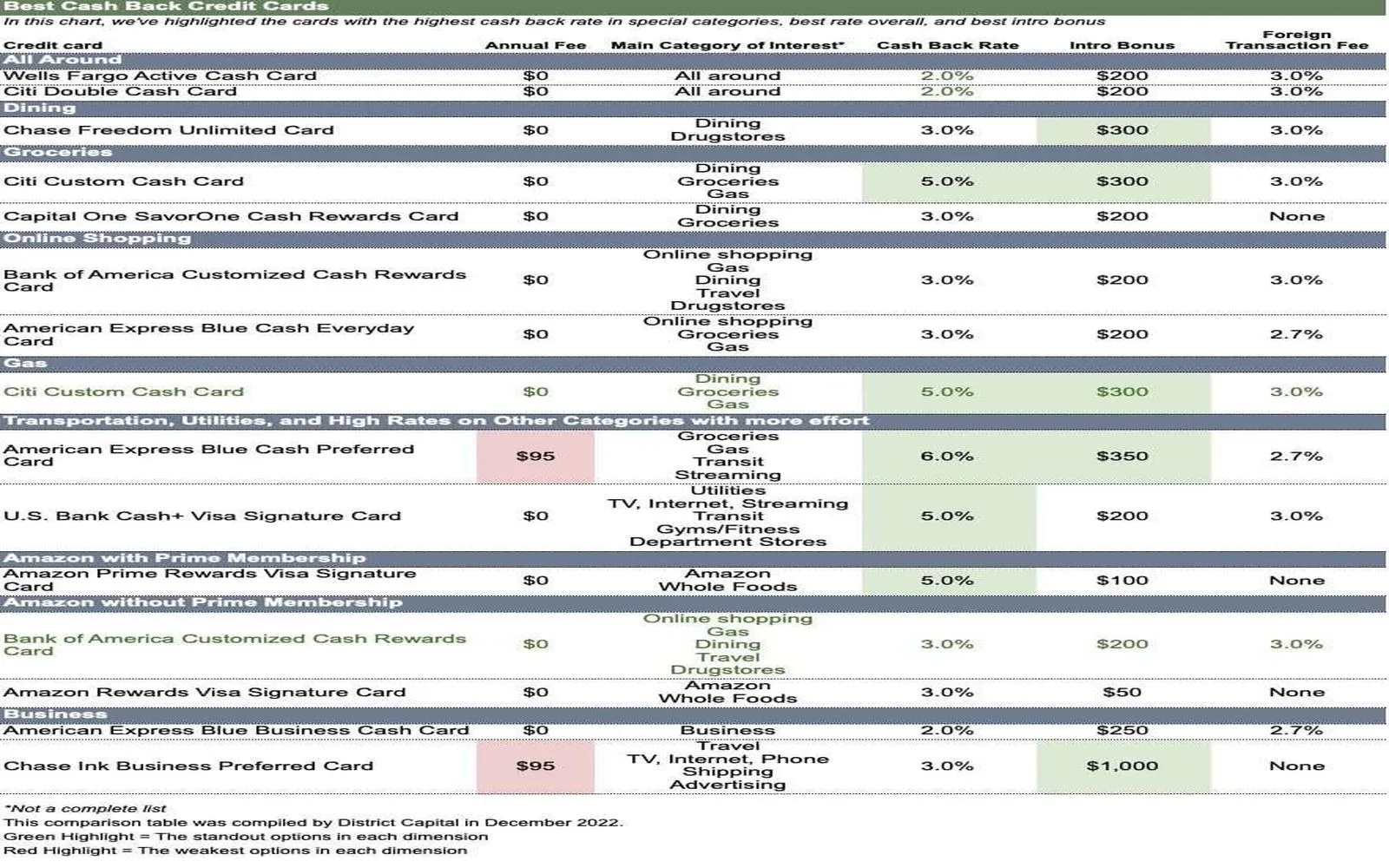

Top Cash Back Credit Cards of 2025: Maximize Your Rewards and Savings

Maximize Your Savings in 2025: The Ultimate Guide to 0% Interest Credit Cards

Maximize Savings in 2025: The Ultimate Guide to 0% APR Credit Card Balance Transfers

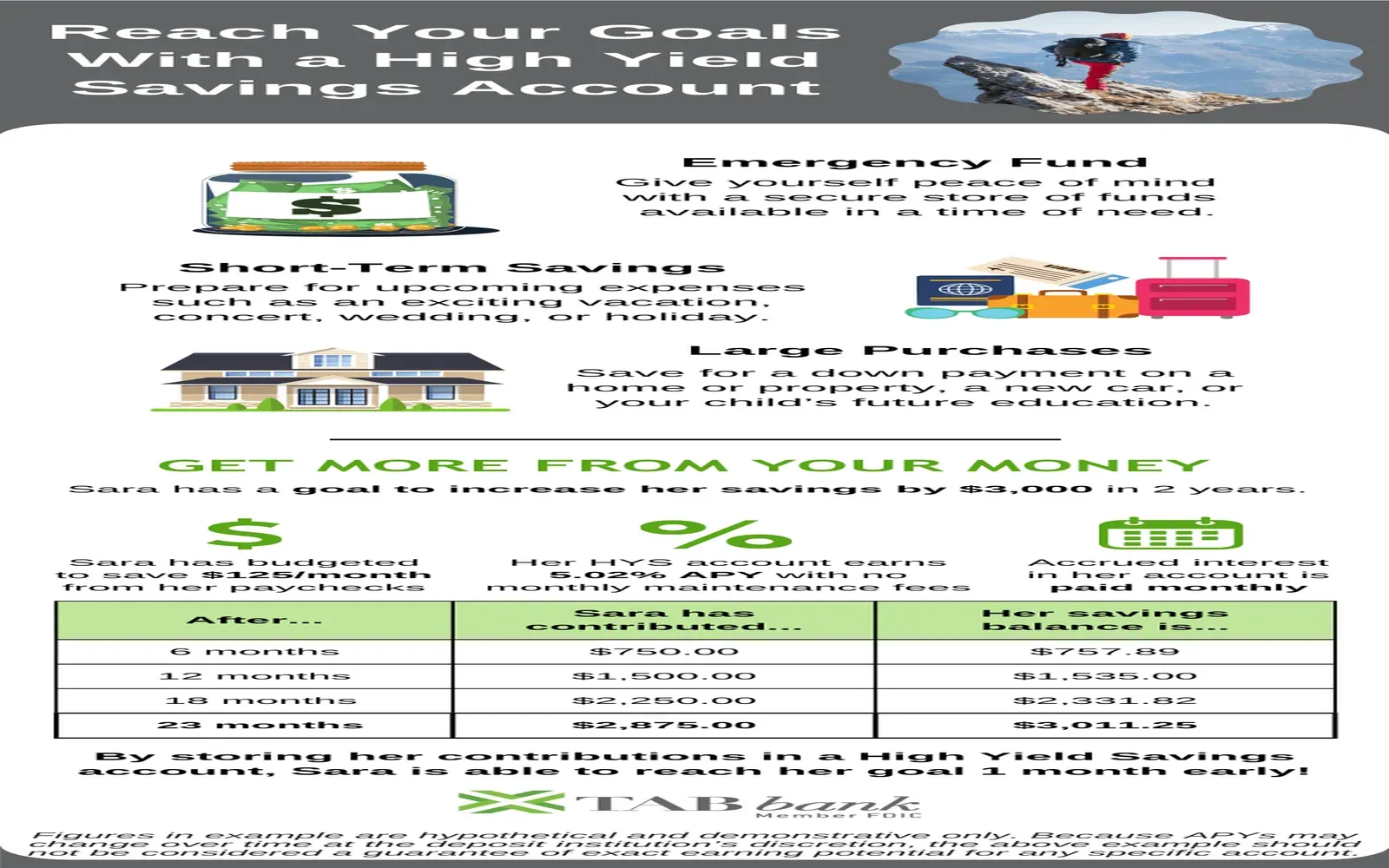

Best High-Yield Savings Accounts of 2025: Maximizing Your Savings Potential

Top Drain Cleaning Services Near You in 2025: Get Efficient Solutions Today!

Top Home Restoration Companies Near You in 2025: Revitalize Your Space Today!