Maximize Savings in 2025: The Ultimate Guide to 0% APR Credit Card Balance Transfers

Understanding 0% APR Credit Card Balance Transfers

As we step into 2025, many consumers are looking for effective ways to maximize their savings and manage their debts more efficiently. One of the most popular strategies involves utilizing 0% APR credit card balance transfers. This method allows individuals to transfer high-interest debt from one or more credit cards to a new card offering a promotional 0% annual percentage rate (APR). This article will guide you through the process of balance transfers, the benefits, potential pitfalls, and tips for maximizing your savings.

What is a Balance Transfer?

A balance transfer involves moving the outstanding balance from one credit card to another, typically to take advantage of a lower interest rate. When you transfer a balance to a credit card with a 0% APR promotional offer, you can avoid paying any interest on that balance for a specified period, which can often range from 6 to 18 months, depending on the card issuer.

Benefits of 0% APR Balance Transfers

Transfering balances to a credit card with 0% APR can provide several benefits, including:

- Interest Savings: The primary benefit is the significant savings on interest payments. By using a 0% APR card, you can focus your payments on the principal amount rather than accruing interest.

- Consolidation: If you have multiple credit cards with outstanding balances, you can consolidate them into one payment, making it easier to manage your debt.

- Improved Cash Flow: With no interest charges during the promotional period, you may have more disposable income available for other expenses.

- Credit Score Benefits: Reducing your overall credit utilization ratio by transferring balances can potentially improve your credit score.

How to Choose the Right 0% APR Card for Balance Transfers

Choosing the right credit card for a balance transfer is crucial to maximizing your savings. Here are some factors to consider:

1. Promotional Period Length

Look for cards that offer a longer 0% APR promotional period. While some cards may only offer 6 months, others may extend this period to 18 months or more. The longer the promotional period, the more time you have to pay down your debt without incurring interest.

2. Balance Transfer Fees

Most credit cards charge a balance transfer fee, typically ranging from 3% to 5% of the transferred amount. Calculate this fee to ensure that the potential interest savings outweigh the cost of the transfer. For instance, if you plan to transfer $5,000 and the fee is 3%, you’ll incur a $150 charge, which should be factored into your savings calculations.

3. Regular APR After Promotional Period

Once the promotional period ends, the card will revert to a standard APR, which can be significantly higher. Be sure to understand what this rate will be to avoid surprises once the promotional period concludes.

4. Other Card Features

Consider additional features of the card, such as rewards programs, cash back offers, or other benefits. While these may not be the primary reason for your choice, they can provide added value.

Steps to Execute a Balance Transfer

Once you’ve selected the appropriate credit card for your balance transfer, follow these steps to execute the transfer effectively:

1. Apply for the New Credit Card

Submit an application for the credit card that offers the 0% APR balance transfer. Ensure that your credit score is in good shape to improve your chances of approval.

2. Gather Your Current Credit Card Information

Before initiating the transfer, gather details of your existing credit card accounts, including account numbers and outstanding balances.

3. Initiate the Balance Transfer

Once your new credit card is approved, contact the card issuer to initiate the balance transfer. This can typically be done online, over the phone, or via a form included with your credit card documentation. Provide the necessary details, including the balances to be transferred and the account numbers.

4. Continue Making Payments on the Old Card

To avoid any potential complications during the transfer process, continue making minimum payments on your old credit card until you receive confirmation that the transfer is complete. This helps you avoid late fees and potential damage to your credit score.

Strategies for Maximizing Your Savings

Once your balance transfer is in place, here are several strategies to ensure you maximize your savings during the promotional period:

1. Create a Payment Plan

Develop a structured payment plan to pay off your transferred balance before the promotional period ends. Calculate how much you need to pay each month to eliminate the debt within the promotional timeframe, and stick to this plan as closely as possible.

2. Make More Than the Minimum Payment

Consider making payments that exceed the minimum required amount. Paying more than the minimum not only reduces your debt faster but also helps you avoid the risk of reverting to a high-interest rate once the promotional period ends.

3. Avoid New Purchases on the Card

While it may be tempting to use your new card for purchases, doing so can complicate your payment strategy. New purchases may accrue interest immediately, negating the benefits of the 0% APR balance transfer. Stick to using the card solely for the transferred balance until it is paid off.

4. Set Up Automatic Payments

To ensure you never miss a payment, consider setting up automatic payments. This strategy can help you stay on track with your payment plan and avoid late fees, which could adversely affect your credit score.

5. Monitor Your Progress

Regularly check your account balances and payment progress. Monitoring your progress can help you stay motivated and allow you to make adjustments to your payment plan if necessary.

Potential Pitfalls to Avoid

While 0% APR balance transfers can be an effective debt management tool, there are potential pitfalls to watch out for:

1. Missing Payments

Missing a payment during the promotional period can result in penalties and may cause your interest rate to revert to a higher standard rate. Always prioritize making your payments on time.

2. Transferring More Than You Can Handle

It can be tempting to transfer large balances, but ensure you only transfer what you can realistically pay off within the promotional period. Overextending yourself can lead to further debt issues.

3. Ignoring the Fine Print

Always read the terms and conditions associated with the balance transfer offer. Look for any potential fees or conditions that could affect your financial situation.

4. Failing to Address Underlying Spending Habits

Using a balance transfer as a quick fix without addressing spending habits may lead to a cycle of debt. Take this opportunity to evaluate and adjust your spending patterns to ensure long-term financial health.

Conclusion

Maximizing savings in 2025 through 0% APR credit card balance transfers is a smart strategy for managing debt effectively. By understanding the benefits, carefully choosing the right card, and implementing a structured payment plan, you can significantly reduce your financial burden and save on interest payments. However, it’s crucial to be mindful of potential pitfalls and to use this opportunity as a stepping stone towards better financial habits. With diligence and careful planning, you can take control of your debts and pave the way for a more secure financial future.

Explore

Instant Money Transfers to Bank Accounts: The Future of Fast Payments in 2025

Maximize Your Savings in 2025: The Ultimate Guide to 0% Interest Credit Cards

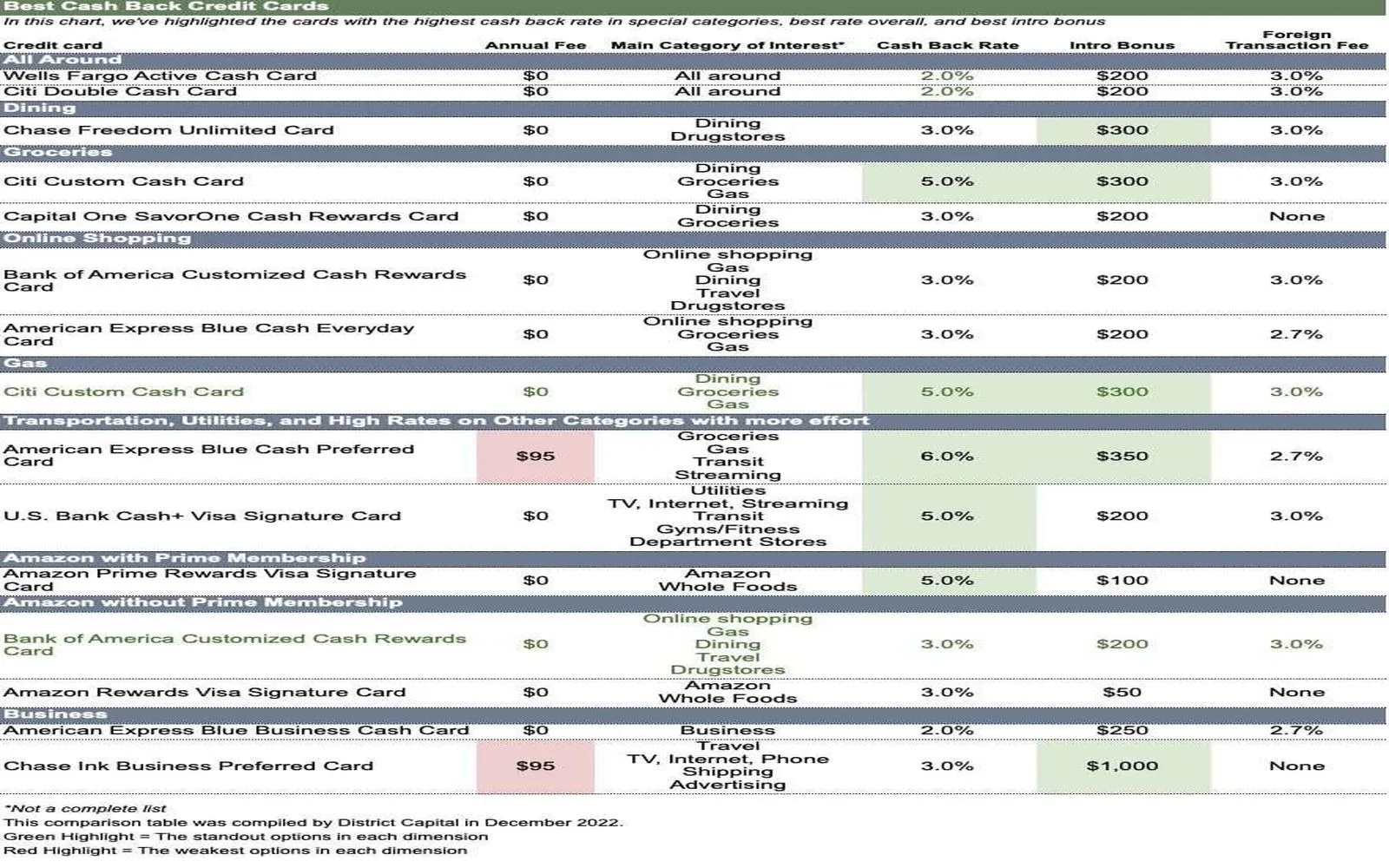

Top Cash Back Credit Cards of 2025: Maximize Your Rewards and Savings

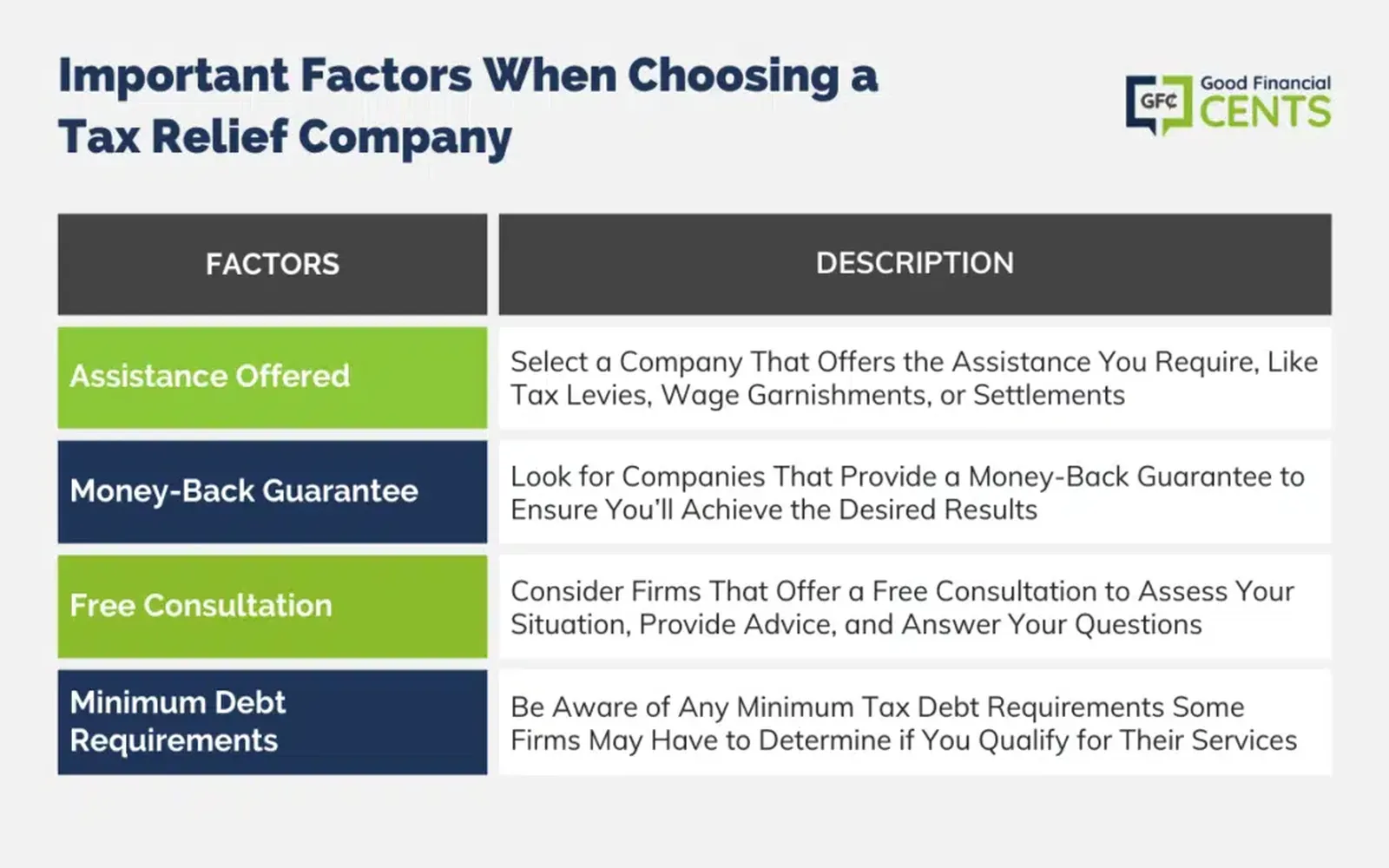

Discover Top Tax Relief Services Near You in 2025: Maximize Your Savings Today!

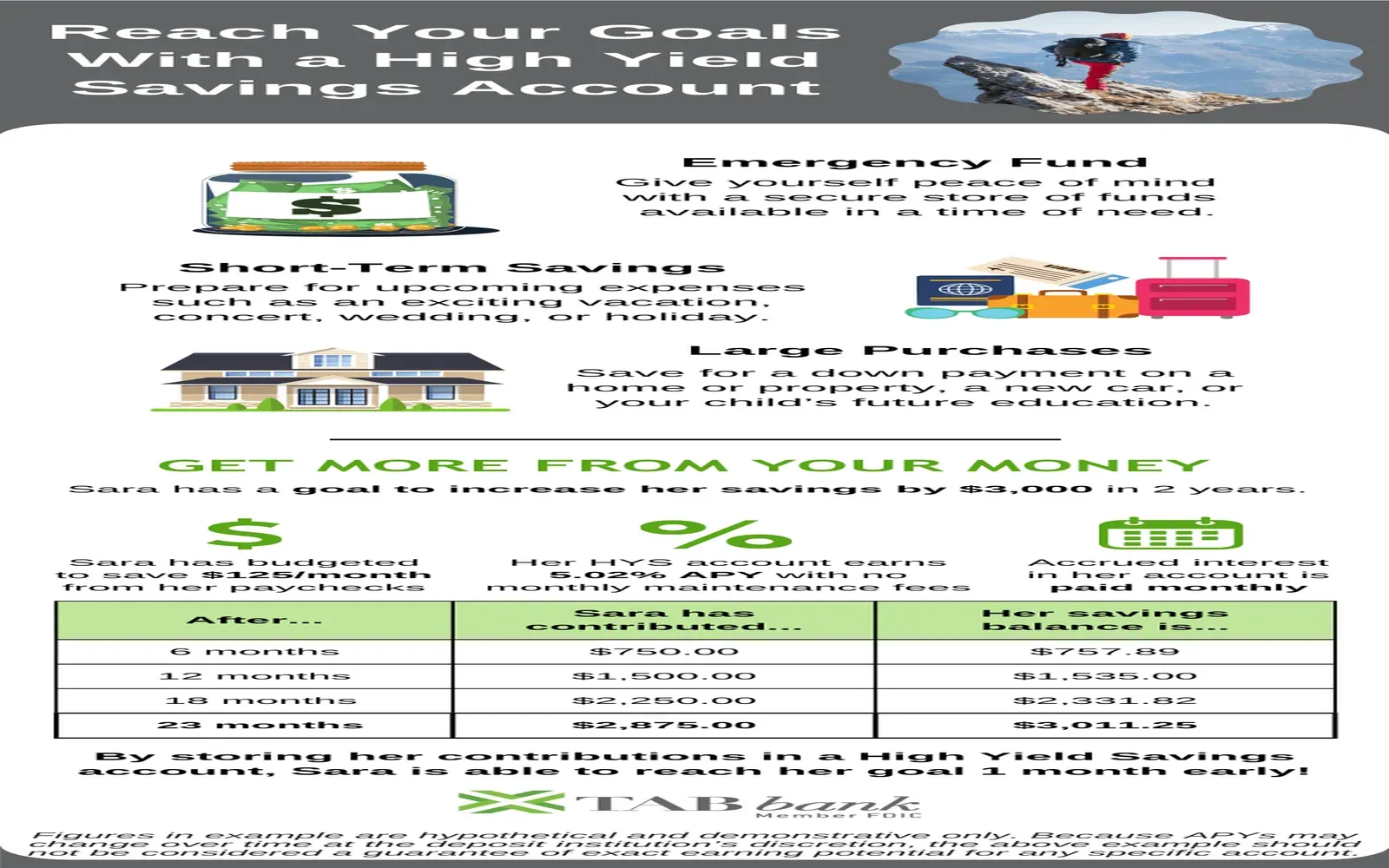

Best High-Yield Savings Accounts of 2025: Maximizing Your Savings Potential

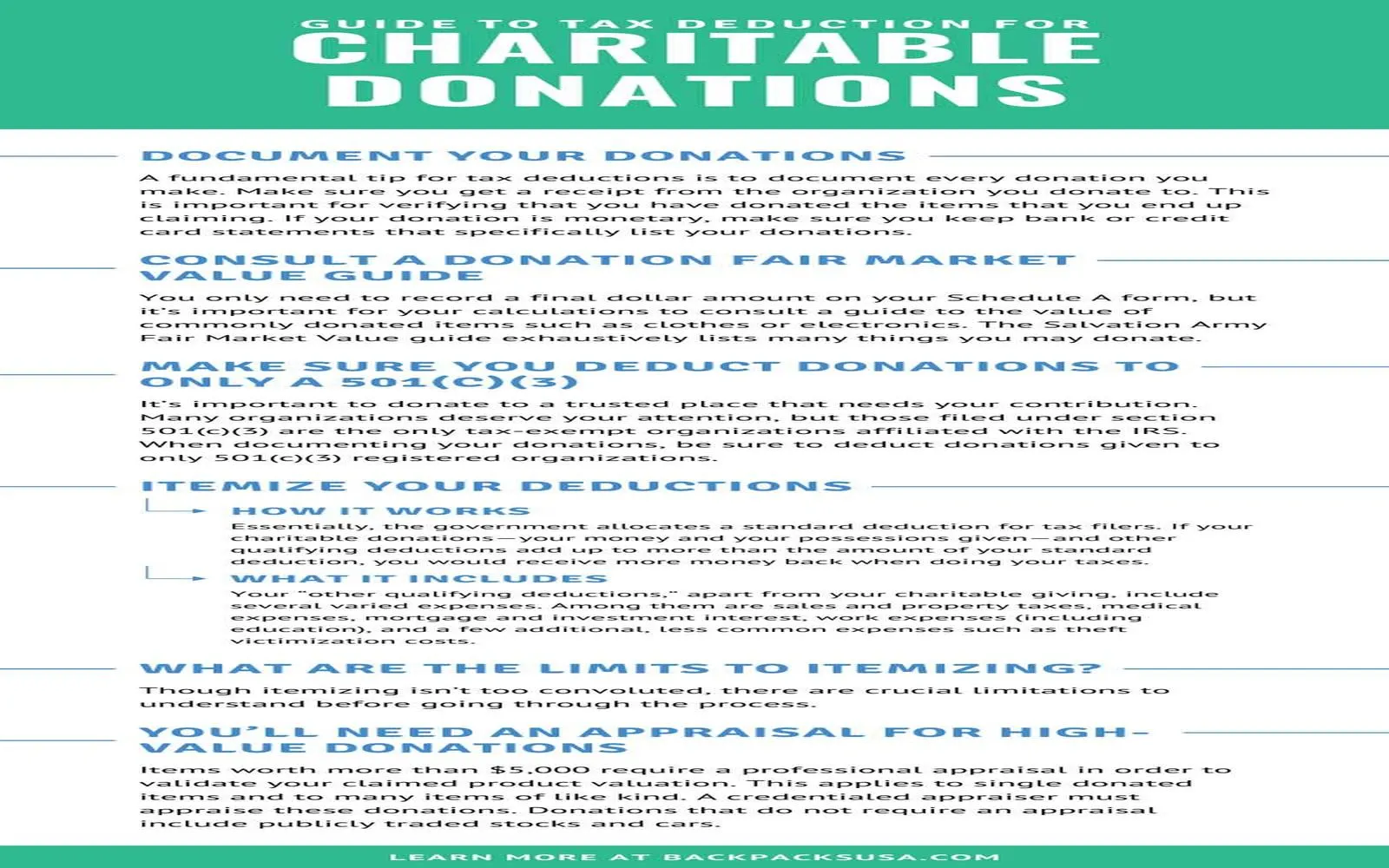

Maximize Your Tax Deductions in 2025: The Ultimate Guide to Charitable Donations

Bright Savings: Your Guide to Affordable Solar Panels for Every Home

Best High-Yield Savings Accounts for 2025