Maximize Your Savings in 2025: The Ultimate Guide to 0% Interest Credit Cards

Introduction

As we step into 2025, financial planning has never been more crucial. With the cost of living rising and economic uncertainties lingering, maximizing your savings is essential. One effective tool to help you achieve this is the 0% interest credit card. These cards can offer significant advantages if used wisely. In this comprehensive guide, we’ll explore how to maximize your savings using 0% interest credit cards, including strategies, benefits, potential pitfalls, and tips for selecting the best card for your needs.

Understanding 0% Interest Credit Cards

0% interest credit cards are financial products that allow you to borrow money without incurring interest for a specified period, typically ranging from 6 to 18 months. During this promotional period, any purchases or balance transfers you make will not accrue interest, which can lead to significant savings if you manage your payments effectively.

Benefits of 0% Interest Credit Cards

There are several compelling benefits to using 0% interest credit cards:

- Debt Consolidation: If you have existing credit card debt, transferring that balance to a 0% interest card can help you save on interest payments, allowing you to pay off your debt more quickly.

- Interest-Free Purchases: For larger purchases, using a 0% interest credit card means you can spread the cost over several months without the burden of interest, making it easier to manage your budget.

- Building Credit: Responsible use of a credit card, including making payments on time and keeping your balance low, can help improve your credit score.

- Rewards and Cash Back: Some 0% interest cards also offer rewards programs, allowing you to earn points or cash back on your purchases.

How to Maximize Your Savings with 0% Interest Credit Cards

To fully leverage the benefits of 0% interest credit cards, consider the following strategies:

Create a Repayment Plan

Before applying for a 0% interest credit card, outline a clear repayment plan. Determine how much you can afford to pay each month to ensure you can pay off the balance before the promotional period ends. This planning will help you avoid accumulating interest once the introductory period expires.

Utilize Balance Transfers Wisely

If you have existing credit card debt, a balance transfer to a 0% interest card can be a smart move. However, be aware of any balance transfer fees, which can range from 3% to 5% of the amount transferred. Calculate whether the savings on interest outweigh these fees to ensure it’s a beneficial decision.

Make Timely Payments

To maximize your savings, always make at least the minimum payment on time. Missing a payment can lead to penalties and may cause the credit card issuer to revoke the promotional 0% interest rate. Set up automatic payments or reminders to ensure you never miss a due date.

Stay Within Your Budget

While a 0% interest credit card can offer flexibility, it’s crucial to stay within your budget. Avoid overspending just because you won’t incur interest for a certain period. Stick to a budget to ensure you can pay off your balance without financial strain.

Take Advantage of Rewards Programs

If your 0% interest credit card offers a rewards program, use it to your advantage. Earn points or cash back on your everyday purchases, and consider using the rewards to offset future spending or pay down your balance faster.

Choosing the Right 0% Interest Credit Card

With numerous options available, selecting the right 0% interest credit card is vital. Here are some factors to consider:

Promotional Period Length

Different cards offer varying lengths for their 0% interest promotions. Look for a card that provides a longer promotional period, especially if you anticipate needing more time to pay off your balance.

Balance Transfer Fees

As mentioned earlier, balance transfer fees can impact your overall savings. Some cards have no balance transfer fees, while others may charge a percentage of the transferred amount. Evaluate which card offers the best balance between fees and benefits.

Ongoing Interest Rates

Once the promotional period ends, the interest rate will revert to the standard rate. Compare the ongoing rates of different cards to ensure you don’t end up with a high-interest rate that could negate your savings.

Rewards and Perks

Look for additional perks that may come with the card, such as cash back, travel rewards, or purchase protection. These benefits can enhance your overall experience and provide additional savings.

Credit Limit

Consider the credit limit offered by the card. A higher credit limit can provide more flexibility for purchases and balance transfers, but be cautious not to overspend simply because you have a higher limit.

Potential Pitfalls of 0% Interest Credit Cards

While 0% interest credit cards offer many advantages, they also come with potential pitfalls. Being aware of these can help you avoid costly mistakes:

Deferred Interest

Some 0% interest offers come with deferred interest clauses. This means that if you don’t pay off the balance by the end of the promotional period, interest will be charged retroactively on the entire amount. Always read the fine print to understand the terms fully.

Over-Reliance on Credit

It’s easy to fall into the trap of using credit liberally when you have a 0% interest card. This can lead to accumulating debt that may become unmanageable once the promotional period ends. Stick to your budget and avoid unnecessary spending.

Impact on Credit Score

While responsibly using a credit card can improve your credit score, maxing out your credit limit or missing payments can have the opposite effect. Maintain a low credit utilization ratio and make timely payments to protect your credit score.

Promotional Period Expiration

Be mindful of when the promotional period ends. Plan your payments to ensure you pay off the balance before interest kicks in. Mark the expiration date on your calendar to avoid surprises.

Tips for Managing Your 0% Interest Credit Card

To effectively manage your 0% interest credit card, consider the following tips:

Track Your Spending

Use budgeting apps or spreadsheets to track your spending. Keeping a close eye on your purchases will help you stay within your budget and ensure you can pay off your balance in full.

Set Up Alerts

Most credit card issuers allow you to set up alerts for payment due dates, spending limits, and promotional period expirations. Utilize these alerts to keep your finances on track.

Consider Multiple Cards

If you have significant debt or anticipate large purchases, consider applying for multiple 0% interest credit cards. Just ensure you can manage the payments across all cards without exceeding your budget.

Review Your Credit Card Statements

Regularly review your credit card statements to check for unauthorized charges or errors. This practice helps you stay informed about your spending and protects you against fraud.

Conclusion

Maximizing your savings in 2025 using 0% interest credit cards can be a powerful strategy when executed correctly. By understanding the benefits, potential pitfalls, and effective management strategies, you can leverage these financial tools to your advantage. Remember to create a solid repayment plan, choose the right card, and remain disciplined in your spending habits. With careful planning and responsible use, you can take full advantage of the benefits offered by 0% interest credit cards and enhance your financial well-being.

Explore

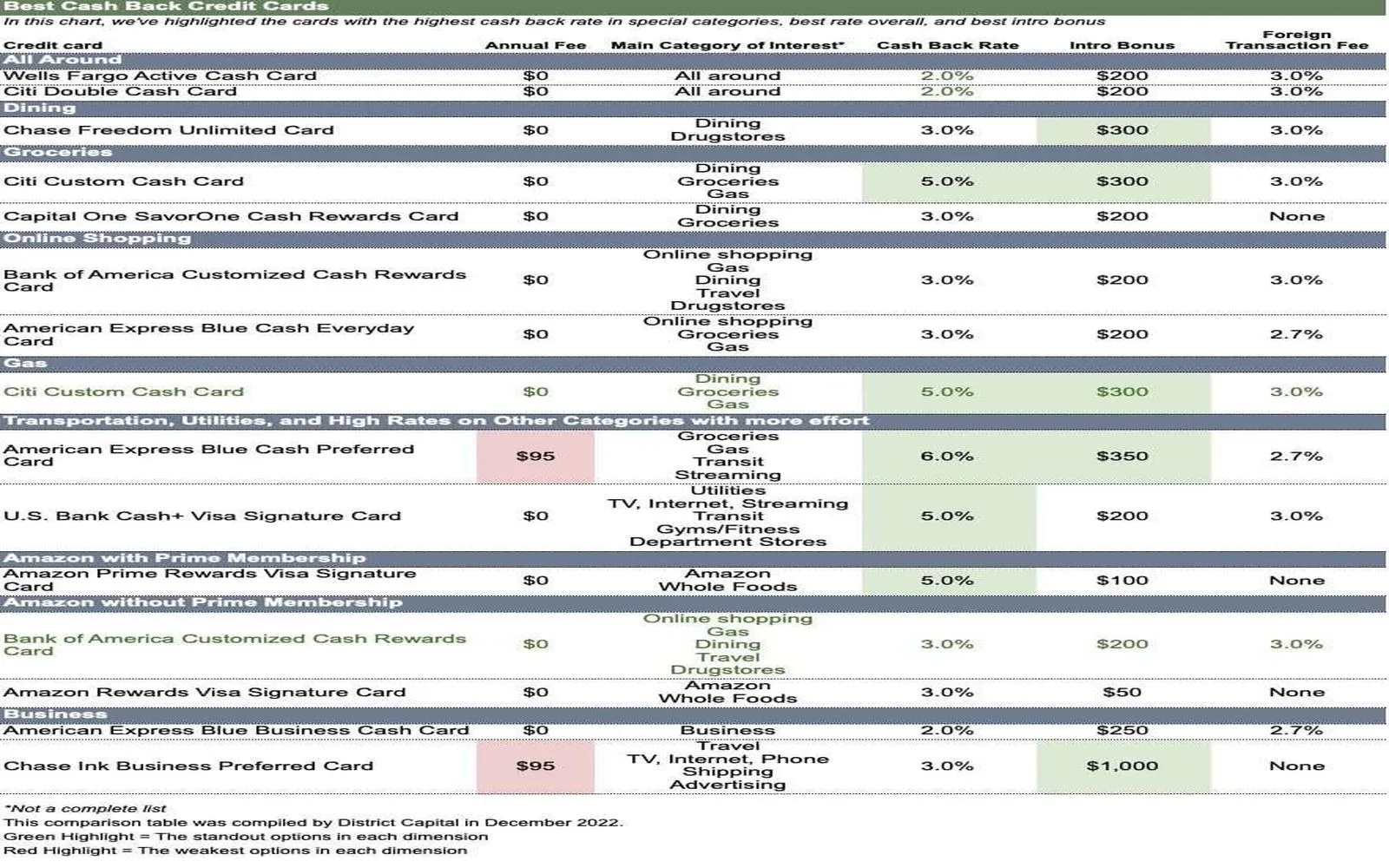

Top Cash Back Credit Cards of 2025: Maximize Your Rewards and Savings

Maximize Savings in 2025: The Ultimate Guide to 0% APR Credit Card Balance Transfers

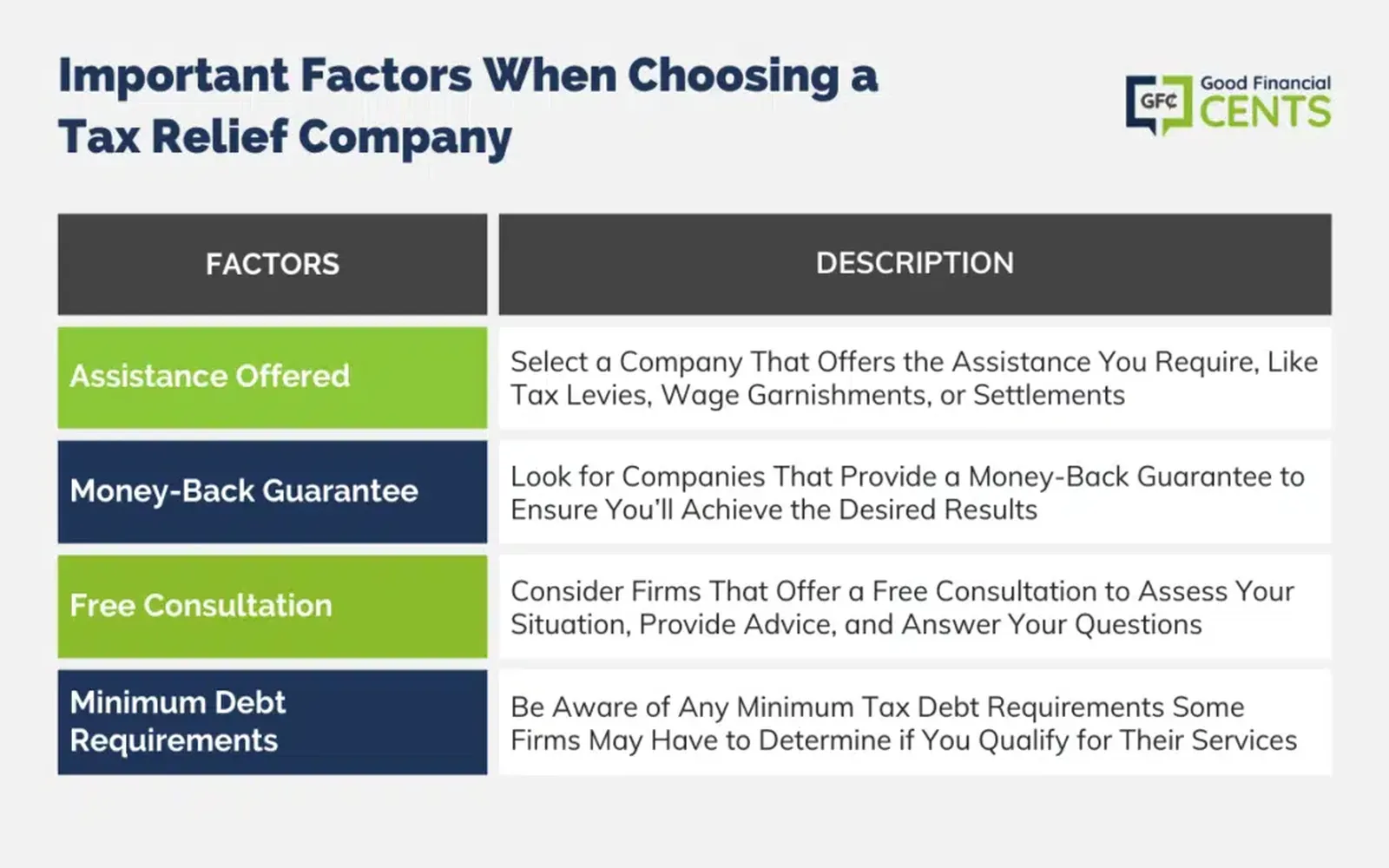

Discover Top Tax Relief Services Near You in 2025: Maximize Your Savings Today!

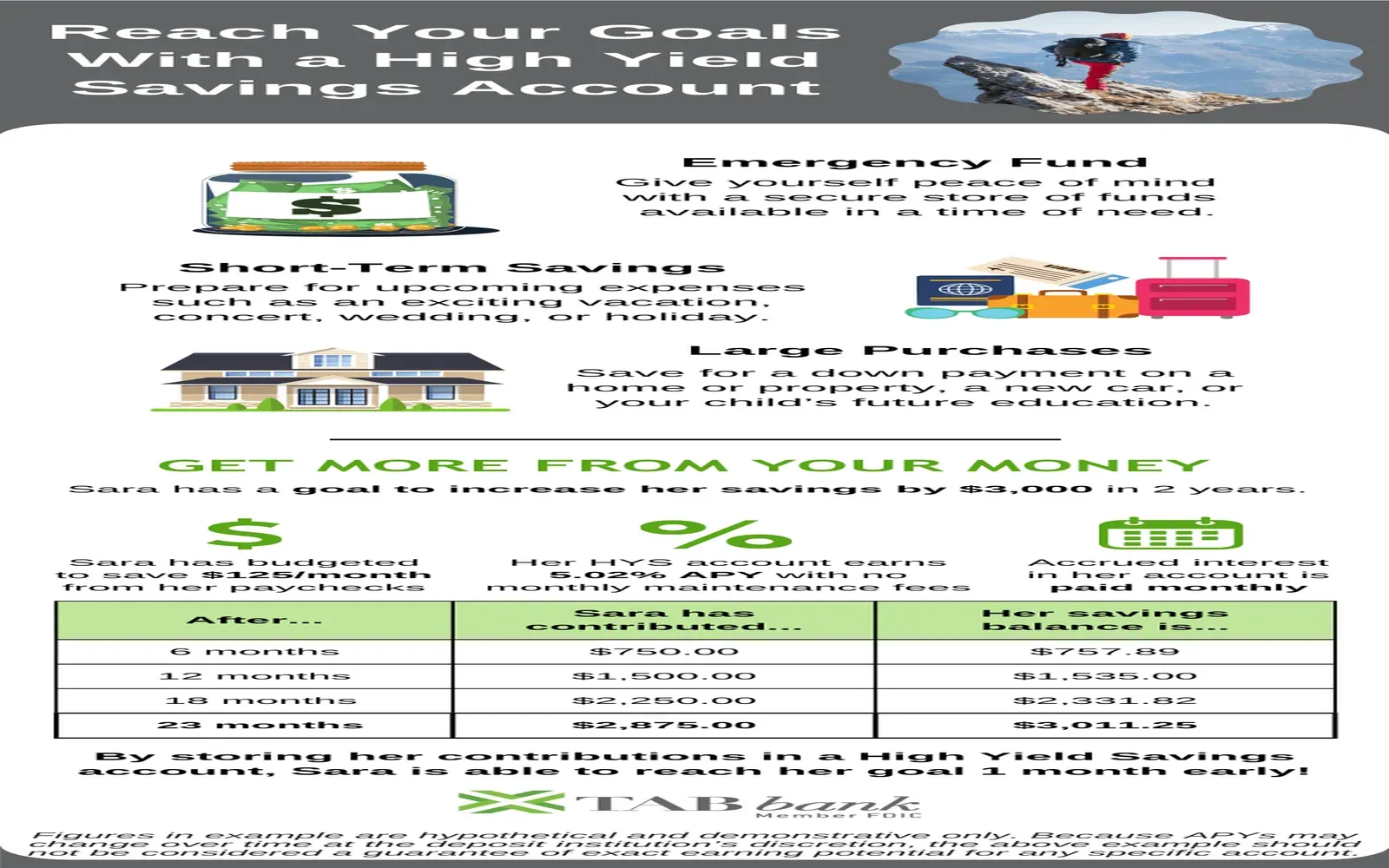

Best High-Yield Savings Accounts of 2025: Maximizing Your Savings Potential

Best Travel Credit Cards of 2025: Top Picks for Earning Rewards on Your Adventures

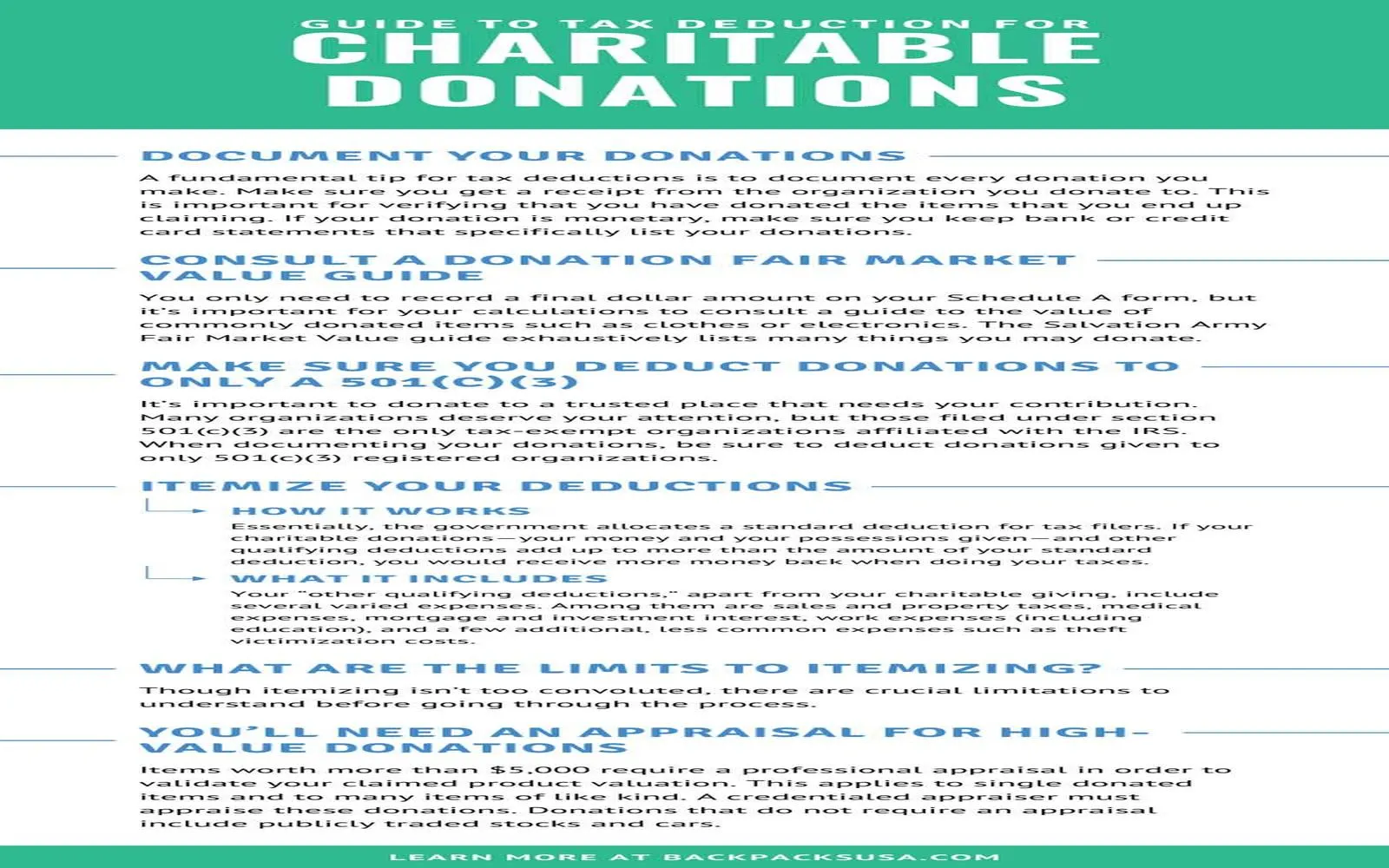

Maximize Your Tax Deductions in 2025: The Ultimate Guide to Charitable Donations

Bright Savings: Your Guide to Affordable Solar Panels for Every Home

Best High-Yield Savings Accounts for 2025