Maximize Your Tax Deductions in 2025: The Ultimate Guide to Charitable Donations

Understanding Charitable Donations and Tax Deductions

As we approach the tax season in 2025, it’s essential to understand the various avenues available for maximizing your tax deductions. One of the most impactful ways to reduce your taxable income is through charitable donations. This guide will provide you with a comprehensive understanding of how charitable donations work within the tax framework and how to maximize these deductions effectively.

The Basics of Charitable Donations

Charitable donations refer to contributions made to qualified organizations that are recognized by the IRS as tax-exempt under Section 501(c)(3). These organizations can range from large national charities to small local nonprofits. When you make a donation to these entities, you may be eligible to deduct the amount donated from your taxable income, thus reducing your overall tax liability.

Types of Charitable Contributions

To maximize your tax deductions, it’s important to understand the different types of charitable contributions that qualify for deductions. These include:

- Cash Donations: Direct cash contributions to qualifying organizations are the simplest form of charitable donations. Be sure to keep records of your donations, such as receipts or bank statements.

- Non-Cash Donations: Donations of goods, such as clothing, furniture, or vehicles, can also be deducted. The value of these items should be determined based on their fair market value at the time of donation.

- Securities and Stocks: Donating appreciated securities can provide a double tax benefit. You can deduct the fair market value of the securities while avoiding capital gains taxes on the appreciation.

- Volunteer Expenses: While you cannot deduct the value of your time spent volunteering, you can deduct out-of-pocket expenses incurred while volunteering, such as transportation or supplies.

Choosing Qualified Charitable Organizations

To ensure your donations are tax-deductible, it’s crucial to donate to qualified organizations. You can verify an organization’s status by checking the IRS’s online database of tax-exempt organizations. This step is vital as donations made to non-qualified entities, such as individuals or political organizations, do not qualify for tax deductions.

Documenting Your Charitable Donations

Proper documentation is key to ensuring that your charitable donations are deductible. Here are some important guidelines to follow:

- Cash Donations: For any cash donation of $250 or more, you must obtain a written acknowledgment from the charity confirming the donation amount and the date it was made.

- Non-Cash Donations: If you donate items valued at more than $500, you must complete Form 8283 and obtain a written appraisal if the total value exceeds $5,000.

- Keep Receipts: Always retain receipts, bank statements, or credit card statements as proof of your donations.

Understanding the Standard Deduction vs. Itemizing Deductions

In 2025, taxpayers can choose between taking the standard deduction or itemizing their deductions. The standard deduction simplifies the filing process but may limit the potential tax benefits of your charitable donations. Here’s how to decide which option is best for you:

- Standard Deduction: For 2025, the standard deduction amounts are expected to be higher than in previous years, making it an appealing option for many taxpayers. However, if your total itemized deductions, including charitable contributions, exceed the standard deduction, itemizing may be more beneficial.

- Itemizing Deductions: If you have significant deductible expenses, such as mortgage interest, medical expenses, and state taxes, along with charitable contributions, it may be advantageous to itemize your deductions.

Maximizing Your Charitable Contributions

To optimize your tax deductions through charitable donations, consider the following strategies:

1. Bunching Donations

Bunching involves making multiple years' worth of donations in a single year to exceed the standard deduction threshold. This strategy can allow you to itemize in that year and take advantage of tax savings while reducing your taxable income over several years.

2. Donor-Advised Funds

A donor-advised fund (DAF) allows you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants to charities over time. This can be a great way to bunch donations and manage your charitable giving strategically.

3. Timing Your Donations

Consider the timing of your donations. If you anticipate a higher income year, making larger contributions in that year can help offset your tax liability. Conversely, if you expect a lower income year, you may want to delay donations to maximize their tax impact.

4. Utilizing Retirement Accounts

Charitable contributions from retirement accounts, such as a Qualified Charitable Distribution (QCD) from an IRA, can allow you to donate without incurring taxes on the distribution. This is especially beneficial for those over age 70½.

Special Considerations for 2025

As tax laws can change, it’s essential to stay informed about any specific provisions or changes that may impact charitable donations in 2025. Some key areas to consider include:

- Changes to Standard Deduction: Be aware of any adjustments to the standard deduction that may affect your decision to itemize.

- State Tax Implications: Some states have different rules regarding charitable deductions, so ensure you understand your state’s tax laws as well.

- Temporary Provisions: Keep an eye out for any temporary tax provisions related to charitable giving that may be enacted, especially in response to economic conditions or disasters.

Common Mistakes to Avoid

To ensure you maximize your charitable deductions, avoid these common pitfalls:

- Failure to Keep Records: Without proper documentation, you risk losing your deductions. Always keep detailed records of your donations.

- Ineligible Organizations: Donating to organizations that do not qualify can result in denied deductions. Always verify the charity’s status.

- Overvaluing Non-Cash Donations: Ensure that you accurately assess the fair market value of donated items to avoid complications with the IRS.

Conclusion

Charitable donations can be a powerful tool for maximizing your tax deductions in 2025. By understanding the types of contributions that qualify, documenting your donations correctly, and employing strategies like bunching and donor-advised funds, you can significantly reduce your taxable income. Stay informed about any changes in tax laws and ensure that your charitable giving aligns with IRS regulations. With careful planning and execution, you can make a meaningful impact through your contributions while enjoying substantial tax benefits.

Explore

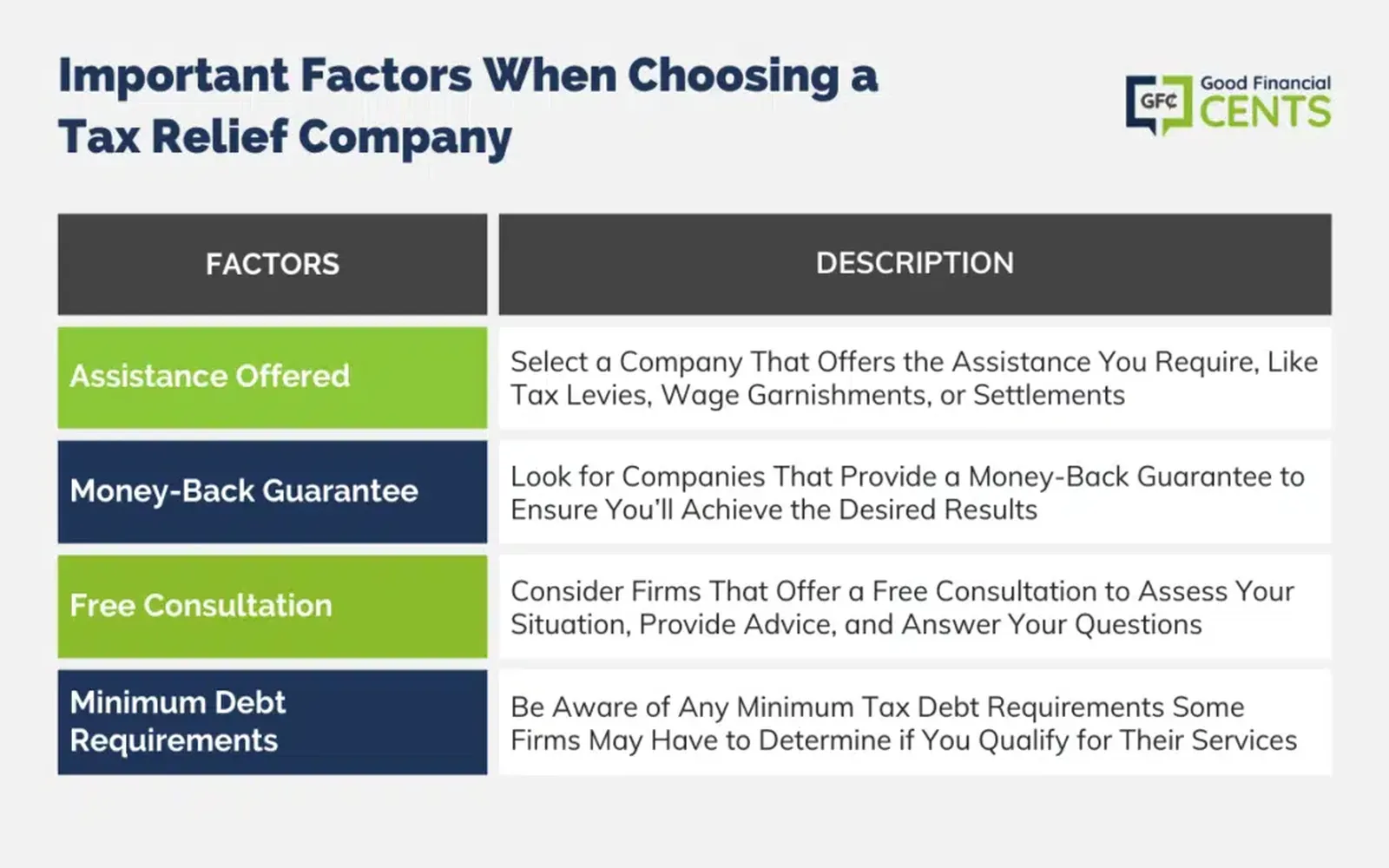

Discover Top Tax Relief Services Near You in 2025: Maximize Your Savings Today!

Tax Debt Relief Service: A Comprehensive Guide to Managing Your Tax Debt

Maximize Your Savings in 2025: The Ultimate Guide to 0% Interest Credit Cards

Maximize Savings in 2025: The Ultimate Guide to 0% APR Credit Card Balance Transfers

Maximizing Your Tax Return: A Guide to Boosting Your Refund

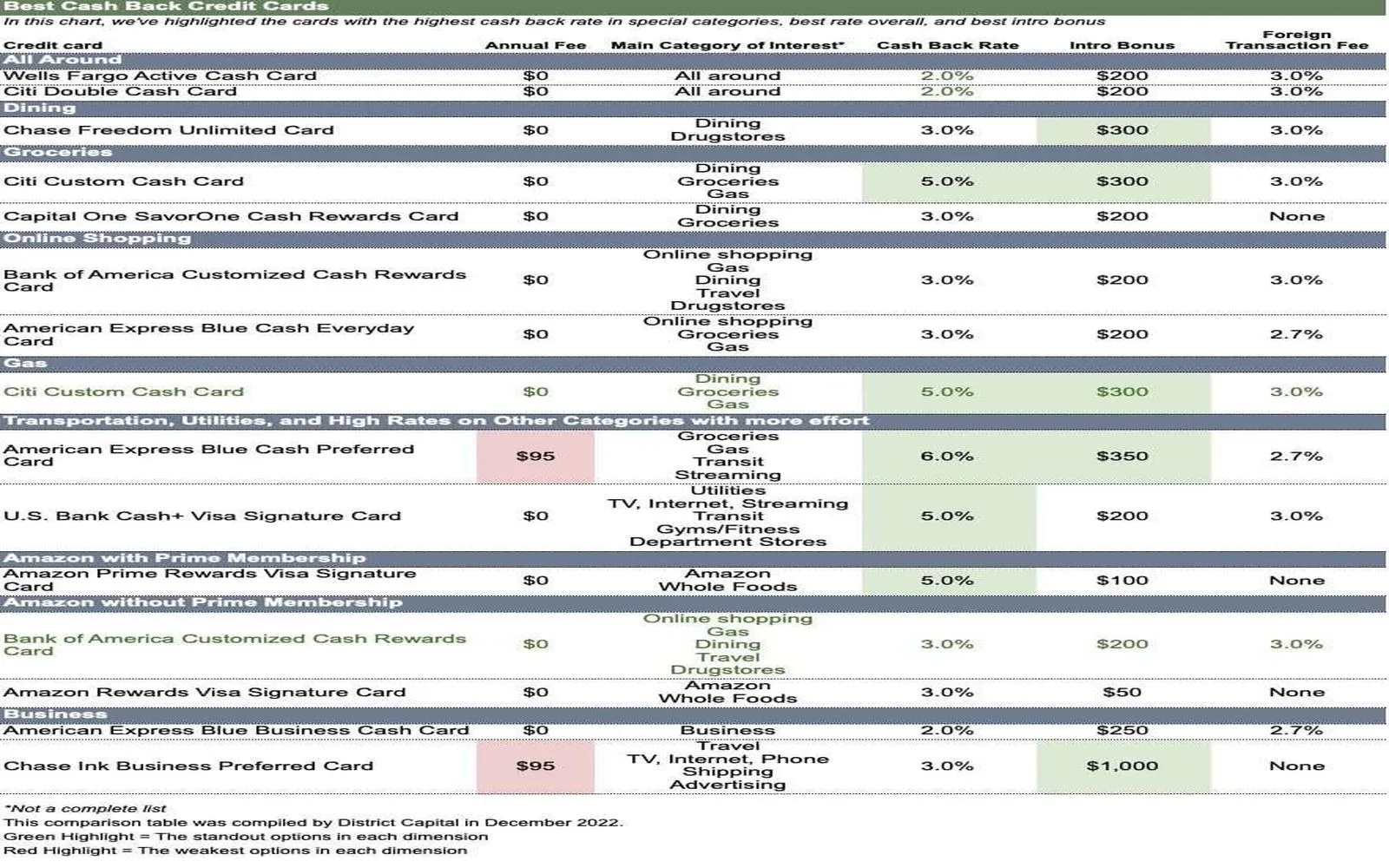

Top Cash Back Credit Cards of 2025: Maximize Your Rewards and Savings

Get the Best Travel Insurance Quotes Online in 2025: Your Ultimate Guide

Top Long Distance Moving Companies to Consider in 2025: Your Ultimate Guide