Navigating Student Loans in 2025: Essential Tips for Future Borrowers

Introduction

As we step into 2025, the landscape of student loans is evolving, shaped by changes in legislation, economic conditions, and the rising costs of education. For future borrowers, understanding how to navigate student loans is crucial for making informed decisions that will impact their financial future. This article provides essential tips for prospective students and their families to manage student loans effectively while minimizing debt burdens.

Understanding the Types of Student Loans

Before diving into the borrowing process, it's important to understand the different types of student loans available. There are generally two categories: federal student loans and private student loans.

Federal Student Loans

Federal student loans are funded by the government and typically offer lower interest rates and more flexible repayment options. The main types include:

- Direct Subsidized Loans: These are need-based loans where the government pays the interest while you’re in school, during the grace period, and during deferment.

- Direct Unsubsidized Loans: Available to all students regardless of financial need, interest begins accruing immediately.

- PLUS Loans: These are designed for graduate students and parents of dependent undergraduates, requiring a credit check.

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. They often have higher interest rates and fewer borrower protections compared to federal loans. It’s crucial to thoroughly compare different lenders and understand the terms before borrowing.

Assessing Your Financial Needs

Before taking out loans, it’s essential to assess your financial needs. Consider the total cost of attendance, which includes tuition, fees, room and board, books, and other living expenses. Here are some steps to help you evaluate your financial needs:

Calculate Total Cost of Attendance

Gather information on tuition rates, as well as expenses related to housing, meals, transportation, and personal expenses. Use the school's net price calculator to estimate your potential costs.

Explore Financial Aid Options

Before resorting to loans, explore scholarships, grants, and work-study programs. These options do not need to be repaid and can significantly reduce the amount you need to borrow.

Determine Your Borrowing Limit

A general rule of thumb is to borrow only what you can afford to repay. Calculate your expected post-graduation income and consider how much of that will be allocated to student loan repayments. Aim to keep your debt manageable.

Applying for Student Loans

Once you have determined your financial needs, it's time to apply for student loans. The Free Application for Federal Student Aid (FAFSA) is the first step for federal loans.

Complete the FAFSA

The FAFSA opens on October 1st each year, and it’s essential to complete it as early as possible to maximize your financial aid opportunities. Gather necessary documents, such as tax returns and financial information, and be prepared to provide details about your family’s financial situation.

Review Your Financial Aid Offer

After submitting the FAFSA, schools will send you a financial aid offer detailing the types and amounts of aid you qualify for. Review this offer carefully, paying close attention to the terms of any loans included.

Choosing the Right Loan

When it comes to selecting the right loan, consider the following factors:

Interest Rates

Compare the interest rates of federal and private loans. Federal loans typically have fixed rates, while private loans may offer variable rates that can increase over time.

Repayment Options

Federal loans offer various repayment plans, including income-driven repayment options that can adjust your monthly payment based on your income. Private loans may have fewer repayment options, so it’s crucial to understand the terms before borrowing.

Loan Forgiveness Programs

Investigate eligibility for loan forgiveness programs, especially if you plan to work in public service or certain high-need professions. Federal loans may qualify for programs like Public Service Loan Forgiveness (PSLF).

Managing Your Loans While in School

While you’re in school, it’s important to manage your loans wisely to minimize future debt. Here are some tips:

Make Interest Payments

If you have unsubsidized loans, consider making interest payments while in school. This can prevent interest from accruing and compounding, reducing your overall loan balance.

Maintain Communication with Your Lender

Stay in touch with your loan servicer for updates on your loans and repayment options. They can provide valuable information and assistance throughout your borrowing journey.

Understanding Repayment Options

Once you graduate, understanding your repayment options is critical. Federal student loans offer several repayment plans:

Standard Repayment Plan

This plan involves fixed monthly payments over ten years. It’s the most straightforward option but may result in higher monthly payments.

Income-Driven Repayment Plans

These plans adjust your monthly payments based on your income and family size, making it easier to manage payments. After 20 to 25 years of qualifying payments, any remaining balance may be forgiven.

Graduated Repayment Plan

This plan starts with lower payments that gradually increase over time, typically every two years. It can be beneficial for those anticipating higher future earnings.

Strategies for Repaying Student Loans

Developing a repayment strategy is essential for managing your loans effectively. Consider the following strategies:

Set a Budget

Create a budget that accounts for your monthly loan payments, living expenses, and savings. This will help you allocate your income effectively and avoid unnecessary debt.

Automate Payments

Setting up automatic payments can help ensure you never miss a due date. Some lenders offer interest rate reductions for borrowers who enroll in autopay.

Consider Refinancing

If you have private loans or a mix of federal and private loans, refinancing may be an option to lower your interest rates. However, be cautious, as refinancing federal loans means losing borrower protections.

Staying Informed about Legislative Changes

The student loan landscape is subject to change due to new legislation and government policies. Staying informed about developments is crucial for future borrowers. Here are some ways to keep updated:

Follow News Outlets and Educational Blogs

Subscribe to reputable news sources and educational blogs that cover student loan topics. These platforms often provide insights into changes in legislation, repayment options, and borrower protections.

Engage with Financial Advisors

If you have questions or need personalized guidance, consider consulting a financial advisor specializing in student loans. They can help you navigate your options and develop a solid financial plan.

Utilizing Resources for Student Loan Management

Several resources are available to help borrowers manage their student loans effectively:

Loan Servicer Websites

Your loan servicer's website can provide information on your loans, repayment options, and account management tools. Make use of these resources to stay organized.

Financial Aid Offices

Your school’s financial aid office can be a valuable resource for information on scholarships, grants, and loan options. Don’t hesitate to reach out with questions.

Online Calculators and Tools

Use online calculators to estimate monthly payments, total repayment amounts, and the impact of making extra payments. These tools can help you understand your loans better.

The Importance of Financial Literacy

Building financial literacy is essential for successful loan management. Understanding concepts like interest rates, credit scores, and budgeting can empower borrowers to make informed decisions.

Educational Workshops

Consider attending financial literacy workshops offered by schools, community organizations, or online platforms. These workshops often cover essential topics related to budgeting, loans, and credit management.

Online Courses

Many platforms offer free or low-cost online courses on personal finance topics. These courses can provide valuable knowledge that will benefit you long after graduation.

Conclusion

Navigating student loans in 2025 requires a proactive approach to understanding your options, managing your debt, and staying informed about changes in the educational landscape. By assessing your financial needs, exploring all available aid, and developing a solid repayment strategy, you can make informed decisions that set you up for success. Empower yourself with knowledge, utilize available resources, and prioritize financial literacy to ensure a brighter financial future.

Explore

Navigating Data Protection in 2025: Essential Strategies for Businesses to Safeguard Sensitive Information

Navigating Medical Loans in 2025: A Comprehensive Guide to Financing Your Healthcare Needs

2025 Guide to Small Business Health Insurance: Affordable Options & Essential Tips for Employers

Choosing the Right Divorce Attorney in 2025: Essential Tips for a Smooth Separation

Essential Guide to Commercial Vehicle Insurance in 2025: Trends, Tips, and Coverage Options

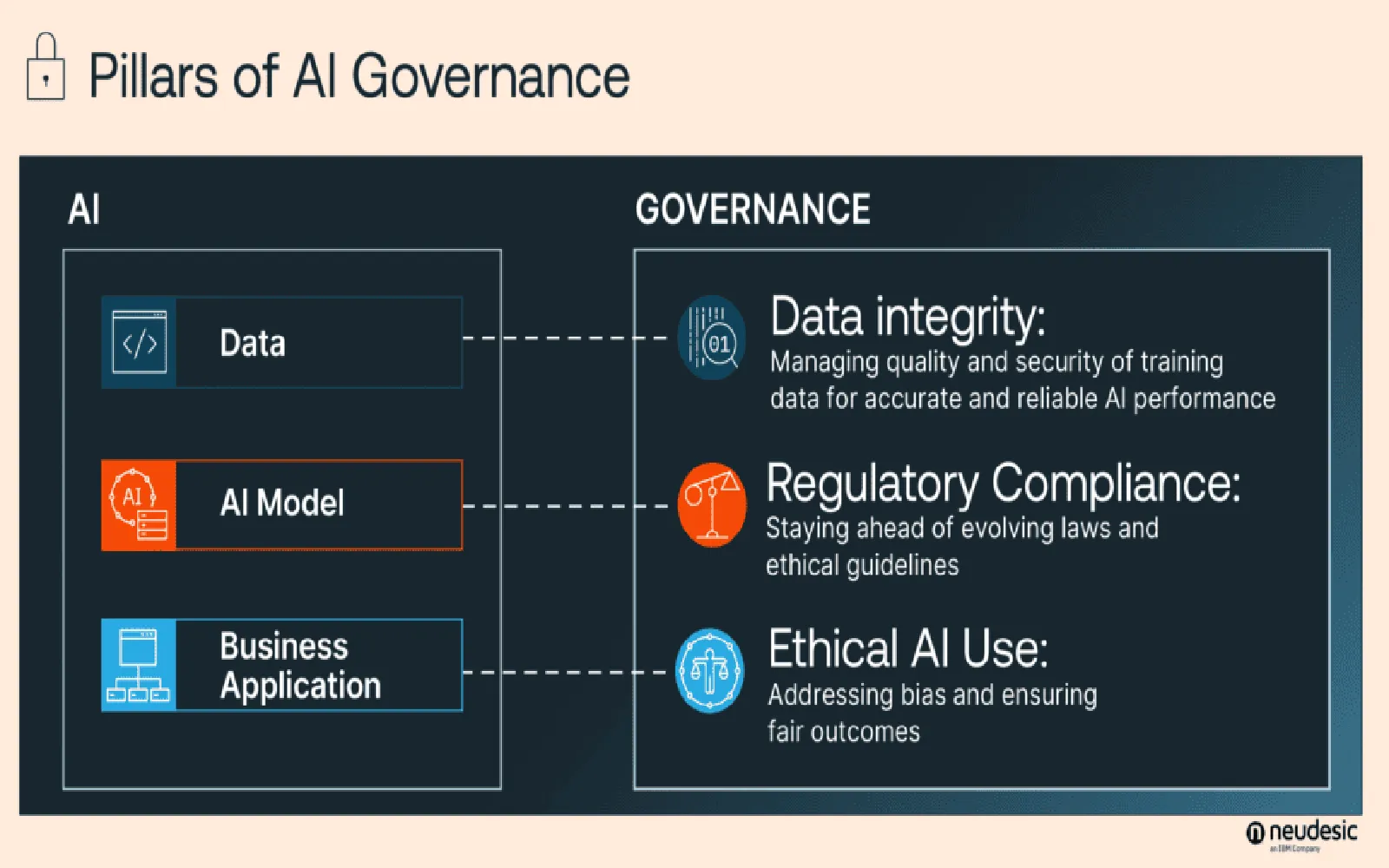

Navigating AI Governance in 2025: Strategies for Ethical and Responsible AI Development

Top AC Repair Services in 2025: Expert Tips for Efficient Cooling Solutions

Find the Best Physical Therapy Near You in 2025: Top Tips and Local Resources