2025 Guide to Small Business Health Insurance: Affordable Options & Essential Tips for Employers

Understanding Small Business Health Insurance in 2025

As we move into 2025, the landscape of health insurance for small businesses continues to evolve. Employers are increasingly aware of the importance of offering health benefits to attract and retain talent. However, with rising healthcare costs and a myriad of options available, navigating the world of small business health insurance can be challenging. This guide aims to provide insights into affordable options and essential tips to help employers make informed decisions regarding health insurance for their employees.

The Importance of Offering Health Insurance

Offering health insurance is not just a regulatory requirement for some businesses; it is also a strategic advantage. In a competitive job market, quality health insurance can differentiate your business from others. Employees often prioritize health benefits when evaluating job offers, and companies that provide comprehensive health plans are more likely to retain their workforce. Furthermore, the well-being of employees directly affects productivity, reducing absenteeism and enhancing overall workplace morale.

Key Considerations for Small Business Owners

Before diving into specific health insurance options, small business owners must consider several factors that influence their decisions:

- Business Structure: The type of business entity (LLC, corporation, etc.) may affect eligibility for certain health insurance programs.

- Number of Employees: The size of your workforce can determine the insurance plans available to you and whether you qualify for group plans.

- Budget: Assessing your financial capacity is crucial. Determine how much you can afford to contribute toward employee premiums.

- Employee Needs: Consider the demographics and health needs of your employees. Younger employees may prefer lower premiums, while older employees might value comprehensive coverage.

Types of Health Insurance Options for Small Businesses

In 2025, small businesses have access to various health insurance options. Understanding these can help employers choose the most suitable plan for their workforce.

1. Group Health Insurance

Group health insurance is one of the most common options for small businesses. It allows employers to offer coverage to all employees under a single policy, which often results in lower premiums compared to individual plans. Group plans can vary significantly in terms of coverage, deductibles, and premiums, so it’s essential to compare different offerings.

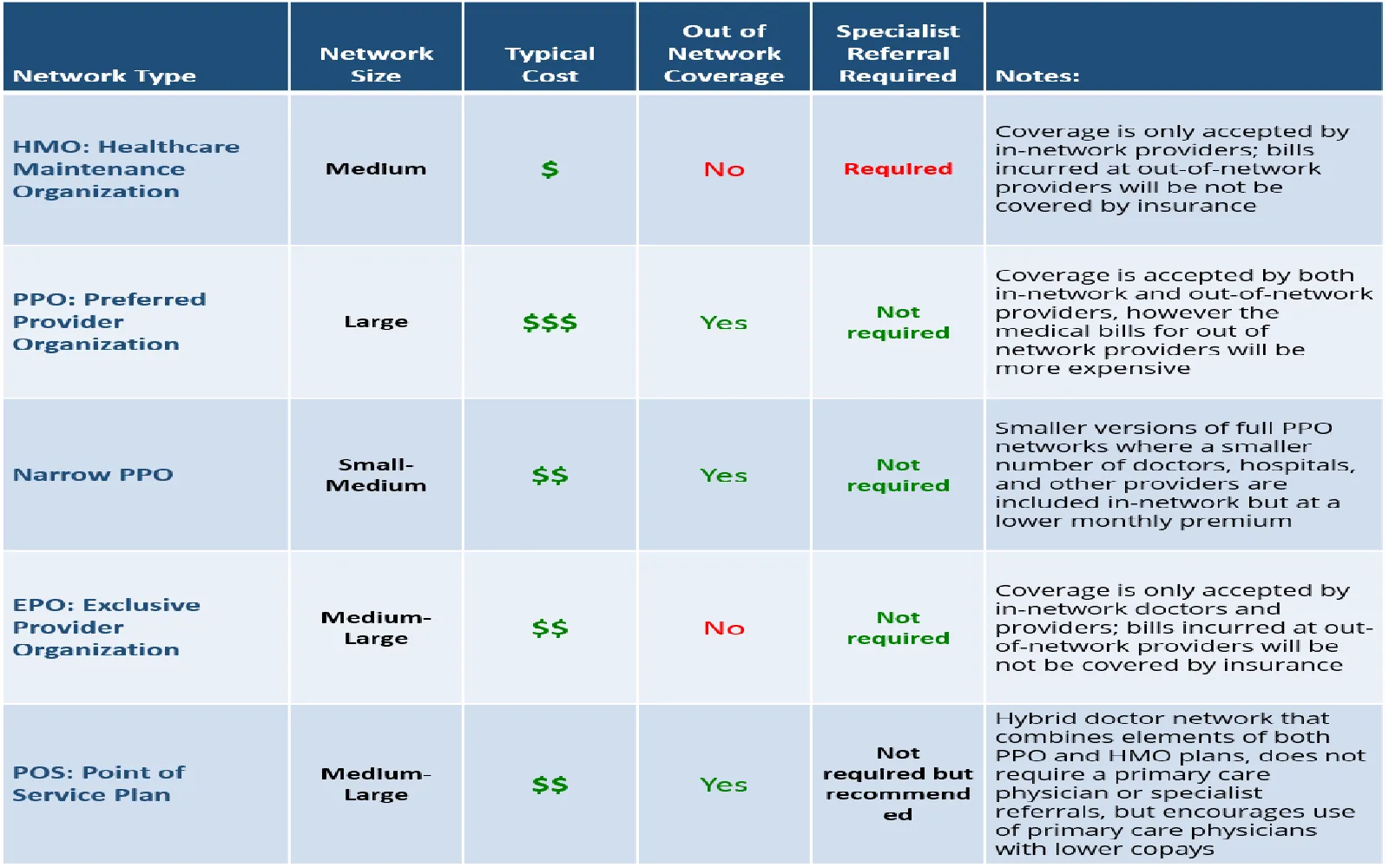

2. Health Maintenance Organization (HMO) Plans

HMO plans require members to choose a primary care physician (PCP) and obtain referrals to see specialists. While these plans typically have lower premiums and out-of-pocket costs, they may limit flexibility in choosing healthcare providers. HMO plans are an excellent choice for businesses looking to control costs while providing essential coverage.

3. Preferred Provider Organization (PPO) Plans

PPO plans offer more flexibility in choosing healthcare providers. Employees can see any doctor without a referral, although staying within the network results in lower costs. While PPO plans tend to have higher premiums than HMO plans, they are popular among employees who value choice and flexibility in their healthcare.

4. High Deductible Health Plans (HDHPs) with Health Savings Accounts (HSAs)

HDHPs have lower monthly premiums but higher deductibles. They are often paired with HSAs, allowing employees to save money tax-free for medical expenses. These plans are becoming increasingly popular among small businesses, especially those with younger employees who may not require extensive medical care.

5. Individual Coverage Health Reimbursement Arrangements (ICHRA)

ICHRA allows employers to reimburse employees for individual health insurance premiums. This option offers flexibility, enabling employees to choose plans that best fit their needs while providing tax advantages for employers. ICHRA is especially beneficial for small businesses that may not have a large workforce.

Cost-Saving Strategies for Small Businesses

While providing health insurance is essential, small businesses must also explore cost-saving strategies to manage expenses effectively. Here are some tips:

1. Shop Around and Compare Plans

Take the time to research different health insurance providers and compare plans. Look beyond the premium costs; consider factors like deductibles, copayments, and out-of-pocket maximums. Using an insurance broker can help simplify this process and identify the best options for your business.

2. Consider Employee Contributions

While offering health insurance is an attractive benefit, sharing the costs with employees can help manage expenses. Determine a fair contribution strategy, ensuring that employees understand the value of the benefits they receive.

3. Utilize Health and Wellness Programs

Investing in health and wellness programs can lead to healthier employees, potentially reducing insurance claims and costs. Programs may include gym memberships, smoking cessation programs, or mental health resources. Healthy employees often lead to lower premiums over time.

4. Take Advantage of Tax Credits

Small businesses may qualify for tax credits under the Affordable Care Act (ACA) if they provide health insurance to employees. Understanding eligibility and the application process can result in significant savings. Consult with a tax professional to explore available credits.

Compliance and Legal Considerations

In 2025, small business owners must stay informed about compliance with federal and state regulations governing health insurance. Here are some critical considerations:

1. Affordable Care Act (ACA) Compliance

The ACA mandates that businesses with 50 or more full-time equivalent employees must provide affordable health insurance. Understanding the criteria for affordability and minimum essential coverage is essential to avoid penalties.

2. State-Specific Regulations

Health insurance regulations can vary by state. Small business owners should familiarize themselves with state-specific requirements, such as mandated benefits or reporting obligations. Staying compliant with local laws is crucial to avoiding legal issues.

Engaging Employees in the Health Insurance Process

Involving employees in the health insurance decision-making process can lead to greater satisfaction and utilization of benefits. Here are some strategies to engage your workforce:

1. Education and Communication

Provide resources and information about the available health insurance options. Host informational sessions or workshops to educate employees on how to choose the best plan for their needs. Clear communication is key to ensuring employees understand their benefits.

2. Soliciting Feedback

Gather feedback from employees regarding their healthcare needs and preferences. Conduct surveys to assess what benefits are most valued. This information can guide future decisions about health insurance offerings.

3. Promoting Health Literacy

Encouraging employees to understand their health insurance plans and how to use them effectively can help maximize the value of the benefits. Providing resources on health literacy can empower employees to make informed decisions about their healthcare.

Conclusion

Navigating the world of small business health insurance in 2025 requires careful consideration and planning. By understanding the various options available, employing cost-saving strategies, and ensuring compliance with regulations, small business owners can provide valuable health benefits to their employees. Ultimately, investing in health insurance is not just an obligation; it is an opportunity to enhance employee satisfaction, improve retention, and foster a healthier workplace.

Final Thoughts

As the healthcare landscape continues to change, staying informed and adaptable is crucial for small business owners. By prioritizing health insurance, employers can create a positive work environment that supports their employees' well-being and contributes to the overall success of the business.

Explore

Essential Guide to Commercial Vehicle Insurance in 2025: Trends, Tips, and Coverage Options

Top Small Business Health Insurance Providers in the USA: A 2025 Guide to Affordable Coverage

Choosing the Right Divorce Attorney in 2025: Essential Tips for a Smooth Separation

Navigating Student Loans in 2025: Essential Tips for Future Borrowers

2025 Guide to Breast Enlargement Financing: Affordable Options for Your Transformation

Top Small Business Financial Advisors Near Me in 2025: Expert Tips for Success

Best Health Insurance in the USA: A Comprehensive Guide

2025 Guide to Pet Insurance: Protect Your Furry Friends with the Best Coverage Options