Navigating Medical Loans in 2025: A Comprehensive Guide to Financing Your Healthcare Needs

Introduction

In 2025, navigating the world of medical loans has become an essential skill for many individuals seeking healthcare. As medical costs continue to rise, understanding how to finance your healthcare needs is crucial. This comprehensive guide will explore the various types of medical loans available, the application process, and tips for managing repayment effectively.

Understanding Medical Loans

Medical loans are personal loans specifically designed to cover healthcare expenses. They can be used for a variety of medical needs, including elective surgeries, dental procedures, fertility treatments, and even cosmetic procedures. Unlike traditional loans, medical loans often come with specific terms and conditions tailored to the healthcare sector.

Types of Medical Loans

There are several types of medical loans available in 2025, each suited for different healthcare needs:

1. Personal Loans

Personal loans can be used for any purpose, including medical expenses. These loans can be secured or unsecured, with interest rates varying based on your credit score and financial history. Borrowers can typically access a larger loan amount with a secured loan, but it requires collateral.

2. Medical Credit Cards

Medical credit cards are specifically designed for healthcare expenses. They often come with promotional financing options, such as deferred interest plans, allowing you to pay off the balance without accruing interest if paid within a specified period. However, borrowers should be cautious, as high-interest rates may apply after the promotional period ends.

3. Health Care Financing Programs

Many healthcare providers offer their own financing programs, allowing patients to pay for services over time. These programs often come with flexible repayment terms and may offer low or no interest. Always check with your provider to see what financing options are available.

4. Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual investors willing to fund loans. This alternative financing option can provide competitive interest rates, especially for those with good credit. However, the application process may take longer than traditional loans.

5. Home Equity Loans

Home equity loans allow homeowners to borrow against the equity in their homes. While these loans can offer lower interest rates, they do carry the risk of foreclosure if you are unable to repay. This option is best suited for significant medical expenses.

How to Apply for a Medical Loan

The application process for medical loans can vary depending on the lender and the type of loan. Here is a general outline to help you navigate the process:

1. Assess Your Financial Situation

Before applying for a medical loan, evaluate your financial situation. Consider your income, expenses, and existing debts to determine how much you can afford to borrow. This self-assessment will help you avoid overextending yourself financially.

2. Research Lenders

Take the time to research different lenders and their offerings. Look for reviews and compare interest rates, fees, and repayment terms. Online comparison tools can help you easily evaluate your options.

3. Gather Documentation

Most lenders will require documentation to process your application. Commonly requested documents include:

- Proof of income

- Credit history

- Identification (e.g., driver's license, Social Security number)

- Details about the medical procedure or expense

4. Complete the Application

Once you have selected a lender, complete the application form. Be sure to provide accurate information to avoid delays. Some lenders offer online applications for convenience.

5. Review Loan Offers

After submitting your application, you may receive multiple loan offers. Review each offer carefully, paying attention to interest rates, fees, and repayment terms. Choose the loan that best fits your financial situation and healthcare needs.

6. Accept the Loan

If you are satisfied with the loan offer, accept the terms and conditions. The lender will then disburse the funds, which you can use to pay for your medical expenses.

Managing Loan Repayment

Once you have secured a medical loan, managing repayment is crucial to maintaining your financial health. Here are some strategies to help you manage your payments effectively:

1. Set Up a Budget

Creating a budget that includes your new loan payments is essential. Allocate funds for your monthly expenses, and make sure to prioritize your loan repayments. This will help you stay on track and avoid late payments.

2. Automate Payments

Consider setting up automatic payments to ensure you never miss a due date. Many lenders offer this option, which can simplify the repayment process and help you avoid late fees.

3. Communicate with Your Lender

If you encounter financial difficulties, communicate with your lender as soon as possible. Many lenders offer hardship programs or alternative repayment options to help borrowers during tough times.

4. Explore Refinancing

If interest rates drop or your credit score improves, consider refinancing your medical loan. This can lead to lower monthly payments or reduced interest rates, making it easier to manage your debt.

Understanding the Implications of Medical Debt

Medical debt can have a significant impact on your financial health. It is essential to understand the implications of taking on medical loans:

1. Impact on Credit Score

Like any loan, medical loans will affect your credit score. Timely payments can help improve your score, while missed payments can lead to a negative impact. Monitor your credit report regularly to track changes.

2. Debt-to-Income Ratio

Your debt-to-income ratio is a crucial factor in determining your financial health. High medical debt can increase this ratio, making it difficult to secure additional loans in the future. Strive to keep your debt manageable to maintain a healthy ratio.

3. Bankruptcy Considerations

If medical debt becomes unmanageable, bankruptcy may be an option. However, this should be a last resort, as it can have long-lasting effects on your credit and financial future. Consult with a financial advisor or attorney to explore your options.

Conclusion

Navigating medical loans in 2025 requires careful consideration and planning. By understanding the various types of loans available, the application process, and effective repayment strategies, you can make informed decisions about financing your healthcare needs. Remember to stay proactive in managing your debt and seek assistance when necessary. With the right approach, you can access the care you need without compromising your financial well-being.

Explore

Top Mortgage Lenders in the U.S. for 2025: Your Guide to Smart Home Financing

2025 Guide to Breast Enlargement Financing: Affordable Options for Your Transformation

Top Mortgage Lenders in the USA: Your 2025 Guide to Affordable Home Financing

Navigating Student Loans in 2025: Essential Tips for Future Borrowers

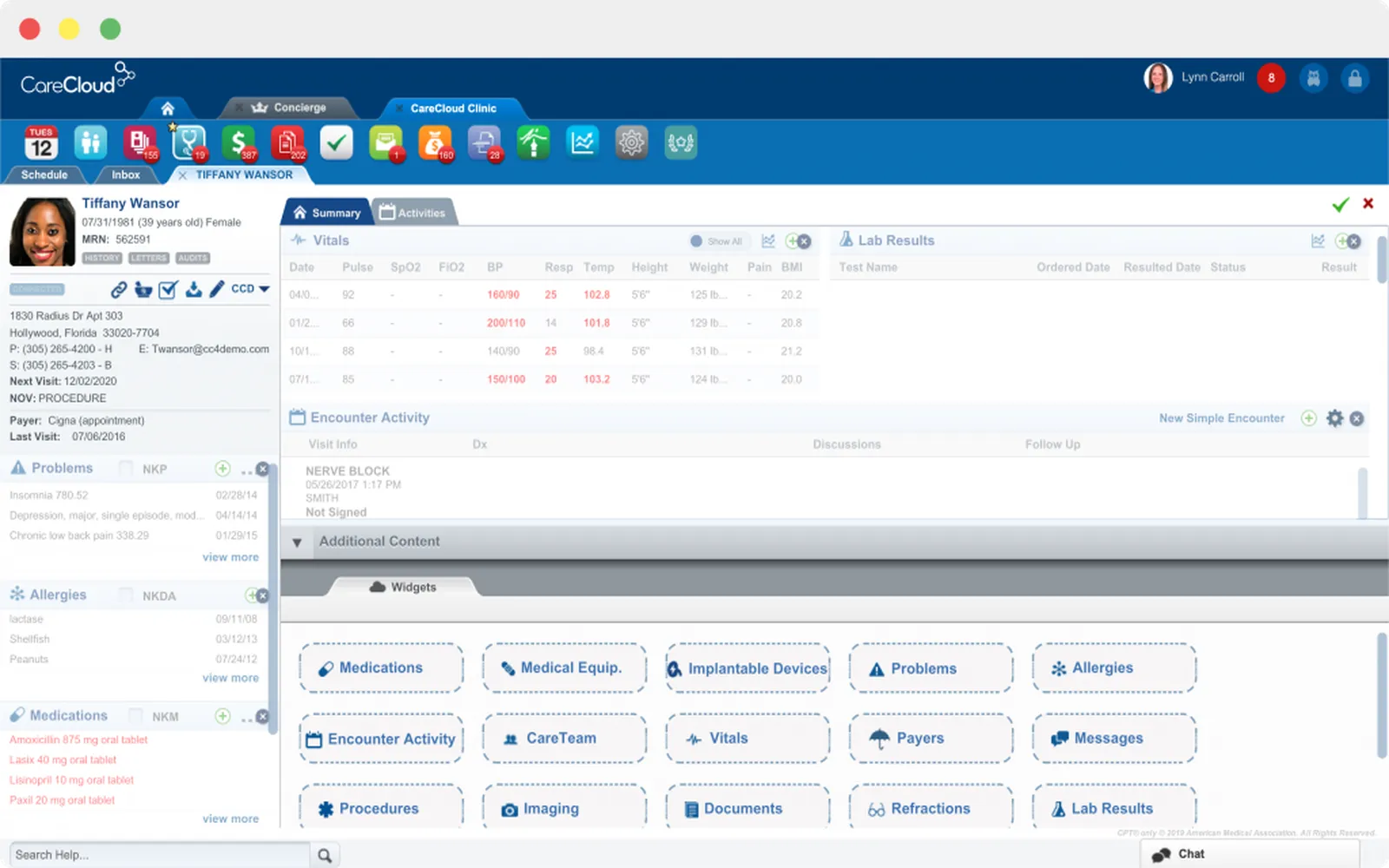

Best EMR & EHR Software for Healthcare Providers in 2025

Choosing a Good Medical Record System: Key Features and Benefits

Finding the Right Local Law Firm for Your Legal Needs

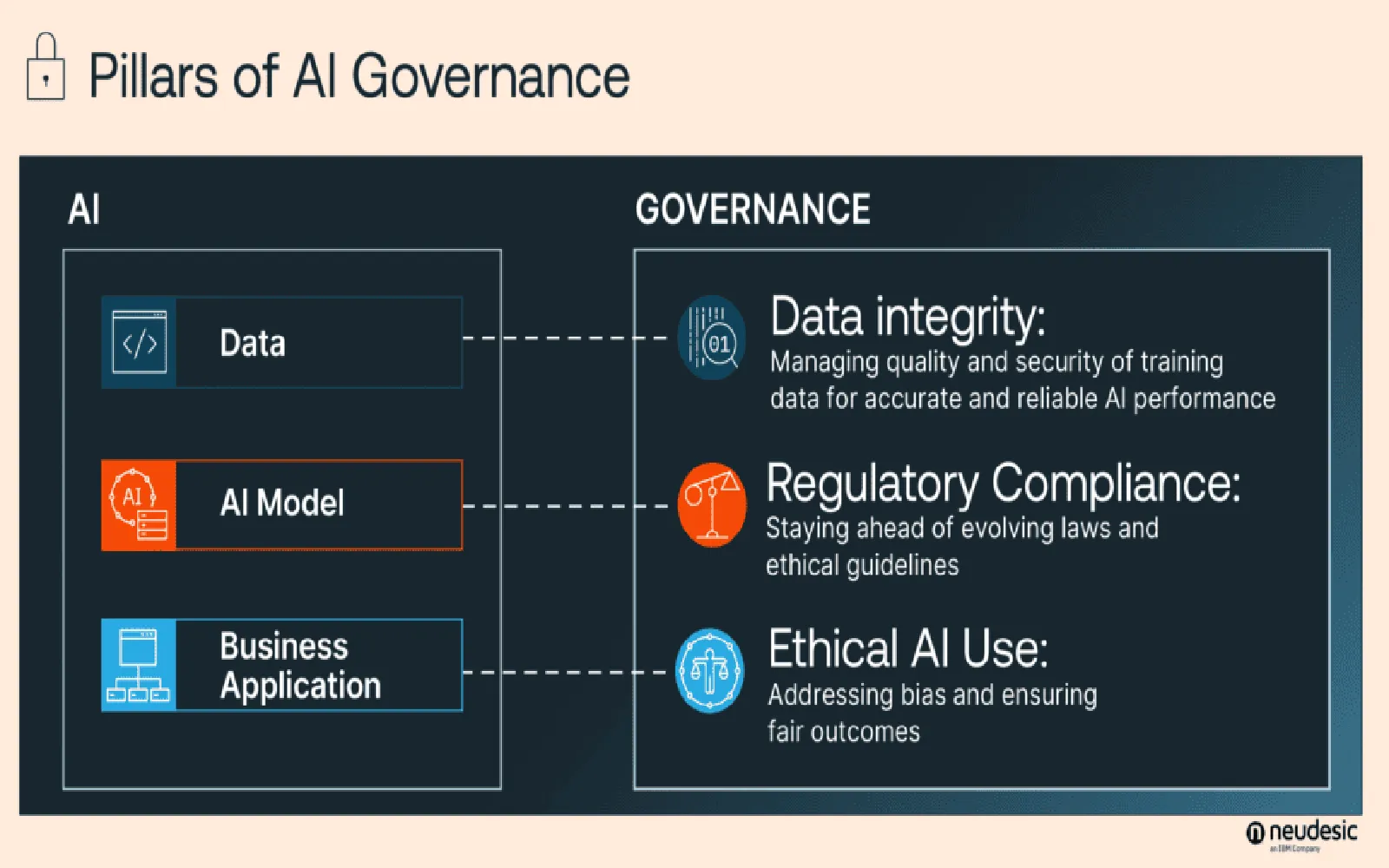

Navigating AI Governance in 2025: Strategies for Ethical and Responsible AI Development