2025 Guide to Pet Insurance: Protect Your Furry Friends with the Best Coverage Options

Introduction

As pet ownership continues to rise, the need for comprehensive pet insurance becomes increasingly important. By 2025, the landscape of pet insurance has evolved significantly, offering pet owners a myriad of options to protect their furry friends. This guide aims to provide valuable insights into pet insurance, helping you navigate the complexities of coverage options, ensuring your beloved pets receive the best care possible.

Understanding Pet Insurance

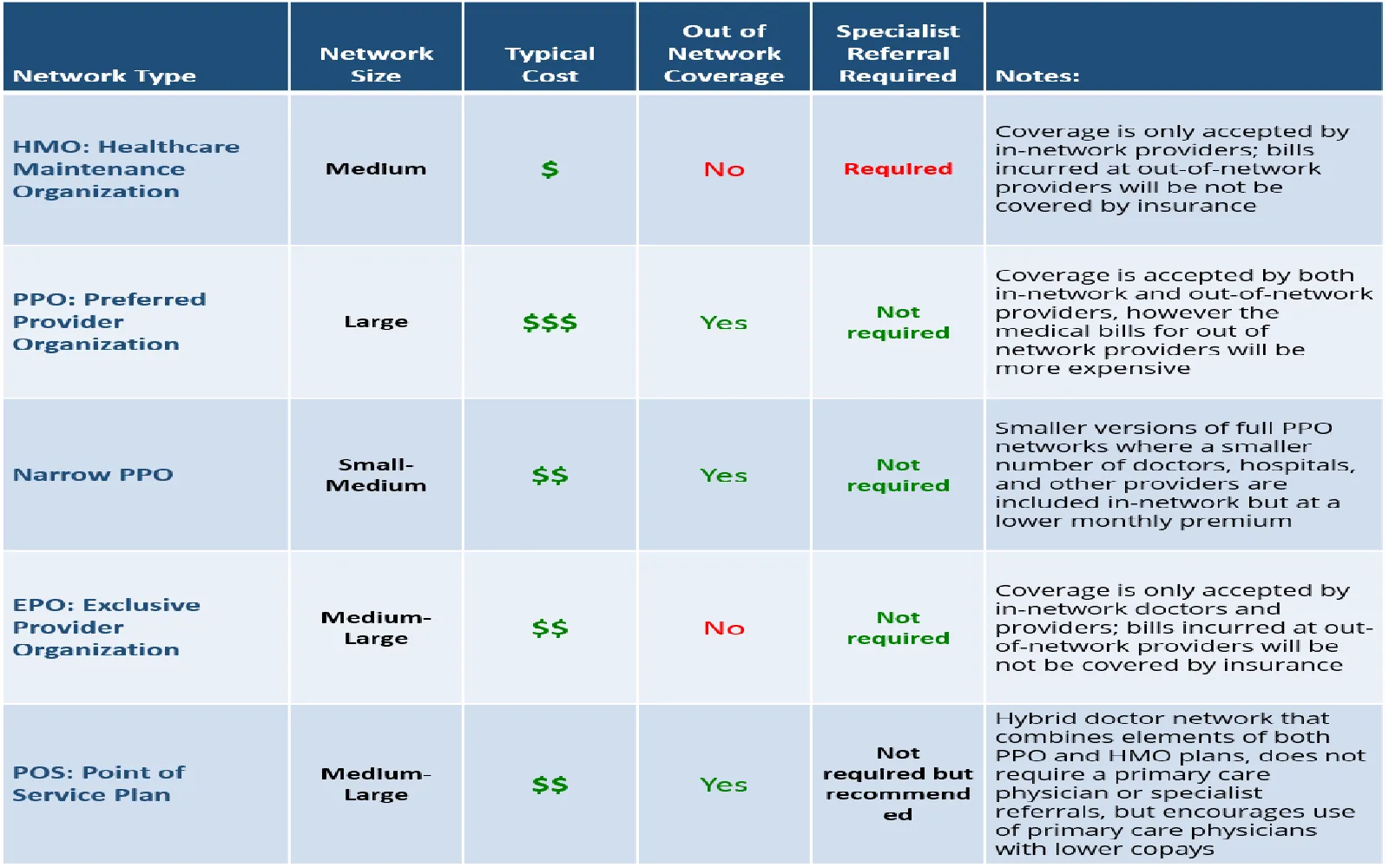

Pet insurance is designed to help offset the costs of veterinary care. Much like health insurance for humans, it provides financial protection against unexpected medical expenses. There are several types of coverage available, allowing pet owners to choose a plan that best suits their needs and budget.

Types of Pet Insurance Coverage

In 2025, there are primarily three types of pet insurance coverage available: accident-only plans, accident and illness plans, and wellness plans. Each type offers different levels of protection, allowing you to tailor your coverage to your pet's needs.

Accident-Only Plans

Accident-only plans provide coverage for unexpected accidents such as broken bones, cuts, or ingestion of foreign objects. These plans are generally more affordable but do not cover illnesses or preventive care. They are ideal for pet owners who want basic coverage for emergencies without the higher premiums associated with more comprehensive plans.

Accident and Illness Plans

Accident and illness plans offer a broader range of coverage, protecting against both accidents and a variety of illnesses, including chronic conditions, infections, and hereditary diseases. These plans typically have higher premiums but provide peace of mind knowing that you are covered in most situations. This type of coverage is recommended for pet owners who want to ensure their pets receive the best possible care throughout their lives.

Wellness Plans

Wellness plans, often referred to as preventive care plans, cover routine care such as vaccinations, annual check-ups, and dental cleanings. While these plans do not cover emergencies or illnesses, they are an excellent addition to accident and illness plans, helping pet owners budget for routine care. In 2025, many insurance companies offer customizable wellness plans, allowing you to choose the services that best fit your pet's needs.

Factors to Consider When Choosing Pet Insurance

Choosing the right pet insurance can be overwhelming, given the plethora of options available in 2025. Here are some key factors to consider when selecting a plan:

Breed and Age of Your Pet

The breed and age of your pet can significantly influence the cost of insurance premiums. Certain breeds are predisposed to specific health issues, leading to higher premiums. Additionally, older pets may require more medical attention, resulting in increased costs. Be sure to factor in these considerations when evaluating insurance options.

Coverage Limits

Most pet insurance plans come with coverage limits, which cap the amount the insurer will pay for claims. These limits can be annual, per incident, or lifetime. It's essential to choose a plan with coverage limits that align with your pet's potential medical needs. Higher limits typically result in higher premiums but provide better protection for serious health issues.

Deductibles and Copayments

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Copayments are the percentage of the bill you are responsible for after the deductible has been met. Understanding these terms is critical, as they will affect your overall costs. In 2025, many insurers offer customizable deductibles, allowing you to find a balance between premium costs and out-of-pocket expenses.

Exclusions and Waiting Periods

Before purchasing a pet insurance policy, it's essential to read the fine print regarding exclusions. Most plans do not cover pre-existing conditions, so any health issues your pet has before obtaining insurance will not be covered. Additionally, insurers often impose waiting periods—timeframes during which new illnesses or accidents are not covered. Be sure to understand these terms to avoid surprises down the line.

The Role of Technology in Pet Insurance

As technology continues to advance, so does the pet insurance industry. By 2025, many insurers leverage technology to improve customer experience and streamline claims processing. Here are some technological innovations shaping the future of pet insurance:

Mobile Apps

Many pet insurance companies now offer mobile apps that allow pet owners to manage their policies, submit claims, and access customer support. These apps often feature a user-friendly interface, making it easier to navigate your coverage and track your pet's health history.

Telemedicine

Telemedicine services have gained popularity in the veterinary field, enabling pet owners to consult with veterinarians remotely. Some pet insurance plans in 2025 include telehealth coverage, allowing you to seek advice for minor health concerns without incurring additional costs. This innovation can save time and money while ensuring your pet receives prompt care.

AI and Data Analytics

Artificial intelligence (AI) and data analytics play a significant role in assessing risk and determining premiums. Insurers use data to identify trends in pet health, allowing them to create more tailored coverage options. This technology can lead to more competitive prices and better policy offerings, ultimately benefiting pet owners.

How to Make a Claim

Filing a claim can be one of the more daunting aspects of pet insurance, but understanding the process can make it much simpler. Here’s a step-by-step guide to making a claim in 2025:

Step 1: Gather Documentation

Before submitting a claim, ensure you have all necessary documentation, including your pet's medical records, invoices, and receipts from the veterinarian. Some insurers also require a claim form that can typically be downloaded from their website or mobile app.

Step 2: Submit Your Claim

Most insurance companies allow you to submit claims online, through their mobile app, or via traditional mail. Filling out the claim form accurately is crucial to avoid delays. Be sure to include all necessary documentation, ensuring everything is clear and legible.

Step 3: Monitor Claim Status

After submitting your claim, you can track its status through the insurer's website or mobile app. Many companies provide updates on the progress of your claim, so you know when to expect reimbursement.

Step 4: Receive Reimbursement

Once your claim is approved, you will receive reimbursement based on your plan’s coverage limits, deductibles, and copayments. This process can take anywhere from a few days to several weeks, depending on the insurer's policies.

Cost of Pet Insurance in 2025

The cost of pet insurance varies widely based on several factors, including the type of coverage, the age and breed of your pet, and your location. In 2025, the average monthly premium for accident and illness coverage ranges from $30 to $70 for dogs and $15 to $40 for cats. Wellness plans may add an additional $10 to $30 per month to your overall costs.

Factors Affecting Premiums

Several factors can affect your pet insurance premiums:

- Pet Age: Older pets often have higher premiums due to increased health risks.

- Breed: Some breeds are prone to specific health issues, leading to higher premiums.

- Location: Veterinary costs can vary by region, impacting insurance rates.

- Coverage Type: More comprehensive plans generally come with higher premiums.

Choosing the Right Pet Insurance Provider

In 2025, numerous pet insurance providers compete in the market, each offering unique plans and features. Here are some tips for selecting the right provider:

Research and Compare Plans

Take the time to research various insurers and compare their plans. Look for reviews and testimonials from other pet owners to gauge customer satisfaction. Many websites offer comparison tools to help you evaluate different policies side by side.

Customer Service and Support

Consider the quality of customer service offered by each insurer. A responsive and knowledgeable support team can make a significant difference when you need assistance or have questions about your policy.

Financial Stability

Check the financial stability of the insurance provider. You want to ensure that the company can cover claims and remains viable in the long term. Independent rating agencies can provide insights into an insurer's financial health.

Common Misconceptions About Pet Insurance

There are several misconceptions surrounding pet insurance that can deter pet owners from obtaining coverage. Here are a few common myths debunked:

Myth 1: Pet Insurance is Too Expensive

While pet insurance premiums can vary, many affordable options are available. By choosing a plan that fits your budget and needs, you can provide your pet with valuable coverage without breaking the bank.

Myth 2: Older Pets Cannot Get Insurance

While it may be more challenging to find coverage for older pets, many insurers offer plans specifically for senior animals. It's crucial to start researching your options early to ensure you can find a suitable policy.

Myth 3: All Pet Insurance Plans are the Same

Not all pet insurance plans are created equal. Different providers offer various coverage options, exclusions, and premium rates. It's essential to compare plans to find one that meets your specific needs and budget.

Conclusion

In 2025, pet insurance is more important than ever for ensuring the health and well-being of your furry friends. With a variety of coverage options available, it's essential to research and select a plan that best fits your pet's needs. By understanding the different types of coverage, factors affecting premiums, and the claims process, you can make informed decisions that ultimately protect your pets and your finances. Investing in pet insurance is a proactive step towards ensuring that your beloved companions receive the care they deserve, no matter what life throws their way.

Explore

Top Pet Insurance Companies of 2025: Finding the Best Coverage for Your Furry Friends

Essential Guide to Commercial Vehicle Insurance in 2025: Trends, Tips, and Coverage Options

Top Small Business Health Insurance Providers in the USA: A 2025 Guide to Affordable Coverage

2025 Trends in Auto Insurance: What You Need to Know for Optimal Coverage

Top Antivirus Software of 2025: Protect Your Digital World from Evolving Cyber Threats

2025 Home Warranty Quotes: What You Need to Know for Affordable Coverage

Exploring Humana Health Benefits in 2025: What You Need to Know for Optimal Coverage

2025 Guide to Small Business Health Insurance: Affordable Options & Essential Tips for Employers