2025 Trends in Auto Insurance: What You Need to Know for Optimal Coverage

Introduction

As we move into 2025, the auto insurance landscape is evolving rapidly, influenced by technological advancements, changing consumer behaviors, and regulatory shifts. Understanding these trends is crucial for consumers seeking optimal coverage. This article explores the key trends in auto insurance for 2025, helping you make informed decisions about your coverage options.

The Rise of Usage-Based Insurance

Usage-based insurance (UBI) has gained significant traction over the past few years, and by 2025, it is expected to become a mainstream option for many drivers. UBI policies use telematics data to assess driving behaviors, such as speed, braking patterns, and mileage. This data allows insurers to offer personalized premiums based on individual risk profiles, rewarding safe driving habits with lower rates.

Telematics Technology Advancements

With the increasing integration of telematics technology in vehicles, insurers are able to gather more accurate data than ever before. In 2025, expect advancements in connected car technology to enhance the capabilities of UBI programs. Features such as real-time monitoring and predictive analytics will provide insurers with deeper insights into driver behavior, leading to more tailored insurance solutions.

Increased Focus on Electric Vehicles

The shift towards electric vehicles (EVs) is reshaping the auto insurance market. By 2025, the number of EVs on the roads is expected to grow significantly, prompting insurers to develop specialized policies that account for the unique characteristics of these vehicles. Factors such as battery life, charging infrastructure, and maintenance requirements will influence coverage options and pricing.

Enhanced Cybersecurity Coverage

As vehicles become increasingly connected and reliant on technology, the risk of cyberattacks looms larger. By 2025, auto insurers will likely expand their coverage options to include specific cybersecurity protections. Policies may offer coverage for data breaches, hacking incidents, and the costs associated with recovering from cyber threats, ensuring that consumers are protected in this digital age.

Personalized Coverage Options

In 2025, the trend toward personalized insurance coverage will continue to gain momentum. Insurers will utilize data analytics to create tailored policies that meet the unique needs of individual drivers. This approach allows consumers to select coverage options that reflect their driving habits, lifestyle, and financial situation, leading to more affordable and relevant insurance solutions.

The Impact of Autonomous Vehicles

As autonomous vehicle technology progresses, the implications for auto insurance are profound. By 2025, more discussions around liability and coverage for self-driving cars will emerge. Insurers will need to navigate the complexities of determining fault in accidents involving autonomous vehicles. This may lead to the development of new insurance models that address the unique challenges posed by this technology.

The Role of Artificial Intelligence

Artificial intelligence (AI) is set to play a pivotal role in the auto insurance industry by 2025. Insurers will increasingly leverage AI for underwriting, claims processing, and customer service. AI algorithms can analyze vast amounts of data quickly, allowing insurers to make more accurate risk assessments and streamline the claims process. This will result in faster service for consumers and potentially lower premiums.

Increased Regulatory Scrutiny

As technology and consumer expectations evolve, regulatory bodies are likely to increase their scrutiny of the auto insurance industry. By 2025, insurers will need to adapt to new regulations aimed at protecting consumers and ensuring fair practices. This could include guidelines on data privacy, transparency in pricing, and standardized coverage options, impacting how insurers operate and offer their products.

Shift Toward Environmental Considerations

With growing awareness of environmental issues, auto insurance companies are likely to incorporate sustainability into their offerings by 2025. Insurers may provide discounts for eco-friendly driving habits, such as using public transportation or driving fuel-efficient vehicles. Additionally, policies may be designed to incentivize customers to reduce their carbon footprint, aligning the insurance industry with broader environmental goals.

Digital-First Customer Experiences

The demand for seamless, digital-first experiences continues to rise. By 2025, consumers will expect insurers to provide intuitive online platforms for policy management, claims filing, and customer support. Insurers that prioritize digital transformation will be better positioned to meet the needs of tech-savvy customers, offering features like mobile apps, chatbots, and online communication channels.

The Gig Economy and Flexible Coverage

The gig economy is reshaping traditional employment structures, and auto insurance must adapt accordingly. By 2025, more drivers will engage in gig work, such as ridesharing or food delivery, necessitating flexible insurance options. Insurers may offer short-term or on-demand coverage solutions that cater to the unique needs of gig workers, allowing them to obtain insurance that aligns with their varying work schedules.

Better Claims Processes

Claims processing has long been a pain point for consumers, but advancements in technology are set to change that by 2025. Insurers are likely to adopt more efficient claims handling systems, utilizing AI and automation to expedite the process. Expect features like instant claims approval, digital documentation submission, and real-time tracking of claims status, enhancing the overall customer experience.

Telematics-Based Discounts and Incentives

In addition to personalized premiums, insurers are expected to introduce more telematics-based discounts and incentives in 2025. Safe drivers may receive rewards such as cash back, lower deductibles, or even discounts on future policies based on their driving behavior. This trend not only encourages safer driving but also fosters a sense of loyalty between consumers and insurers.

Education and Awareness Campaigns

As the auto insurance landscape evolves, education and awareness will become paramount. By 2025, insurers will likely invest in campaigns to inform consumers about new coverage options, telematics benefits, and the implications of emerging technologies. Educated consumers will be better equipped to make informed decisions about their auto insurance, leading to more satisfactory outcomes.

Conclusion

The auto insurance landscape in 2025 promises to be dynamic and multifaceted, driven by technological advancements, changing consumer expectations, and regulatory developments. By understanding these trends, consumers can navigate the evolving market and secure optimal coverage that meets their individual needs. Whether it's embracing usage-based insurance, adapting to the rise of electric vehicles, or leveraging new digital tools, being informed will empower consumers to make the best choices in their auto insurance journey.

Explore

Exploring Humana Health Benefits in 2025: What You Need to Know for Optimal Coverage

2025 Home Warranty Quotes: What You Need to Know for Affordable Coverage

Essential Guide to Commercial Vehicle Insurance in 2025: Trends, Tips, and Coverage Options

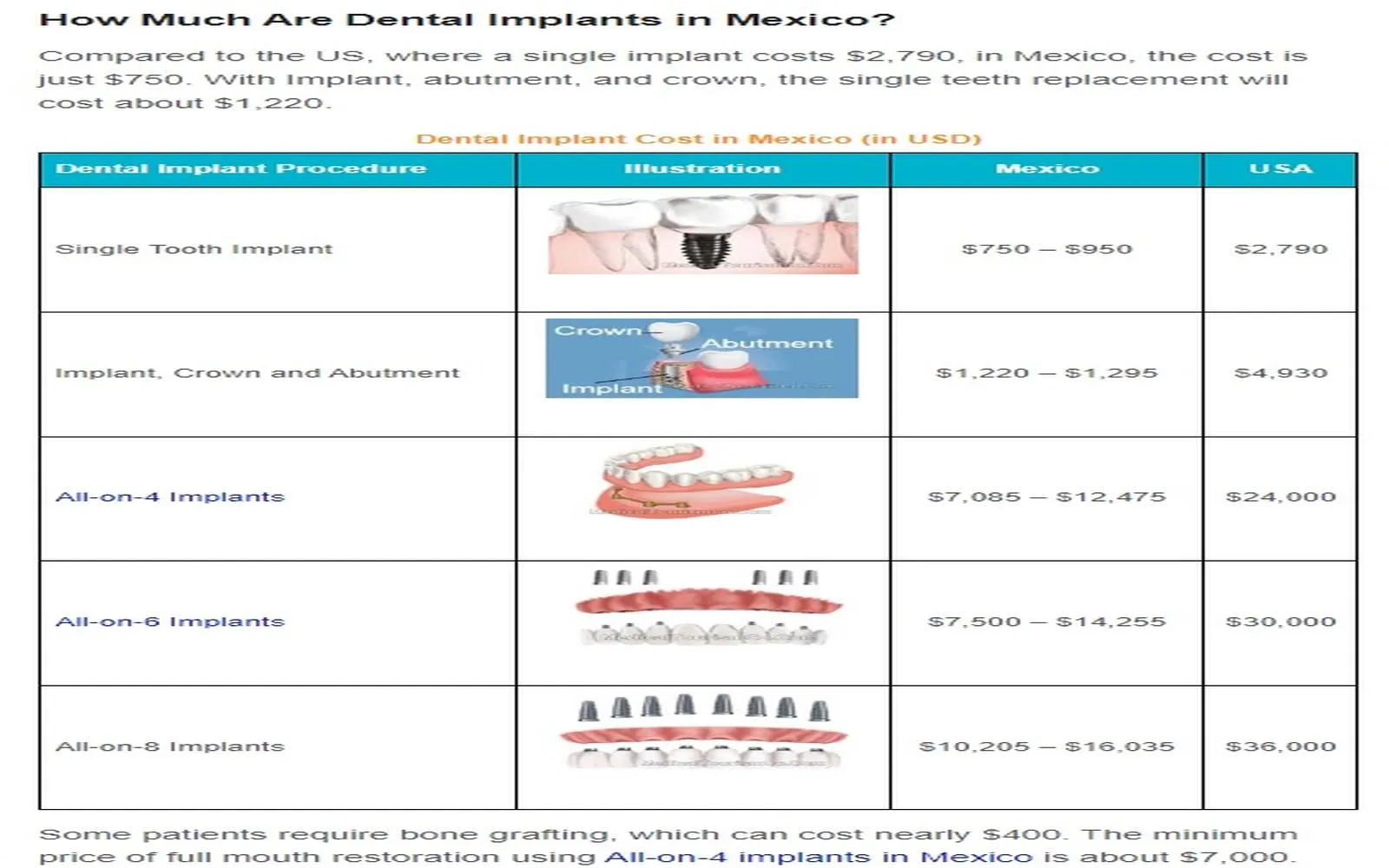

Dental Insurance That Covers Implants: Everything You Need to Know

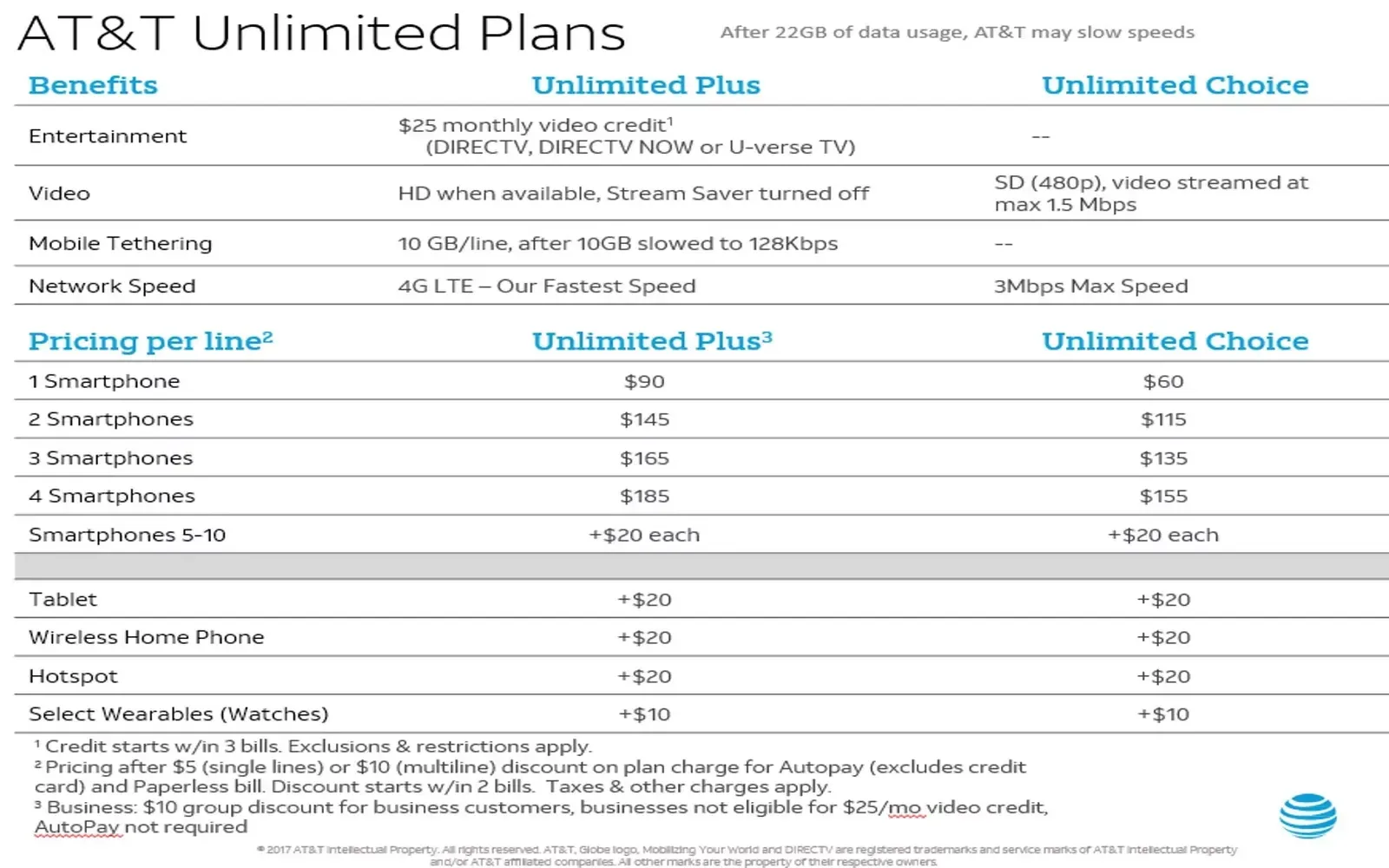

Unlimited Data Plans: What You Need to Know

2025 Guide to Solar Roof Tiles Cost: What You Need to Know for a Sustainable Home

Top Pet Insurance Companies of 2025: Finding the Best Coverage for Your Furry Friends

Top Small Business Health Insurance Providers in the USA: A 2025 Guide to Affordable Coverage