2025 Home Warranty Quotes: What You Need to Know for Affordable Coverage

Understanding Home Warranties in 2025

As we step into 2025, the importance of home warranties has become more pronounced than ever. With the rising costs of home repairs and the aging of many homes, having a safety net such as a home warranty can provide homeowners with peace of mind. In this article, we will explore the ins and outs of home warranty quotes, helping you navigate the options available to ensure you receive the most affordable and comprehensive coverage for your home.

What is a Home Warranty?

A home warranty is a service contract that covers the repair or replacement of major home systems and appliances that break down due to normal wear and tear. Unlike homeowners insurance, which protects against property damage and loss from events like fire or theft, a home warranty specifically addresses the functionality of home appliances and systems such as plumbing, electrical, heating, and cooling systems.

Why Consider a Home Warranty in 2025?

In 2025, the housing market is expected to remain competitive, and homeowners are looking for ways to protect their investments. Home warranties offer several benefits:

- Financial Protection: A home warranty can save you from unexpected repair bills that can reach thousands of dollars.

- Convenience: Most home warranty companies provide a network of service technicians, simplifying the repair process.

- Peace of Mind: Knowing that your home systems and appliances are covered can relieve stress, especially for new homeowners.

Key Components of Home Warranty Coverage

Before diving into quotes, it’s essential to understand what home warranties typically cover. While coverage can vary by provider, here are some common components:

- Major Appliances: Refrigerators, ovens, dishwashers, and washing machines are often included.

- Home Systems: HVAC systems, plumbing, electrical systems, and water heaters are typically covered.

- Optional Add-Ons: Many companies allow you to customize your plan with add-ons like pool equipment, spa systems, or well pumps.

How to Obtain Home Warranty Quotes

Acquiring home warranty quotes is a straightforward process. Here’s how to go about it:

- Research Providers: Start by researching reputable home warranty companies. Look for customer reviews, ratings, and the range of coverage they offer.

- Request Quotes: Most companies offer free quotes online. You’ll need to provide details about your home, including its age, size, and the systems and appliances you wish to cover.

- Compare Coverage and Costs: After receiving multiple quotes, compare the coverage details and pricing. Pay attention to service fees, deductibles, and any exclusions.

Factors Affecting Home Warranty Quotes

Several factors influence the cost of home warranty quotes in 2025:

- Home Age: Older homes may have higher warranty costs due to the likelihood of system failures.

- Location: Geographic location can affect pricing. For example, homes in areas prone to extreme weather may have higher coverage costs.

- Coverage Level: The extent of coverage you select will impact the quote. More comprehensive plans will generally cost more.

- Deductibles and Service Fees: Different plans have varying deductibles per service call, which can influence overall pricing.

Understanding Policy Terms and Conditions

When considering a home warranty, it’s crucial to understand the terms and conditions of the policy. Here are key aspects to look for:

- Exclusions: Each policy will have exclusions, so read these carefully. Common exclusions include pre-existing conditions and improper maintenance.

- Claim Process: Understand how to file a claim and what the timeline looks like for repairs.

- Renewal Terms: Check how the warranty renews each year and whether costs may increase.

- Transferability: If you plan to sell your home, find out if the warranty is transferable to the new owner, which can be a selling point.

Common Misconceptions About Home Warranties

As you explore home warranty options, it’s important to address some common misconceptions:

- Home Warranties Are the Same as Homeowners Insurance: As mentioned earlier, these are two different products. Home warranties cover mechanical failures, while homeowners insurance covers damages from specific events.

- All Home Warranties are the Same: There are significant differences between providers in terms of coverage, service quality, and claim processes.

- You Can Only Use Their Technicians: While most companies prefer you use their network, some allow you to use your own contractors, though reimbursement rules may apply.

Tips for Choosing the Right Home Warranty

Selecting the right home warranty can be daunting, but these tips can help you make an informed decision:

- Assess Your Needs: Consider the age and condition of your home systems and appliances. Tailor your coverage to what you need most.

- Read Reviews: Customer reviews can provide insight into the reliability of the service and the claims process of different companies.

- Ask About Discounts: Some companies offer discounts for bundling services or for new customers. Don’t hesitate to ask.

- Check for Customer Support: Ensure that the company has good customer service. You want to be able to reach them easily if you need assistance.

The Role of Home Inspections

In some cases, home warranty providers may require a home inspection before issuing a policy. This inspection assesses the condition of major systems and appliances. It can be beneficial to you as well, as it provides an understanding of potential issues that may arise. If you are purchasing a new warranty or renewing an existing one, consider having an inspection done to avoid surprises later on.

How to File a Claim

Filing a claim with a home warranty company usually involves several steps:

- Contact the Warranty Provider: Reach out to the company via phone or their online portal.

- Provide Necessary Information: Be ready to provide details about the issue, the type of coverage you have, and any relevant information about your home.

- Schedule a Service Call: The company will typically arrange for a service technician to evaluate the situation.

- Pay Applicable Fees: Be aware of any service fees or deductibles you need to pay at the time of service.

Cost of Home Warranties in 2025

The average cost of home warranties in 2025 can vary significantly based on the factors mentioned earlier, but you can expect to pay anywhere between $300 to $600 annually for a basic plan. Comprehensive plans can range from $600 to $1,200 or more, depending on coverage levels and additional options. Always consider the potential return on investment when evaluating these costs against potential repair bills.

Conclusion: Making Informed Decisions

In 2025, securing a home warranty can be an excellent way to safeguard your home and finances against unexpected repairs. By understanding the components of home warranties, obtaining multiple quotes, and carefully reviewing policy terms, you can find affordable coverage that meets your needs. As you navigate the home warranty landscape, remember to assess your personal circumstances and prioritize coverage that protects your most valuable asset: your home.

Ultimately, the right home warranty can provide you with not only financial protection but also peace of mind, allowing you to enjoy your home without the constant worry of unexpected repair costs.

Explore

2025 Trends in Auto Insurance: What You Need to Know for Optimal Coverage

Exploring Humana Health Benefits in 2025: What You Need to Know for Optimal Coverage

2025 Guide to Solar Roof Tiles Cost: What You Need to Know for a Sustainable Home

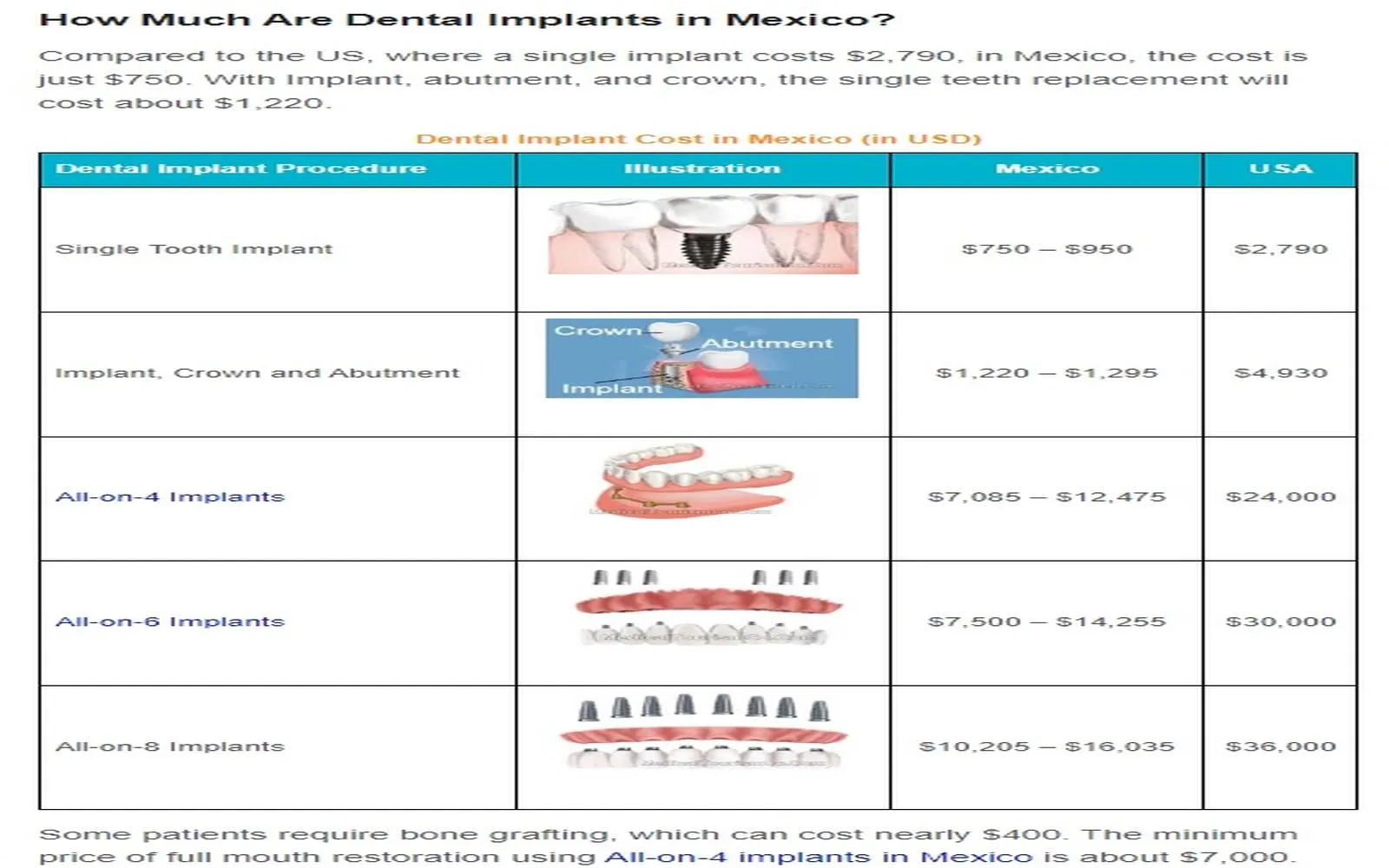

Dental Insurance That Covers Implants: Everything You Need to Know

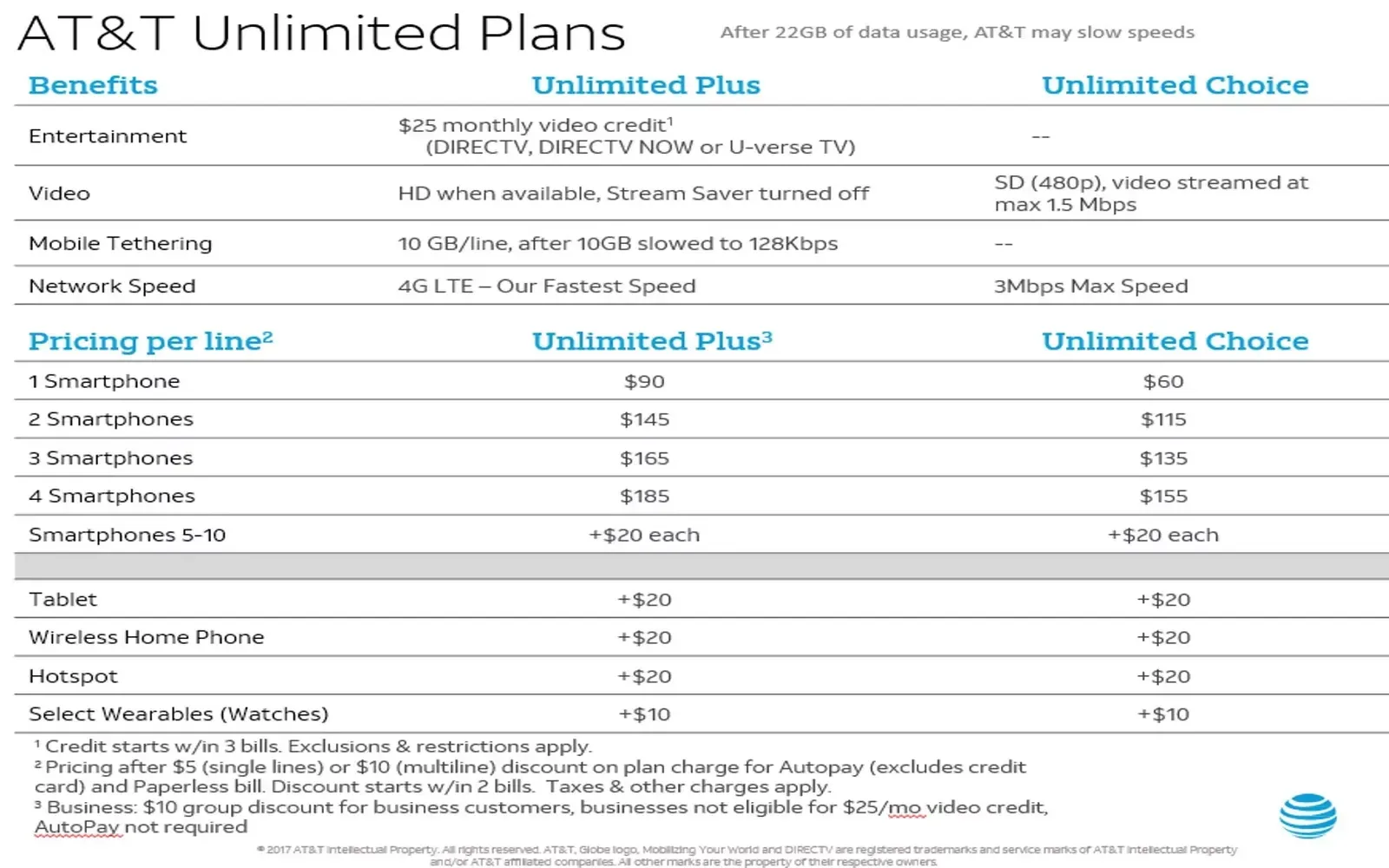

Unlimited Data Plans: What You Need to Know

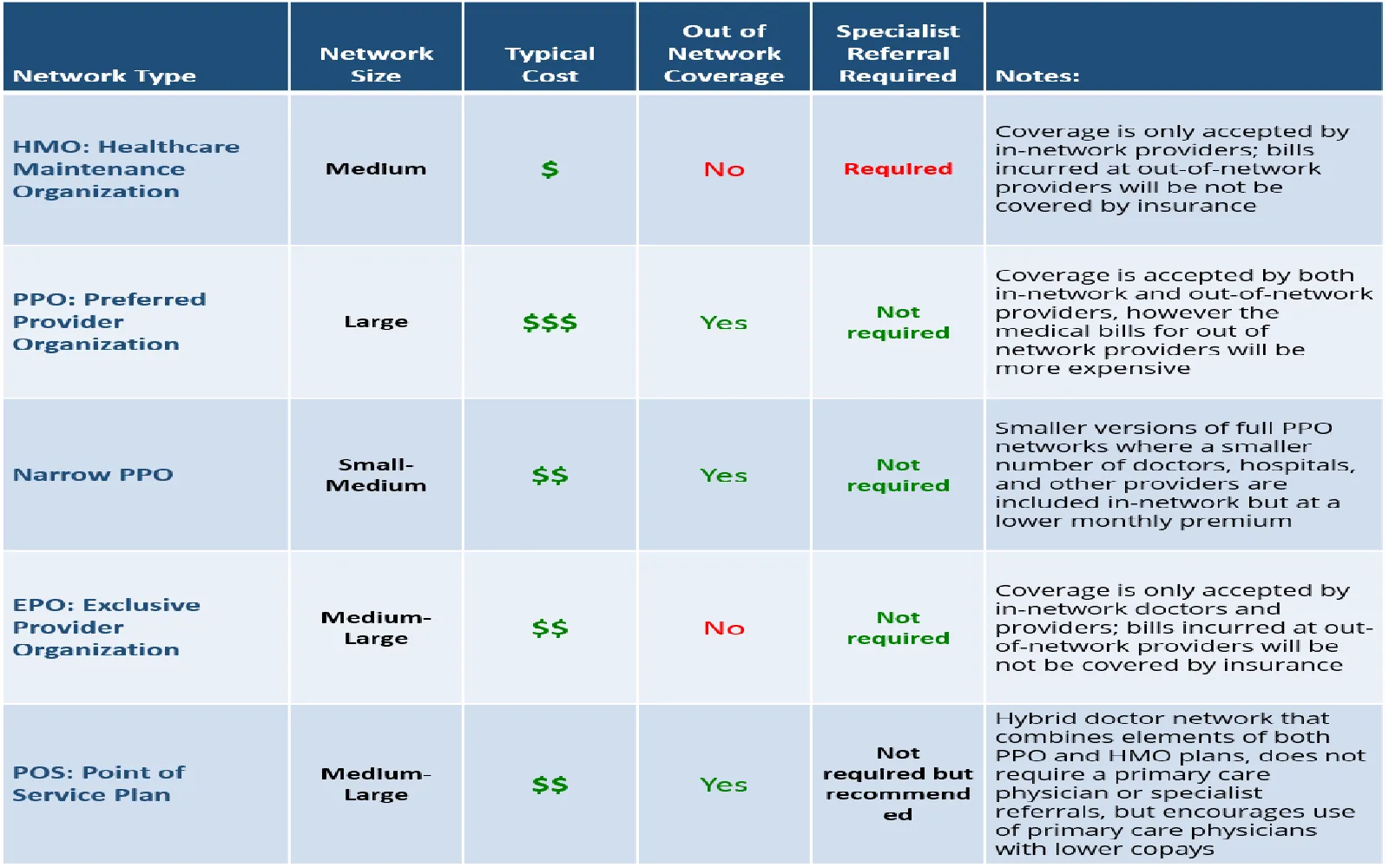

Top Small Business Health Insurance Providers in the USA: A 2025 Guide to Affordable Coverage

Best Car Insurance Quotes 2025: A Comprehensive Guide

Get the Best Travel Insurance Quotes Online in 2025: Your Ultimate Guide