Unlocking Growth: The Ultimate Guide to Small Business Loans in 2025

Introduction

As we step into 2025, small businesses continue to be the backbone of the economy, driving innovation, creating jobs, and fostering community engagement. However, the path to growth is often fraught with challenges, particularly when it comes to securing financing. Understanding the intricacies of small business loans is paramount for entrepreneurs looking to unlock their growth potential. This guide aims to provide a comprehensive overview of the types of loans available, the application process, and tips for increasing the likelihood of approval.

Understanding Small Business Loans

Small business loans are financial products designed to help entrepreneurs fund their operations, purchase equipment, or expand their business. In 2025, various types of loans cater to different needs, making it crucial for business owners to understand their options.

Types of Small Business Loans

1. Traditional Bank Loans

Traditional bank loans are typically secured loans with fixed or variable interest rates. They are ideal for established businesses with a solid credit history. Banks often require detailed business plans, financial statements, and collateral. These loans can be difficult to obtain for new businesses but offer competitive rates for those who qualify.

2. SBA Loans

The Small Business Administration (SBA) offers various loan programs designed to support small businesses. SBA loans are partially guaranteed by the government, making them a safer option for lenders. The most popular SBA loan is the 7(a) loan, which can be used for a variety of purposes, including working capital and equipment purchase. The application process can be lengthy but often results in lower interest rates and longer repayment terms.

3. Online Lenders

Online lenders have gained popularity due to their quick and easy application processes. They often offer a range of loan products, including short-term loans, lines of credit, and merchant cash advances. While these loans can be approved within a day, they often come with higher interest rates compared to traditional lenders. Online lenders are ideal for businesses that need immediate funding and may not qualify for traditional loans.

4. Microloans

Microloans are small loans, typically ranging from $500 to $50,000, aimed at startups and small businesses. Organizations like Kiva and Accion provide these loans, often with lower interest rates and flexible terms. Microloans are a great option for entrepreneurs seeking to fund small projects or start their businesses without the burden of large debt.

5. Equipment Financing

Equipment financing allows businesses to purchase or lease equipment while using the equipment itself as collateral. This type of loan is beneficial for businesses that require expensive machinery or technology to operate. The terms vary, but the repayment period typically aligns with the equipment's useful life.

6. Business Credit Cards

Business credit cards are a flexible financing option that allows business owners to manage cash flow and make purchases. They often come with rewards programs and can help build a business's credit profile. However, it’s essential to pay off the balance each month to avoid high-interest charges.

The Application Process

Securing a small business loan in 2025 involves several steps. Understanding this process can help entrepreneurs prepare and increase their chances of approval.

1. Assess Your Financial Needs

Before applying for a loan, it's crucial to determine how much funding your business needs and how you plan to use it. This will help you choose the right type of loan and present a compelling case to lenders.

2. Check Your Credit Score

Your credit score plays a significant role in the loan approval process. Most lenders require a personal credit score of at least 650. Checking your credit report for errors and taking steps to improve your score can enhance your chances of securing a loan.

3. Prepare Documentation

Different lenders require different documentation, but typically, you’ll need to provide:

- A detailed business plan outlining your business model, target market, and financial projections.

- Financial statements, including balance sheets, income statements, and cash flow statements.

- Personal and business tax returns for the last few years.

- Legal documents, such as business licenses and contracts.

4. Research Lenders

Not all lenders are created equal. Research various options, considering factors such as interest rates, repayment terms, and customer reviews. Online lenders may offer faster approval times, but traditional banks might provide better rates for those who qualify.

5. Submit Your Application

Once you have chosen a lender and gathered the necessary documents, it’s time to submit your application. Be thorough and ensure all information is accurate to avoid delays in the approval process.

6. Await Approval

After submitting your application, lenders will review your financial history and business plan. This process can take anywhere from a few days to several weeks, depending on the lender and the complexity of your application.

Tips for Increasing Approval Chances

Securing a small business loan can be competitive, but there are several strategies entrepreneurs can use to increase their chances of approval.

1. Build a Strong Business Plan

A well-structured business plan demonstrates to lenders that you have a clear vision for your business and a strategy for achieving your goals. Include detailed financial projections, a market analysis, and your plans for using the loan funds.

2. Maintain Good Personal and Business Credit

Both personal and business credit scores are critical in the application process. Pay bills on time, reduce outstanding debts, and monitor your credit reports regularly to ensure accuracy.

3. Consider a Co-Signer

If your credit score is low or your business is new, consider asking a co-signer with a strong credit history to support your loan application. This can increase your chances of approval and potentially secure better terms.

4. Show Positive Cash Flow

Lenders want to see that your business generates sufficient cash flow to cover loan repayments. Providing recent bank statements and financial projections can help demonstrate this.

5. Be Prepared to Explain Your Needs

Clearly articulating why you need the funds and how you plan to use them can instill confidence in lenders. Be specific about how the loan will contribute to your business's growth and profitability.

Alternative Funding Options

While traditional loans are a common choice for funding, there are alternative financing options available for small businesses in 2025.

1. Crowdfunding

Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to raise funds from a large number of people. This approach not only provides capital but also validates your business idea through community support.

2. Angel Investors

Angel investors are wealthy individuals who provide capital to startups in exchange for equity. They often bring valuable industry experience and connections, making them an attractive option for new businesses.

3. Venture Capital

Venture capitalists invest in startups and small businesses with high growth potential in exchange for equity. While this can provide substantial funding, it often requires giving up a portion of ownership and control of the business.

4. Grant Programs

Various government and private organizations offer grants to small businesses, particularly those focused on innovation, sustainability, or community development. Unlike loans, grants do not need to be repaid, making them an excellent funding source.

Conclusion

In 2025, small business loans remain a crucial tool for entrepreneurs looking to unlock their growth potential. By understanding the various types of loans available, preparing a strong application, and exploring alternative funding options, business owners can navigate the complex landscape of financing. While challenges may arise, being informed and proactive can empower you to secure the funding necessary to achieve your business goals. With the right support, your small business can thrive and contribute to the vibrant economy of the future.

Explore

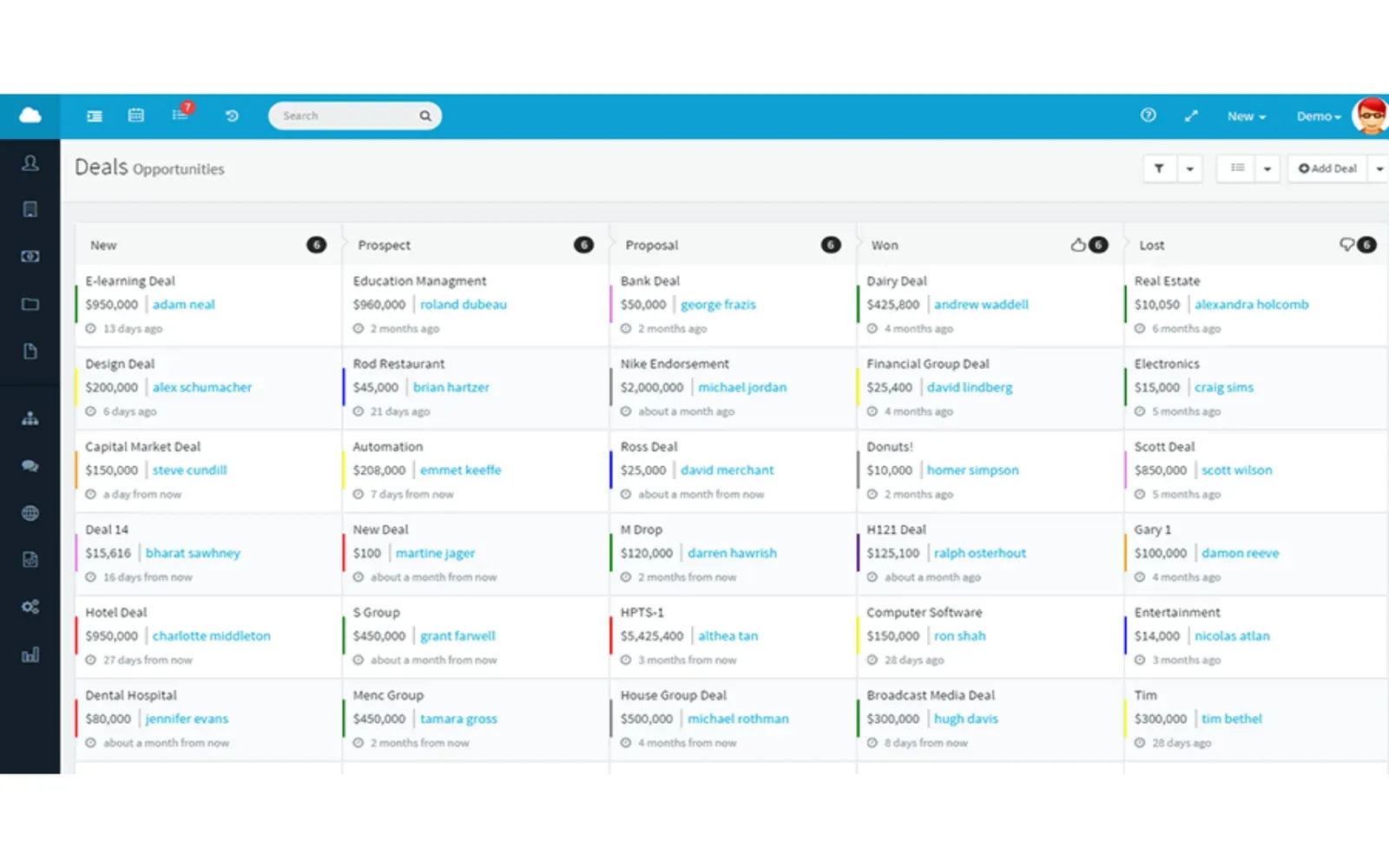

Top Data Management Software for Small Businesses in 2025: Boost Efficiency and Drive Growth

Top PEO Companies for Small Businesses in 2025: Streamline HR and Boost Growth

The Power of Press Release Services: A Vital Tool for Business Growth

Unlocking Homeownership in 2025: Your Guide to No Down Payment Loans

Transform Your Small Business in 2025: The Ultimate Guide to Virtual Receptionists

Exploring Nurse Practitioner (NP) Programs in 2025: Trends, Opportunities, and Growth

Navigating Medical Loans in 2025: A Comprehensive Guide to Financing Your Healthcare Needs

2025 Guide to Personal Loans for Debt Consolidation: Smart Strategies for Financial Freedom