2025 Guide to Personal Loans for Debt Consolidation: Smart Strategies for Financial Freedom

Introduction to Personal Loans for Debt Consolidation

In today's fast-paced world, managing personal finances can be a daunting task, especially when juggling multiple debts. As of 2025, personal loans for debt consolidation have emerged as a popular solution for individuals seeking financial freedom. These loans allow borrowers to combine multiple debts into a single loan with a potentially lower interest rate, making it easier to manage monthly payments and reduce overall debt. This guide explores the smart strategies for using personal loans to achieve financial freedom.

Understanding Debt Consolidation

Debt consolidation is the process of combining multiple debts into one single debt, usually with a lower interest rate. This can involve taking out a new loan to pay off existing debts, such as credit cards, medical bills, or personal loans. The primary goal of debt consolidation is to simplify payments and reduce the total interest paid over time. By consolidating debts, borrowers can focus on a single monthly payment rather than managing multiple payments, which can lead to missed payments and increased financial stress.

Types of Personal Loans for Debt Consolidation

When considering personal loans for debt consolidation, it is essential to understand the different types of loans available:

- Unsecured Personal Loans: These loans do not require collateral and are based on the borrower's creditworthiness. They typically have higher interest rates compared to secured loans but are easier to obtain for borrowers without assets.

- Secured Personal Loans: These loans require collateral, such as a home or a vehicle. They often come with lower interest rates but put the borrower's assets at risk if they fail to repay the loan.

- Balance Transfer Credit Cards: While not a personal loan per se, balance transfer cards allow borrowers to transfer high-interest credit card debt to a new card with a lower interest rate, often with an introductory 0% APR period.

Assessing Your Financial Situation

Before pursuing a personal loan for debt consolidation, it is crucial to assess your financial situation. Start by gathering all your financial information, including income, expenses, and outstanding debts. Calculate your total debt load and monthly payments to get a clear picture of your financial health. Understanding your debt-to-income ratio, which is the percentage of your monthly income that goes toward debt payments, will also help you determine whether debt consolidation is the right path.

Researching Lenders and Loan Options

Once you've assessed your financial situation, the next step is to research lenders and loan options. Different lenders offer varying terms, interest rates, and fees, so it’s essential to shop around. Look for reputable lenders, including banks, credit unions, and online lenders. Consider the following factors when comparing loan offers:

- Interest Rates: Compare annual percentage rates (APRs) to find the most affordable option. Lower rates can significantly reduce the total cost of the loan.

- Loan Terms: Review the repayment period and monthly payment amounts. A longer term may result in lower monthly payments but could increase the total interest paid over time.

- Fees: Be aware of any origination fees, prepayment penalties, or other charges that may apply. Choose a loan with minimal fees to maximize savings.

Improving Your Credit Score

Your credit score plays a significant role in determining the interest rate and terms you can secure for a personal loan. A higher credit score typically results in lower interest rates and better loan terms. To improve your credit score before applying for a loan, consider the following strategies:

- Pay Bills on Time: Consistently paying bills on time is one of the most effective ways to boost your credit score.

- Reduce Credit Utilization: Aim to keep your credit utilization ratio below 30%. This means using less than 30% of your available credit.

- Check Your Credit Report: Regularly review your credit report for errors or inaccuracies that may be negatively impacting your score. Dispute any discrepancies you find.

Applying for a Personal Loan

Once you’ve improved your credit score and researched lenders, it’s time to apply for a personal loan. Here’s a step-by-step guide to the application process:

- Gather Documentation: Lenders typically require personal information, including your Social Security number, income verification, and details about your debts.

- Complete the Application: Fill out the loan application online or in person, providing accurate information to avoid delays.

- Review Loan Offers: Once you receive loan offers, compare the terms and conditions. Choose the loan that best fits your financial situation.

- Accept the Loan: If you’re satisfied with the terms, accept the loan offer and review the final documents carefully before signing.

Using the Loan Wisely

After securing a personal loan for debt consolidation, it’s crucial to use the funds wisely. Pay off existing debts immediately to avoid accruing additional interest. Focus on managing the new loan by making timely payments to avoid penalties and maintain a positive credit history. Additionally, consider setting up automatic payments to ensure you never miss a due date.

Creating a Budget for Financial Freedom

To achieve long-term financial freedom, creating a budget is essential. A budget helps you track income and expenses, allowing you to allocate funds toward debt repayment and savings. Here are some steps to create an effective budget:

- List Income Sources: Include all sources of income, such as salary, bonuses, and side gigs.

- Track Expenses: Record all monthly expenses, including fixed costs (rent, utilities) and variable costs (food, entertainment).

- Set Financial Goals: Determine short-term and long-term financial goals, such as paying off debt or saving for a vacation.

- Adjust as Necessary: Review and adjust your budget regularly to account for changes in income or expenses.

Building an Emergency Fund

While debt consolidation is a critical step toward financial freedom, it's also essential to build an emergency fund. An emergency fund acts as a financial safety net, providing funds for unexpected expenses without relying on credit cards or loans. Aim to save at least three to six months' worth of living expenses in a separate savings account. This fund can help you avoid falling back into debt in case of unforeseen circumstances.

Avoiding Common Pitfalls

While personal loans for debt consolidation can be a powerful tool, there are common pitfalls to avoid:

- Accumulating More Debt: After consolidating your debts, avoid the temptation to accumulate new debt. Focus on living within your means and using credit responsibly.

- Ignoring the Loan Terms: Read the fine print and understand the loan's terms and conditions to avoid surprises in the future.

- Missing Payments: Ensure you make your loan payments on time to avoid penalties and damage to your credit score.

Seeking Professional Advice

If you're struggling with debt or unsure about the best approach to take, consider seeking professional financial advice. Financial advisors or credit counseling services can provide personalized guidance and help you develop a tailored plan to achieve your financial goals. They can also assist with budgeting, debt management, and investment strategies.

Conclusion: Embracing Financial Freedom

In 2025, personal loans for debt consolidation remain a viable solution for those seeking to regain control of their finances. By carefully assessing your situation, researching loan options, and implementing smart financial strategies, you can pave the way to financial freedom. Remember, the journey to financial stability is a marathon, not a sprint. With dedication, discipline, and the right strategies, you can overcome debt and build a brighter financial future.

Explore

The Best Financial Advisors of 2025: Your Guide to Smart Financial Planning

Tax Debt Relief Service: A Comprehensive Guide to Managing Your Tax Debt

Top Trends for High Net Worth Financial Advisors in 2025: Strategies for Success

Top Mortgage Lenders in the U.S. for 2025: Your Guide to Smart Home Financing

Sell Your House Fast in 2025: Proven Strategies to Get Top Dollar Quickly

Top Social Media Marketing Companies to Watch in 2025: Trends, Strategies, and Success Stories

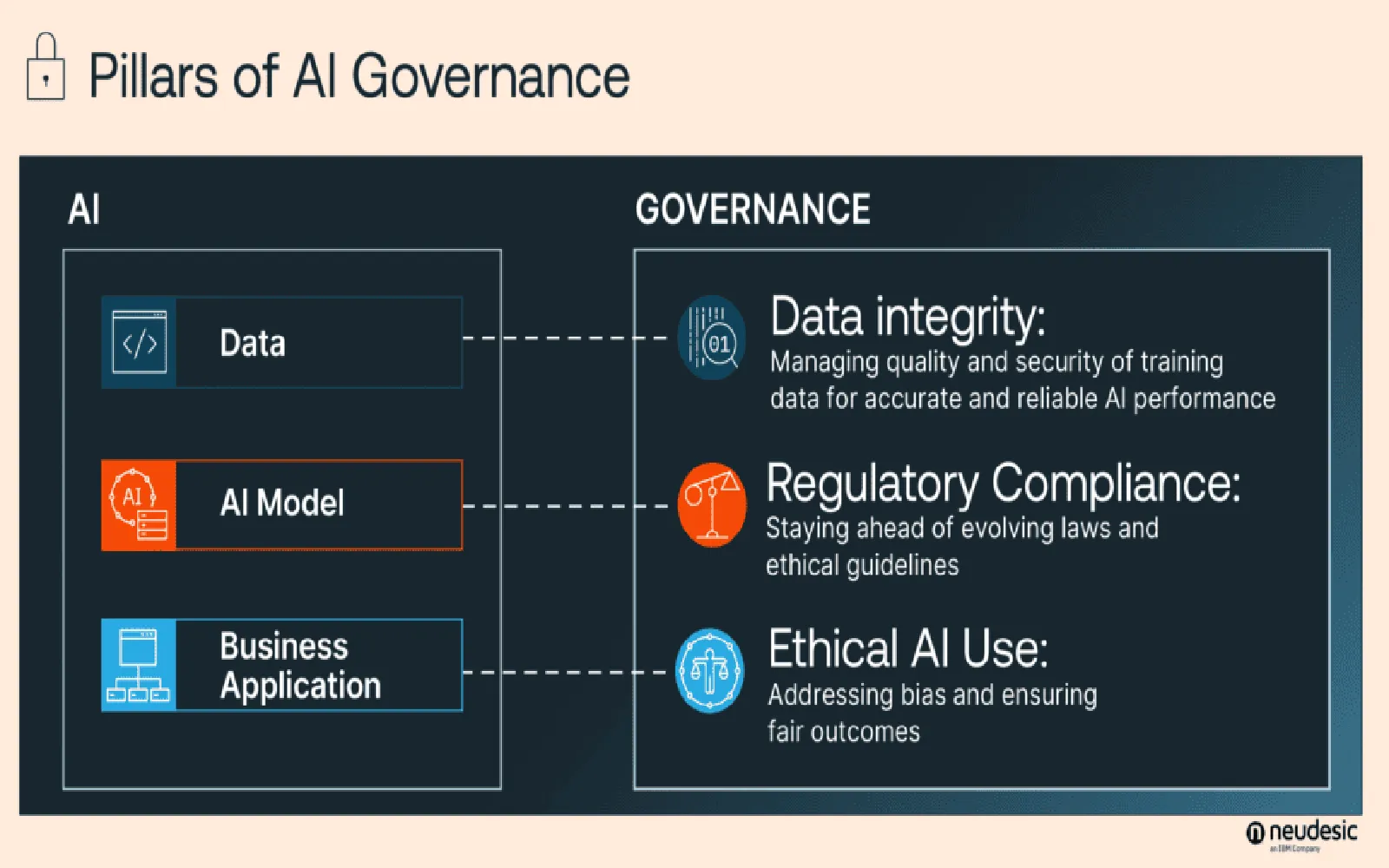

Navigating AI Governance in 2025: Strategies for Ethical and Responsible AI Development

2025 Advances in Psoriasis Treatment: Cutting-Edge Therapies and Effective Management Strategies