Top Mortgage Lenders in the U.S. for 2025: Your Guide to Smart Home Financing

Introduction

As we step into 2025, the landscape of mortgage lending in the U.S. continues to evolve, influenced by changing economic conditions, interest rates, and consumer preferences. Securing a mortgage is one of the most significant financial decisions many people will make in their lives, and choosing the right lender is crucial for a smooth and successful home financing experience. This guide aims to highlight the top mortgage lenders in the U.S. for 2025, offering insights into their offerings, advantages, and what makes them stand out in a competitive market.

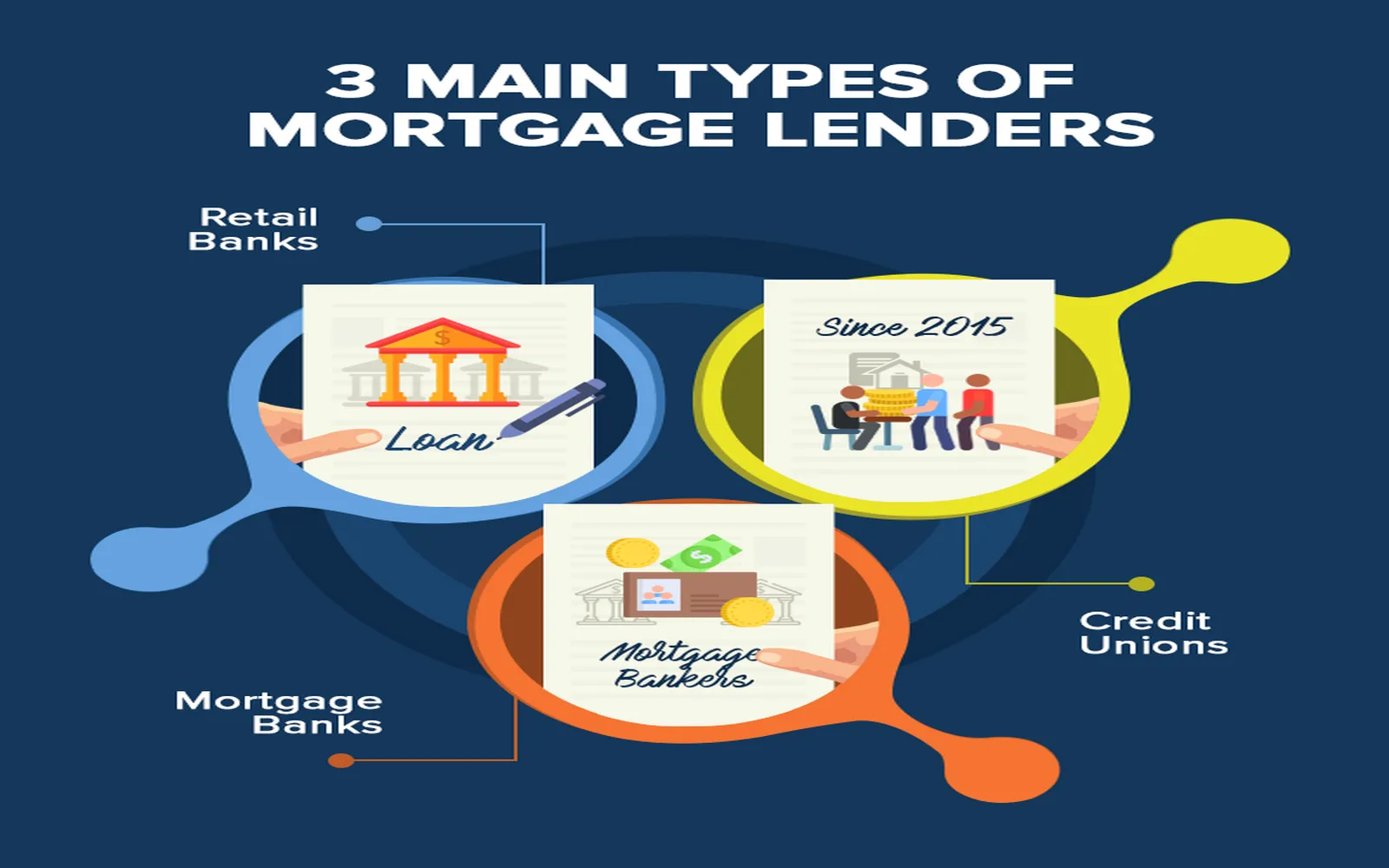

Understanding the Mortgage Lending Landscape

The mortgage lending industry is vast and varied, with numerous players ranging from large national banks to small local credit unions. As interest rates fluctuate and economic conditions change, lenders adapt their products and services to meet consumer needs. Borrowers in 2025 will find a variety of mortgage options, including conventional loans, FHA loans, VA loans, and USDA loans, each catering to different financial situations and homebuyer profiles.

Factors to Consider When Choosing a Mortgage Lender

Before diving into the list of top mortgage lenders, it's essential to understand what factors to consider when selecting the right lender for your needs:

- Interest Rates: Look for competitive rates that can save you money over the life of the loan.

- Fees and Closing Costs: Understand the total cost of the loan, including origination fees, appraisal fees, and other closing costs.

- Customer Service: A lender with excellent customer service can make the mortgage process smoother and less stressful.

- Loan Variety: Consider lenders that offer a range of loan products to fit different financial situations.

- Online Tools: Many lenders offer online applications and tools that can make the mortgage process more efficient.

Top Mortgage Lenders in 2025

With these considerations in mind, let’s explore some of the top mortgage lenders in the U.S. for 2025:

1. Quicken Loans (Rocket Mortgage)

Quicken Loans, now branded as Rocket Mortgage, continues to dominate the mortgage lending landscape. Known for its user-friendly online platform, Rocket Mortgage allows borrowers to apply for a mortgage quickly and easily. With competitive interest rates and a wide range of mortgage products, including conventional, FHA, and VA loans, it's a go-to option for many homebuyers.

One of the standout features of Rocket Mortgage is its technology-driven approach, which offers a streamlined application process and instant updates. Additionally, their customer service is highly rated, making them a solid choice for first-time homebuyers.

2. Wells Fargo

As one of the largest banks in the U.S., Wells Fargo offers a comprehensive range of mortgage products, including fixed-rate and adjustable-rate mortgages, as well as government-backed loans. They provide a robust online platform and local branches, giving borrowers the option to choose how they want to interact with their lender.

Wells Fargo is known for its competitive rates and various loan options tailored to different financial situations. They also have a solid reputation for customer service, providing personalized assistance throughout the mortgage process.

3. Chase Bank

Chase Bank is another major player in the mortgage lending space, offering a wide variety of mortgage products. Their “Chase Home Lending” division provides competitive rates, flexible terms, and a user-friendly online application process. Chase is particularly known for its incentives for existing customers, such as lower fees for those with a Chase banking account.

The bank’s comprehensive online tools and resources make it easy for borrowers to understand their options and manage their mortgages effectively. Additionally, Chase’s extensive branch network provides face-to-face support for those who prefer in-person interactions.

4. LoanDepot

LoanDepot has gained recognition for its commitment to innovation and technology in the mortgage process. Offering a diverse array of loan products, including conventional, FHA, and jumbo loans, LoanDepot is well-suited for various borrower profiles.

The lender's online platform simplifies the application process, allowing borrowers to submit documents digitally and track their loan status in real-time. LoanDepot’s focus on customer service and transparency has earned them a loyal customer base.

5. Guild Mortgage

Guild Mortgage is known for its personalized approach to home financing, particularly for first-time homebuyers. With a wide range of loan options, including FHA, VA, and USDA loans, Guild is dedicated to helping borrowers find the right solution for their needs.

The lender prides itself on its customer-centric approach, providing guidance and support throughout the mortgage journey. Guild Mortgage also offers various down payment assistance programs, making it an excellent choice for those who may struggle with upfront costs.

6. Better Mortgage

Better Mortgage has disrupted the traditional mortgage lending model with its fully online platform, allowing borrowers to apply for a mortgage without the need for a middleman. With no lender fees and competitive rates, Better Mortgage appeals to tech-savvy borrowers looking for a streamlined experience.

Their transparent approach to pricing and commitment to customer satisfaction has garnered positive reviews. Better Mortgage’s easy-to-use online tools and resources make it a convenient option for many homebuyers.

7. U.S. Bank

U.S. Bank offers a comprehensive suite of mortgage products, including conventional, FHA, and VA loans. Known for its strong customer service and extensive resources, U.S. Bank provides borrowers with a range of options and competitive rates.

The bank’s online mortgage application process is straightforward, and their dedicated loan officers are available for personalized assistance. U.S. Bank also offers various educational resources to help borrowers understand their options better.

8. Fairway Independent Mortgage Corporation

Fairway Independent Mortgage Corporation is recognized for its commitment to customer service and efficient loan processing. They offer a variety of mortgage products, including conventional, FHA, and VA loans, catering to a diverse range of borrowers.

One of Fairway's strengths is its focus on local mortgage professionals who provide personalized service. Borrowers appreciate the ability to work with a dedicated loan officer who understands their unique needs and circumstances.

9. Caliber Home Loans

Caliber Home Loans is known for its flexible mortgage options and commitment to customer satisfaction. The lender offers a wide array of loan products, including conventional, FHA, and VA loans, making it suitable for various borrower profiles.

Caliber's online platform is user-friendly, and they provide comprehensive educational resources to help borrowers navigate the mortgage process. Their focus on personalized service ensures that customers receive the support they need throughout their home financing journey.

10. Planet Home Lending

Planet Home Lending is gaining traction in the mortgage market with its focus on customer experience and a wide range of loan options. They offer conventional, FHA, and VA loans, providing flexibility for different financial situations.

Planet Home Lending is known for its fast processing times and excellent customer service. Their user-friendly online tools and resources make the mortgage application process straightforward, appealing to tech-savvy borrowers.

Conclusion

Choosing the right mortgage lender is a critical step in the home financing process. In 2025, borrowers have access to a variety of reputable lenders, each offering unique products and services to meet diverse needs. Whether you prioritize competitive interest rates, exceptional customer service, or a user-friendly online experience, the top mortgage lenders highlighted in this guide provide excellent options for homebuyers.

As you embark on your home financing journey, take the time to compare lenders, understand your options, and choose a lender that aligns with your financial goals and preferences. With the right lender by your side, you can navigate the mortgage process with confidence and secure the home of your dreams.

Explore

Top Mortgage Lenders in the USA: Your 2025 Guide to Affordable Home Financing

Navigating Medical Loans in 2025: A Comprehensive Guide to Financing Your Healthcare Needs

2025 Guide to Breast Enlargement Financing: Affordable Options for Your Transformation

The Best Financial Advisors of 2025: Your Guide to Smart Financial Planning

2025 Guide to Personal Loans for Debt Consolidation: Smart Strategies for Financial Freedom

Top Home Improvement Contractors Near Me in 2025: Your Guide to Finding the Best Local Services

Bright Savings: Your Guide to Affordable Solar Panels for Every Home

2025 Guide to Window Replacement Options: Upgrade Your Home with the Latest Trends and Technologies