Top Payroll Software Solutions for 2025: Streamline Your Business Operations and Boost Efficiency

Introduction

As businesses continue to evolve in the digital age, the need for streamlined operations and efficient management systems has never been more pressing. Payroll, a crucial aspect of business operations, has undergone significant transformations, thanks to advancements in technology. By 2025, the landscape of payroll software solutions will be more sophisticated, integrating artificial intelligence, automation, and enhanced user experiences. This article explores the top payroll software solutions for 2025, designed to streamline business operations and boost efficiency.

1. Gusto

Gusto has consistently been a favorite among small to medium-sized businesses for its user-friendly interface and comprehensive features. By 2025, Gusto will likely enhance its capabilities, offering even more robust integration with other business tools. The platform boasts features such as automated tax calculations, benefits administration, and compliance support, all of which are crucial for businesses in today’s regulatory environment. Gusto’s mobile app also allows employees to access their pay stubs, manage benefits, and even request time off, contributing to a more engaged workforce.

2. ADP Workforce Now

ADP has long been a leader in payroll solutions, and its Workforce Now platform is expected to remain at the forefront in 2025. Known for its scalability, ADP Workforce Now caters to businesses of all sizes, offering features like payroll processing, talent management, and analytics. In the coming years, ADP will likely enhance its AI-driven insights, providing businesses with predictive analytics to better manage workforce costs and optimize employee performance. Integration with third-party applications will also improve, ensuring a seamless experience for users.

3. Paycor

Paycor is an innovative payroll and HR solution designed for small and mid-sized businesses. It is expected that by 2025, Paycor will continue to enhance its capabilities with advanced reporting tools and real-time data analytics. One of its standout features is the ability to customize payroll reports, allowing business owners to gain insights tailored to their specific needs. Paycor also offers a mobile app for employees, which provides access to pay information, time-off requests, and other essential features, fostering a more engaged workforce.

4. QuickBooks Payroll

For businesses already using QuickBooks for accounting, QuickBooks Payroll offers a seamless integration that simplifies payroll processing. By 2025, QuickBooks Payroll is expected to introduce more automation features, enabling users to set up recurring payroll schedules with minimal intervention. The software also provides accurate tax calculations and compliance updates, which are essential for avoiding costly penalties. With its intuitive interface, QuickBooks Payroll makes it easy for business owners to manage payroll while focusing on their core operations.

5. Rippling

Rippling is a relatively new player in the payroll software space, but it has quickly gained popularity for its all-in-one HR and payroll solution. By 2025, Rippling is likely to further expand its capabilities, offering enhanced automation and integration features. One of the standout aspects of Rippling is its ability to manage employee benefits, onboarding, and payroll all in one place. This streamlined approach helps businesses save time and reduce administrative burdens, allowing them to focus on growth and employee satisfaction.

6. Zenefits

Zenefits has positioned itself as a comprehensive HR solution, and its payroll capabilities are an integral part of its offering. By 2025, Zenefits is expected to enhance its user experience, making payroll processing even more intuitive for users. The platform offers features such as automated tax calculations, benefits management, and compliance tracking. Additionally, Zenefits provides a self-service portal for employees, allowing them to manage their information and access pay stubs easily, which can lead to increased employee satisfaction and engagement.

7. Paychex Flex

Paychex Flex is known for its flexibility and scalability, making it suitable for businesses of all sizes. In 2025, Paychex is likely to introduce more advanced analytics and reporting tools to help businesses make data-driven decisions. The software includes features like payroll processing, tax administration, and employee benefits management. Its user-friendly dashboard allows business owners to quickly access key metrics and insights, contributing to more efficient operations.

8. BambooHR

BambooHR is primarily known as an HR management system, but its payroll features are steadily gaining recognition. By 2025, BambooHR is expected to enhance its payroll functionality, offering improved integration with other HR processes. The platform allows businesses to manage employee data, track time off, and process payroll in one unified system. This integration reduces the likelihood of errors and ensures that payroll is accurately aligned with employee status and benefits.

9. Square Payroll

Square Payroll has emerged as a strong contender in the payroll space, particularly for small businesses and freelancers. By 2025, Square is likely to expand its offerings, integrating more features that cater to diverse business needs. Square Payroll simplifies the payroll process by automating tax calculations and providing direct deposit options for employees. Additionally, its integration with other Square products makes it an attractive choice for businesses that already use Square for payment processing.

10. Xero Payroll

Xero is well-known for its accounting software, and its payroll solution is designed to complement its financial management capabilities. By 2025, Xero Payroll is expected to enhance its user experience with more automation features and improved reporting tools. The software allows businesses to manage payroll, track expenses, and handle employee benefits in one system, which can significantly reduce administrative workload. Xero’s strong focus on integration with third-party applications makes it a versatile choice for businesses looking to streamline operations.

The Importance of Integration

As we look toward 2025, one of the most critical factors in choosing payroll software will be its ability to integrate seamlessly with other business systems. Businesses today rely on a multitude of software to manage operations, from accounting and HR to project management and customer relationship management. Payroll solutions that offer robust integration capabilities will not only save time but also reduce the risk of errors that can arise from manual data entry.

AI and Automation: The Future of Payroll

The role of artificial intelligence (AI) and automation in payroll processing is set to expand significantly by 2025. Many payroll software solutions are expected to leverage AI to enhance accuracy, predict trends, and provide actionable insights. For instance, AI can help identify patterns in payroll data, flagging inconsistencies or potential compliance issues before they escalate. Automation will also streamline repetitive tasks, allowing HR and payroll teams to focus on more strategic initiatives that drive business growth.

Compliance and Security

Compliance with labor laws and tax regulations is a constant concern for businesses, and payroll software solutions will increasingly prioritize compliance features by 2025. This includes automated updates to tax rates, labor laws, and reporting requirements. Additionally, with the rise in cyber threats, payroll software must prioritize security to protect sensitive employee information. Features such as data encryption, multi-factor authentication, and regular security audits will be essential in ensuring that businesses can safeguard their payroll data.

Employee Self-Service Features

As businesses aim to improve employee engagement and satisfaction, self-service features are becoming increasingly important in payroll software. By 2025, we can expect payroll solutions to offer enhanced self-service portals, enabling employees to access their pay information, manage benefits, and make changes to their personal information with ease. This not only empowers employees but also reduces the administrative burden on HR teams, allowing them to focus on more value-added tasks.

Conclusion

The payroll landscape is rapidly evolving, and businesses must stay ahead of the curve to streamline operations and boost efficiency. The top payroll software solutions for 2025 will not only enhance payroll processing but also integrate seamlessly with other business functions, leverage AI and automation, and prioritize compliance and security. By adopting the right payroll software, businesses can ensure that they are well-equipped to meet the challenges of the future, ultimately leading to improved employee satisfaction and organizational success.

Explore

Top Help Desk Software Solutions for 2025: Boost Your Customer Support Efficiency

Top PEO Companies for Small Businesses in 2025: Streamline HR and Boost Growth

Top Data Management Software for Small Businesses in 2025: Boost Efficiency and Drive Growth

Top Task Management Software for Small Businesses in 2025: Boost Productivity and Efficiency

Top Digital Asset Management Software Trends to Watch in 2025: Boost Your Brand's Efficiency

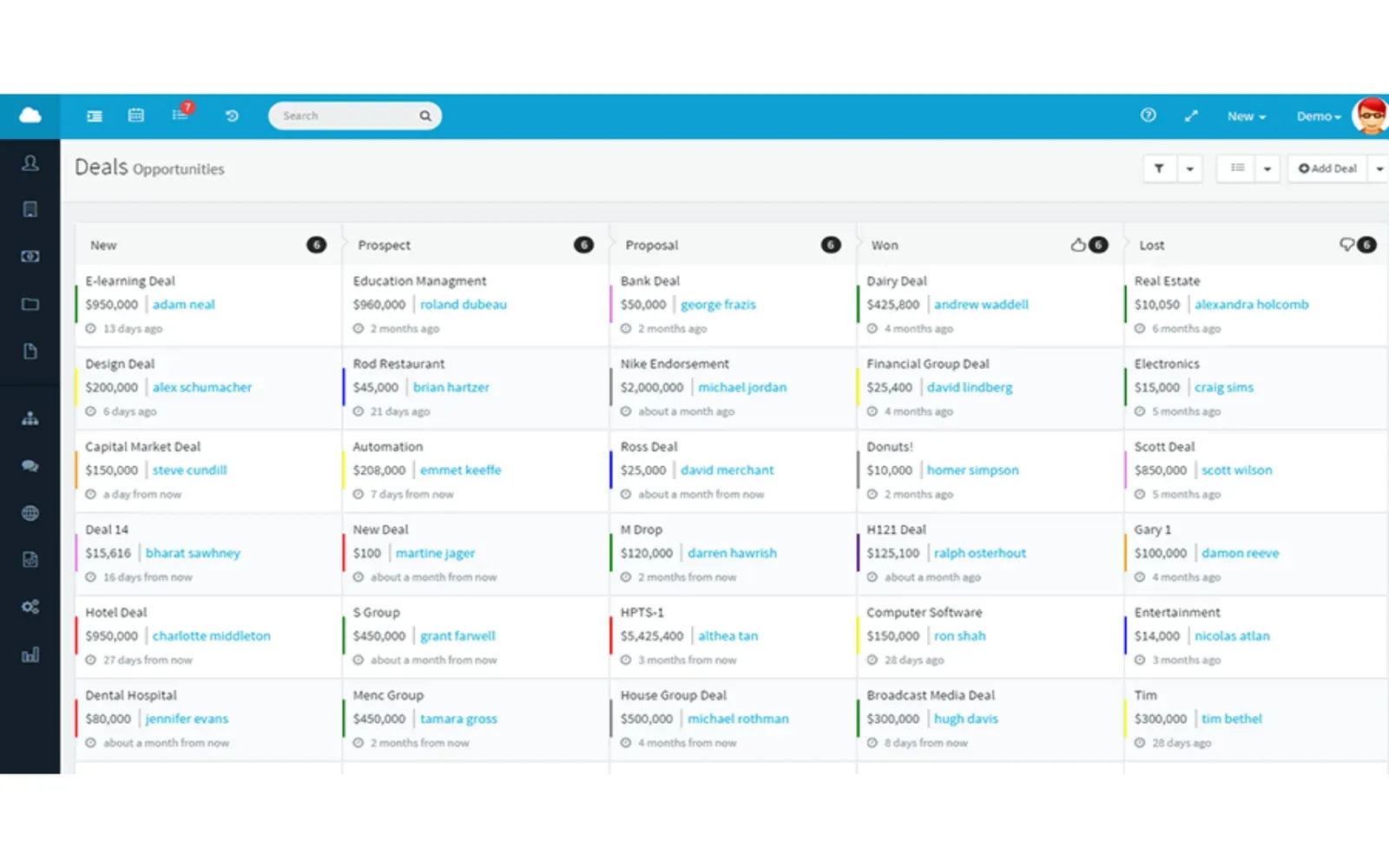

Streamline Your Success: The Best Simple CRM Solutions for Small Businesses in 2025

Top Small Business Accounting Softwares of 2025: Streamline Your Finances for Success

Top Remote Access Software for Small Businesses in 2025: Boost Productivity and Security