Top Small Business Accounting Softwares of 2025: Streamline Your Finances for Success

Introduction

As small businesses continue to grow in number and complexity, the need for effective financial management has never been more critical. In 2025, small business accounting software has evolved to meet these demands, providing entrepreneurs with tools that streamline their financial operations, enhance accuracy, and save time. This article explores the top accounting software options available in 2025, each offering unique features tailored to the needs of small business owners.

1. QuickBooks Online

QuickBooks Online remains a frontrunner in the small business accounting software arena in 2025. Its user-friendly interface and robust features make it suitable for businesses of all sizes. QuickBooks Online allows users to manage invoices, track expenses, and generate financial reports with ease.

One of its standout features is the seamless integration with numerous third-party applications, enhancing its functionality. Additionally, QuickBooks offers advanced reporting capabilities, enabling businesses to gain insights into their financial health. The cloud-based nature of QuickBooks Online ensures that users can access their financial data from anywhere, making it an ideal choice for entrepreneurs on the go.

2. Xero

Xero has gained significant popularity among small businesses in 2025, thanks to its intuitive design and comprehensive features. This cloud-based software provides tools for invoicing, bank reconciliation, payroll, and inventory management, all in one place.

What sets Xero apart is its emphasis on collaboration. Users can invite their accountants and team members to access financial data, fostering a more collaborative approach to financial management. Additionally, Xero offers a mobile app that allows business owners to manage their finances from their smartphones, ensuring they stay updated on their financial situation at all times.

3. FreshBooks

FreshBooks is a cloud-based accounting software tailored for service-based businesses. In 2025, it continues to be a favorite for freelancers and small business owners due to its simplicity and ease of use. FreshBooks specializes in invoicing, expense tracking, and time management, making it an excellent choice for businesses that bill clients by the hour.

With its automated invoicing and payment reminders, FreshBooks helps businesses get paid faster. The software also offers detailed reporting features, allowing users to track their business performance over time. FreshBooks' user-friendly mobile app ensures that entrepreneurs can manage their finances on the go, making it a convenient option for busy professionals.

4. Wave Accounting

Wave Accounting has made a name for itself as a free accounting software solution for small businesses in 2025. Ideal for startups and freelancers, Wave provides essential features such as invoicing, expense tracking, and receipt scanning at no cost. This makes it an attractive option for entrepreneurs looking to minimize their expenses while still maintaining effective financial management.

Wave's interface is straightforward, making it easy for users to navigate through various features. The platform also offers additional paid services, such as payroll and payment processing, which can be added as a business grows. With its robust capabilities and zero cost, Wave Accounting is an excellent choice for small businesses just starting out.

5. Zoho Books

In 2025, Zoho Books stands out as a comprehensive accounting solution that caters to small businesses with diverse needs. It offers a wide range of features, including invoicing, expense tracking, project management, and inventory management. This makes it an ideal choice for businesses that require more than just basic accounting functionalities.

One of the key advantages of Zoho Books is its integration with other Zoho applications, creating a seamless ecosystem for business management. Additionally, Zoho Books supports multi-currency transactions, making it suitable for businesses that operate internationally. The software's automation features also help reduce manual data entry, allowing business owners to focus on growth and strategy.

6. Sage Business Cloud Accounting

Sage Business Cloud Accounting is an all-in-one accounting software solution designed for small businesses. In 2025, it continues to offer robust features that include invoicing, expense management, and tax compliance. Sage's cloud-based platform ensures that users can access their financial data securely from anywhere.

What sets Sage apart is its strong focus on compliance and reporting. The software includes built-in tax calculations and compliance features, helping businesses stay on top of their tax obligations. Additionally, Sage's reporting tools provide valuable insights into business performance, enabling owners to make informed decisions. With its reliability and comprehensive features, Sage Business Cloud Accounting is a solid choice for small business owners.

7. Kashoo

Kashoo is a lesser-known but highly effective accounting software that has gained traction among small businesses in 2025. With its emphasis on simplicity, Kashoo is designed for entrepreneurs who want to manage their finances without the complexity of larger accounting systems.

The software offers essential features like invoicing, expense tracking, and bank reconciliation. Kashoo's user-friendly interface makes it easy for anyone to get started, regardless of their accounting knowledge. One of its standout features is the ability to automate recurring invoices, which can save businesses significant time and effort. Kashoo's straightforward pricing model also appeals to small business owners looking for a cost-effective solution.

8. GoDaddy Bookkeeping

GoDaddy Bookkeeping is a unique accounting solution that caters primarily to online sellers and freelancers. In 2025, it continues to provide features tailored to those who sell products or services online, including integration with popular e-commerce platforms.

The software offers essential features such as invoicing, expense tracking, and tax preparation. GoDaddy Bookkeeping's ability to synchronize with online marketplaces makes it easy for users to manage their financial data in one place. Additionally, the software provides insights into sales performance, helping entrepreneurs make data-driven decisions to grow their businesses.

9. NetSuite ERP

For small businesses with more complex needs, NetSuite ERP offers a comprehensive accounting solution that integrates various aspects of business management. In 2025, it is recognized for its robust capabilities in financial management, inventory management, and customer relationship management (CRM).

NetSuite's strength lies in its scalability. As businesses grow, they can easily add modules to customize the software to their specific needs. The software's real-time reporting and analytics capabilities provide valuable insights into business performance, allowing owners to make informed decisions. While it may be a more significant investment than other options, NetSuite ERP is ideal for businesses looking for a long-term accounting solution.

10. Accounting by 1&1 IONOS

Accounting by 1&1 IONOS has emerged as a reliable accounting software solution for small businesses in 2025. It offers a straightforward interface and essential features such as invoicing, expense tracking, and financial reporting.

What sets this software apart is its commitment to data security and privacy. 1&1 IONOS emphasizes the protection of user data, making it a suitable choice for businesses that prioritize security. Additionally, the software provides automated features that help reduce manual data entry, allowing users to focus on more critical aspects of their business.

Conclusion

In 2025, the landscape of small business accounting software is rich with options that cater to various needs and preferences. From established names like QuickBooks and Xero to emerging contenders like Kashoo and Accounting by 1&1 IONOS, there is a software solution suitable for every small business. When choosing the right accounting software, entrepreneurs should consider factors such as ease of use, scalability, integration capabilities, and cost.

Investing in the right accounting software can streamline financial operations, enhance accuracy, and provide valuable insights into business performance. Ultimately, the right choice will empower small business owners to focus on what they do best—growing their businesses and achieving success.

Explore

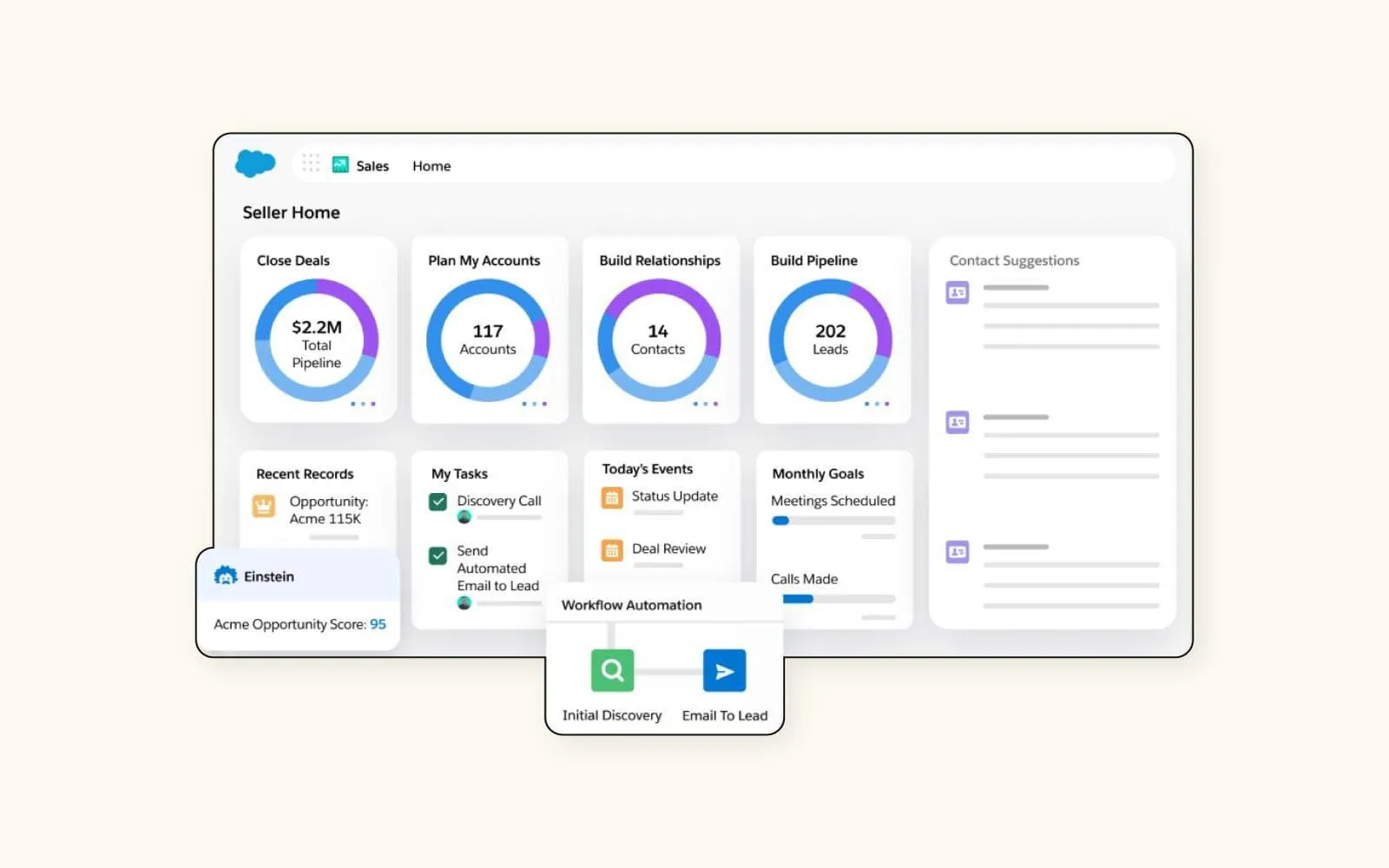

Streamline Your Success: The Best Simple CRM Solutions for Small Businesses in 2025

Top PEO Companies for Small Businesses in 2025: Streamline HR and Boost Growth

Top Payroll Software Solutions for 2025: Streamline Your Business Operations and Boost Efficiency

Top Small Business Financial Advisors Near Me in 2025: Expert Tips for Success

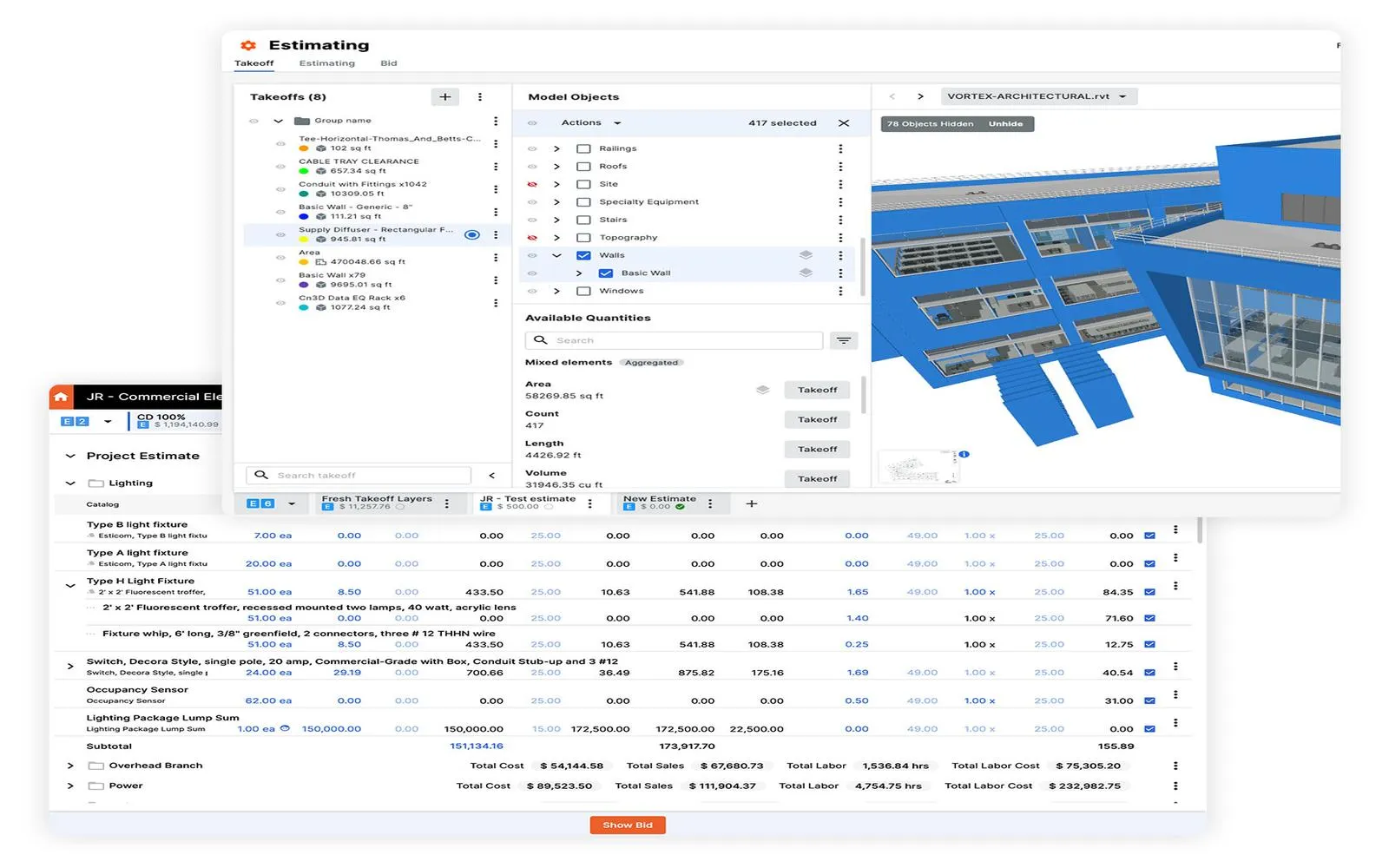

2025 Guide to Construction Estimating Software: Empowering Small Businesses for Success

Top CPA Firms for Startups in 2025: Your Essential Guide to Financial Success

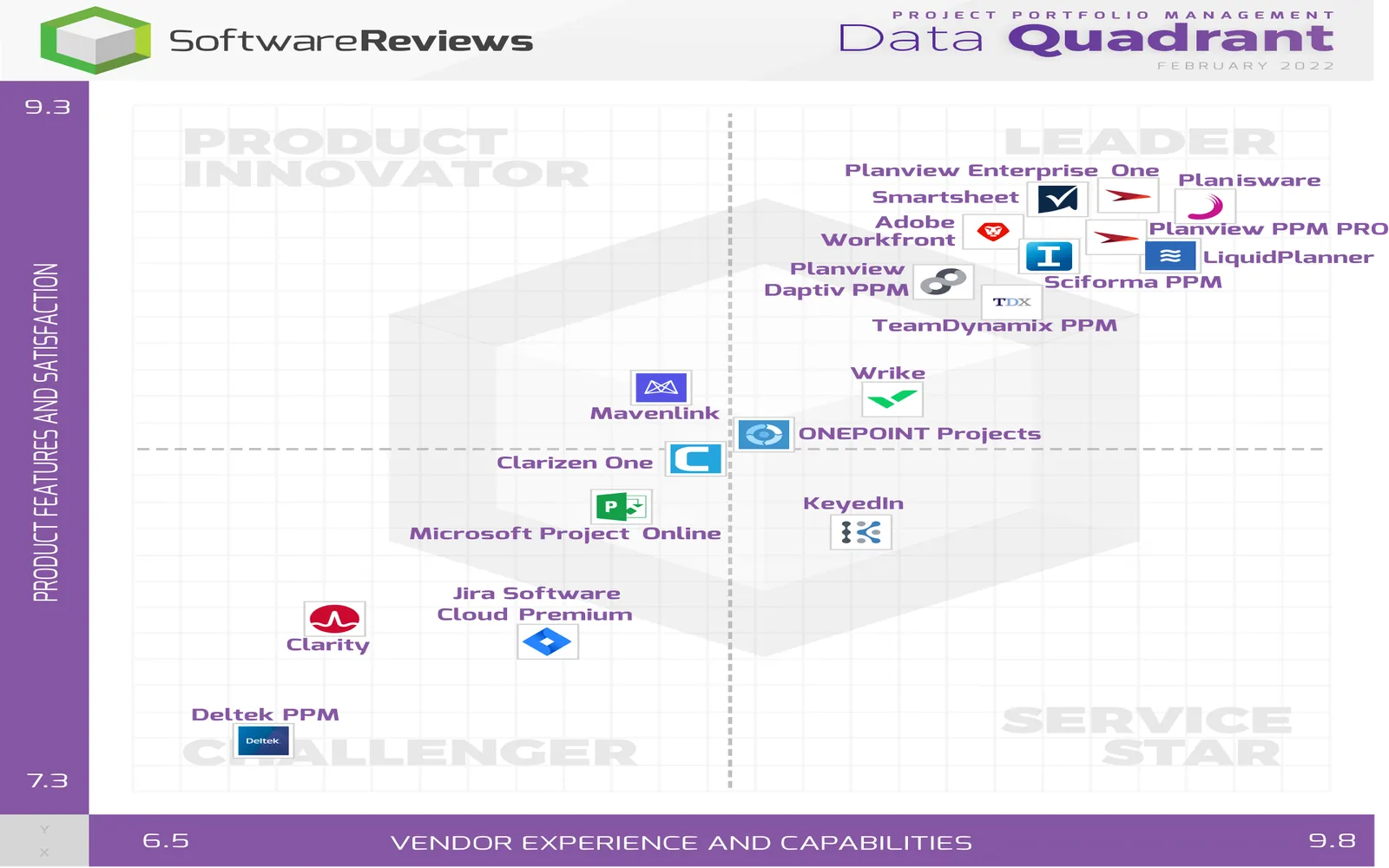

Top Project Portfolio Management Software for 2025: Optimize Your Projects for Success

Top PPC Agencies to Watch in 2025: Boost Your Online Advertising Success