Understanding Lump Settlement: A Comprehensive Guide for 2025 and Beyond

Introduction to Lump Settlement

Lump settlement refers to a type of financial arrangement often found in construction, real estate, and various types of contracts. It involves a single, fixed payment rather than multiple installments over time. This method of settling financial obligations has gained popularity due to its simplicity and efficiency. As we approach 2025, understanding the nuances of lump settlement becomes increasingly important for stakeholders in various industries, including construction, legal, and business sectors.

The Basics of Lump Settlement

At its core, lump settlement is a one-time payment that settles a debt or obligation in full. This payment can be negotiated between parties involved in a transaction, and once made, it typically absolves the payer of any further financial responsibility related to the settled matter. Understanding the basic principles of lump settlement can help individuals and organizations to negotiate better terms and manage their financial commitments effectively.

Benefits of Lump Settlement

There are several advantages to opting for a lump settlement arrangement:

- Simplicity: The straightforward nature of a lump settlement makes it easy to understand and manage. All parties are clear about the amount owed and the terms of payment.

- Reduced Administrative Costs: A single payment eliminates the need for multiple transactions, which can reduce administrative burdens and costs associated with invoicing and collections.

- Faster Resolution: Lump settlements can expedite the resolution of disputes, allowing parties to move forward without lingering financial obligations.

- Negotiation Leverage: In some cases, the ability to offer a lump sum can provide leverage in negotiations, especially when parties are eager to resolve matters quickly.

Challenges of Lump Settlement

While lump settlement offers many benefits, it also comes with its own set of challenges:

- Financial Strain: Paying a large sum upfront can strain the finances of individuals or organizations, especially if they are not prepared for the expense.

- Potential for Under-Settlement: Parties may agree to a lump sum that is less than what they might earn over time, leading to potential financial loss.

- Risk of Future Claims: In some cases, settling for a lump sum may not protect against future claims, particularly in liability agreements.

Understanding Lump Settlement in Construction

In the construction industry, lump settlement often comes into play during contract negotiations, particularly in the form of lump-sum contracts. These contracts outline a fixed price for a project, covering all costs associated with the construction. Understanding the implications of lump-sum contracts is essential for both contractors and clients.

Types of Lump-Sum Contracts

There are several types of lump-sum contracts in the construction industry:

- Fixed Price Contracts: These contracts specify a set price for the entire project, with no adjustments for cost overruns unless explicitly stated.

- Unit Price Contracts: While these contracts are based on predetermined prices for various units of work, they can still lead to lump-sum outcomes depending on the total units completed.

- Design-Build Contracts: In these arrangements, a single entity handles both design and construction, often resulting in a lump-sum payment structure.

Risks Associated with Lump-Sum Construction Contracts

While lump-sum contracts can provide clarity and predictability in pricing, they also carry risks:

- Cost Overruns: If unforeseen conditions arise during construction, contractors may face significant financial strain if they are unable to cover these costs.

- Quality Compromises: To maintain profit margins, contractors may cut corners, potentially compromising the quality of the work.

- Limited Flexibility: Once a lump-sum contract is signed, making changes can be difficult and costly.

Negotiating Lump Settlement Agreements

Effective negotiation is key to reaching a favorable lump settlement agreement. Here are some strategies to consider:

- Research and Preparation: Gather data on similar settlements to understand the market value and standards.

- Clear Communication: Ensure all parties involved understand the terms, conditions, and implications of the settlement.

- Flexibility: Be open to alternative solutions that may benefit both parties, such as payment plans or the inclusion of additional services.

Lump Settlement in Legal Contexts

Lump settlements are also common in legal contexts, particularly in personal injury cases and other tort claims. In these situations, a lump sum payment may be offered to the injured party to settle the case without going to trial.

Advantages of Legal Lump Settlements

There are several advantages to lump settlements in legal contexts:

- Certainty: A lump sum provides immediate financial compensation, helping the injured party avoid the uncertainty of a trial.

- Time Savings: Settling a case quickly can save both parties time and legal expenses associated with prolonged litigation.

- Confidentiality: Many lump settlements are confidential, allowing parties to keep the details of the settlement out of the public eye.

Disadvantages of Legal Lump Settlements

However, there are potential downsides as well:

- Underestimation of Damages: A lump sum may not fully compensate the injured party for future medical expenses or lost wages.

- Tax Implications: Depending on the nature of the settlement, there may be tax liabilities that could affect the total amount received.

The Role of Insurance in Lump Settlements

Insurance plays a crucial role in lump settlements, particularly in cases involving liability. Insurance companies may prefer lump settlements to minimize their overall payout and avoid lengthy litigation. Understanding how insurance policies interact with lump settlements is vital for anyone involved in such agreements.

Trends in Lump Settlement Practices

As we move towards 2025, certain trends are emerging in the realm of lump settlements:

- Digital Tools: The rise of technology has facilitated online negotiations and contract management, making lump settlement processes more efficient.

- Greater Transparency: Stakeholders are increasingly demanding transparency in settlement agreements, leading to clearer terms and conditions.

- Focus on Fairness: There is a growing emphasis on ensuring that lump settlements are fair and equitable for all parties involved.

Preparing for Future Lump Settlements

As we look ahead, individuals and businesses should take proactive steps to prepare for potential lump settlements:

- Educate Yourself: Understanding the legal and financial implications of lump settlements is essential for making informed decisions.

- Consult Professionals: Engaging with legal and financial experts can provide valuable insights and guidance during negotiations.

- Document Everything: Keeping thorough records of agreements and communications can prevent misunderstandings and disputes down the line.

Conclusion

Lump settlements are a significant aspect of various industries, including construction, legal, and business transactions. Understanding the benefits, challenges, and best practices associated with lump settlements can help individuals and organizations navigate these financial arrangements effectively. As we approach 2025, staying informed about emerging trends and preparing for potential lump settlements will be crucial for achieving favorable outcomes and ensuring financial stability.

Explore

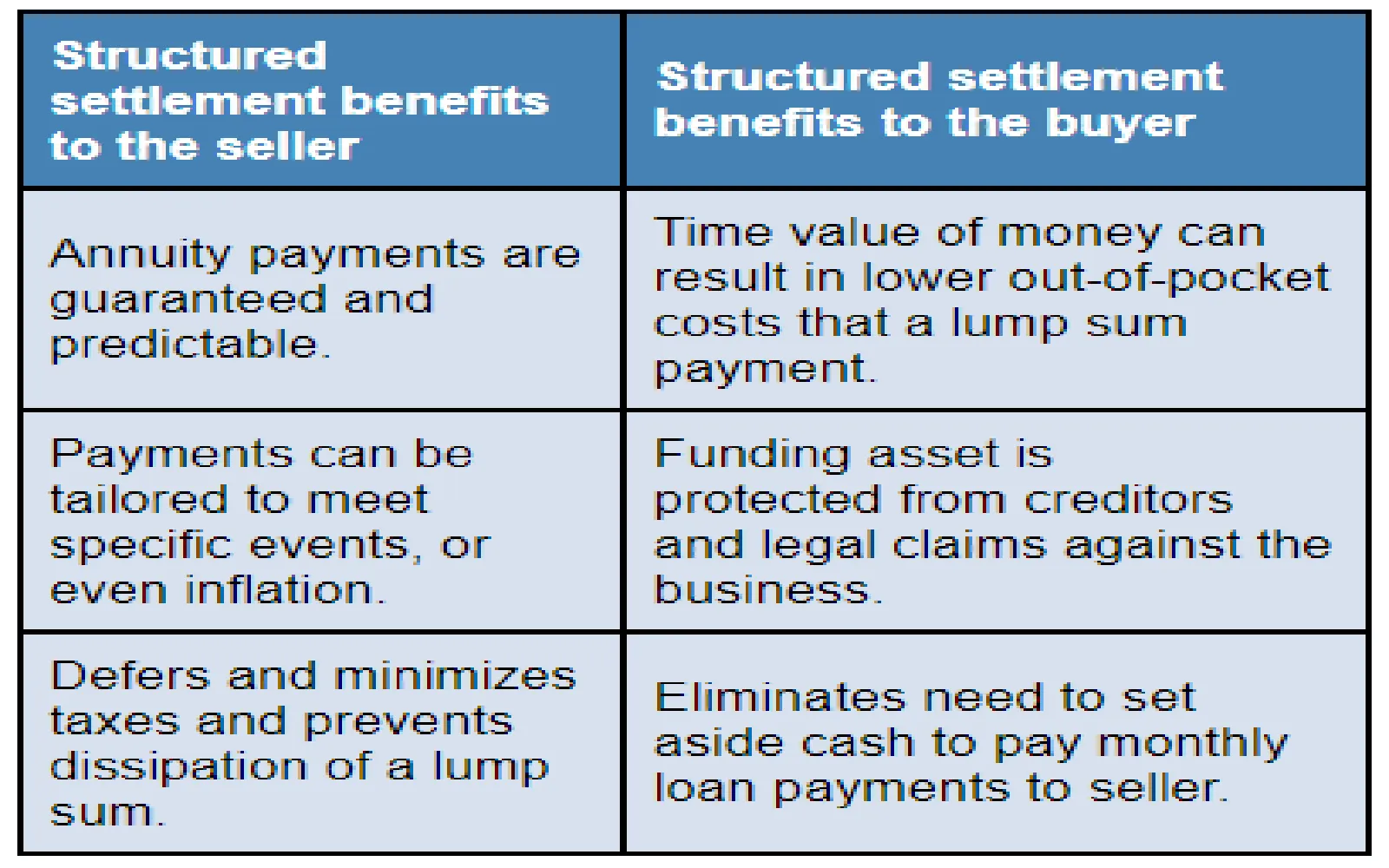

Understanding Structured Settlement Annuities: A Comprehensive Guide

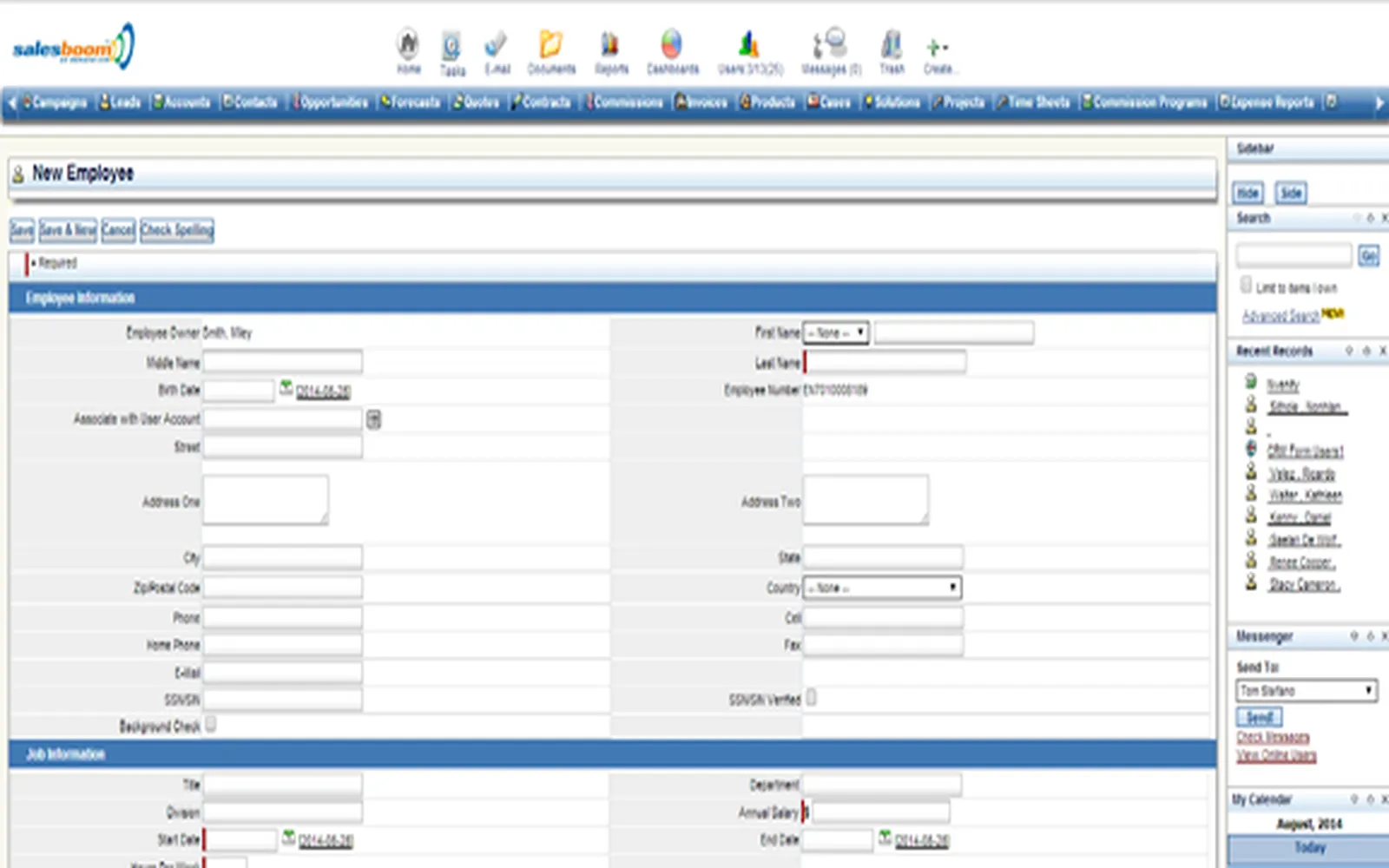

Transforming Employee Management: Top Software Solutions for 2025 and Beyond

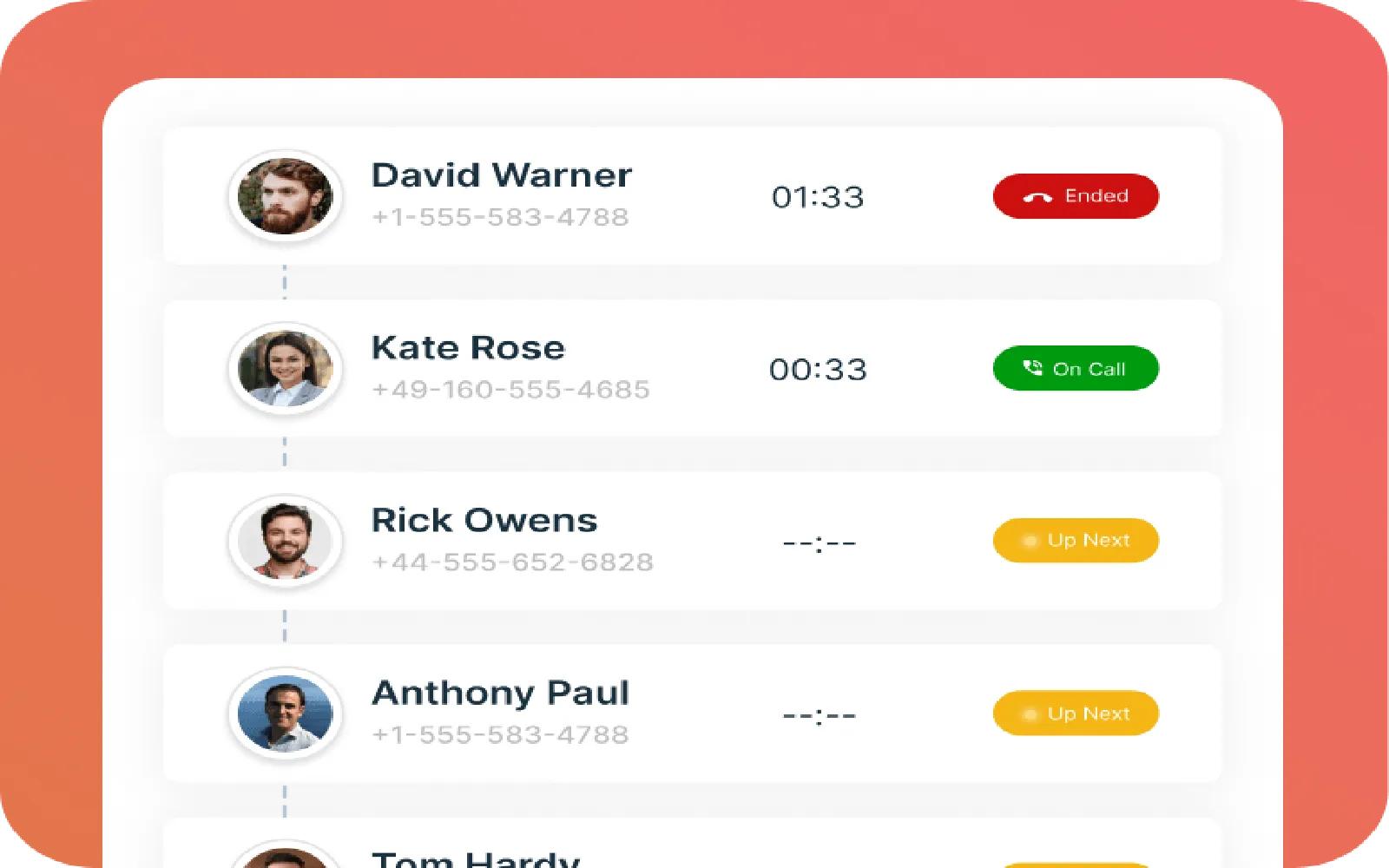

Future-Proof Your Business: Top Enterprise Phone Systems for 2025 and Beyond

Transforming Communication: Ooma Business Solutions for 2025 and Beyond

How to Find a Good Slip and Fall Lawyer: A Comprehensive Guide

The Best Internet Business Phone Systems: A Comprehensive Guide

Tax Debt Relief Service: A Comprehensive Guide to Managing Your Tax Debt

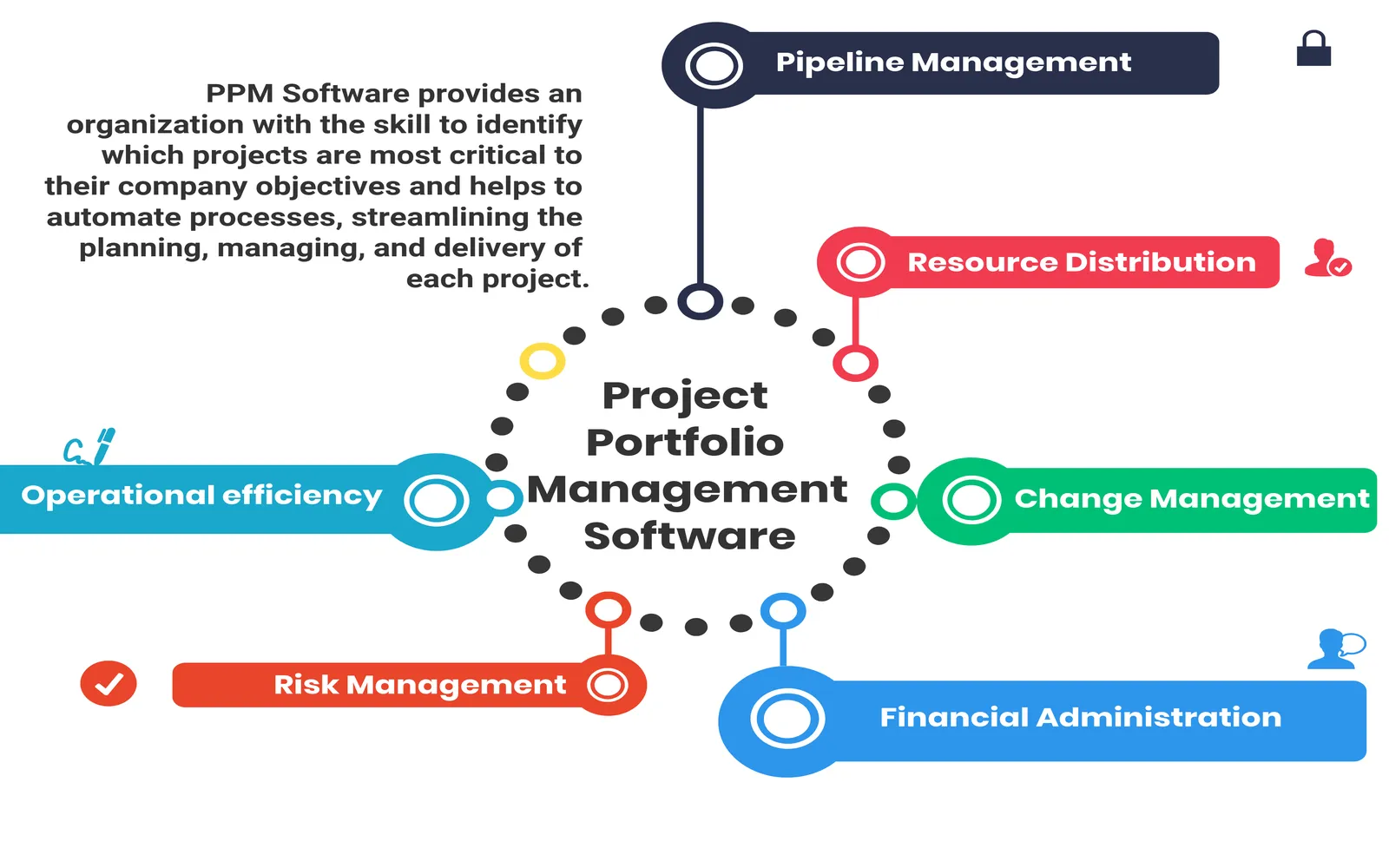

Best Project Portfolio Management Software: A Comprehensive Guide