Transforming Financial Efficiency: The Future of Accounts Receivable Automation Software in 2025

Introduction

As we approach 2025, the landscape of financial operations is poised for a significant transformation, particularly in the realm of accounts receivable (AR) automation software. Businesses of all sizes are increasingly recognizing the critical importance of financial efficiency, and accounts receivable processes are at the forefront of this evolution. The quest for faster, more accurate, and less labor-intensive AR processes has spurred the development of innovative automation solutions. This article delves into the future of accounts receivable automation software, exploring its potential to reshape financial efficiency in 2025 and beyond.

The Current State of Accounts Receivable

Accounts receivable is a vital function for any business, encompassing the management of incoming payments and ensuring that cash flow remains steady. Traditionally, this process has been manual and labor-intensive, involving tasks such as invoicing, payment tracking, and follow-up communications. However, as businesses scale, the complexity of managing receivables increases, often leading to inefficiencies and errors.

In 2023, many organizations still rely on outdated processes, resulting in delayed payments, increased days sales outstanding (DSO), and strained cash flow. As businesses adapt to a rapidly changing economic environment, the need for an agile and efficient AR process is paramount. This necessity has catalyzed the shift toward automation, enabling organizations to streamline operations and enhance financial performance.

Key Trends Shaping AR Automation Software

As we look ahead to 2025, several key trends are emerging that will shape the future of AR automation software:

1. Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are set to revolutionize accounts receivable automation. These technologies allow software to analyze vast amounts of data, identify patterns, and make intelligent predictions about payment behaviors. By leveraging AI and ML, AR automation solutions can automate tasks such as credit risk assessment, payment reminders, and dispute resolution.

In 2025, we can expect AR automation software to become increasingly sophisticated, with capabilities such as predictive analytics that help businesses forecast cash flow more accurately and optimize their credit policies. By understanding customer behaviors and payment trends, organizations can make informed decisions that enhance financial efficiency.

2. Integration with Other Financial Systems

As businesses adopt cloud-based financial technologies, the need for seamless integration between different systems becomes critical. In 2025, AR automation software will likely be designed to integrate effortlessly with enterprise resource planning (ERP) systems, customer relationship management (CRM) tools, and accounting software.

This level of integration will enable organizations to create a holistic view of their financial operations, improving data accuracy and reducing manual data entry. By connecting AR processes with other financial functions, businesses can achieve greater efficiency and gain insights that drive strategic decision-making.

3. Enhanced User Experience and Accessibility

User experience will play a pivotal role in the adoption of AR automation software. In 2025, we can expect a focus on user-friendly interfaces, mobile accessibility, and customizable dashboards that cater to the specific needs of finance teams. As remote work continues to be prevalent, AR solutions that offer flexibility and accessibility will be highly sought after.

Moreover, enhancing the user experience will encourage greater engagement with the software, empowering finance teams to leverage its full potential. Training and onboarding processes will also evolve, utilizing virtual and augmented reality tools to provide immersive learning experiences.

4. Advanced Reporting and Analytics

In 2025, the demand for real-time reporting and analytics will be greater than ever. Businesses will require insights into their accounts receivable processes to make data-driven decisions quickly. Advanced reporting features in AR automation software will enable finance teams to track key performance indicators (KPIs), monitor cash flow, and identify trends.

With robust analytics capabilities, organizations can gain deeper insights into customer payment behaviors, helping them refine credit policies and improve collections strategies. The ability to visualize data through intuitive dashboards will also facilitate better communication across departments and with stakeholders.

The Benefits of AR Automation Software

The adoption of accounts receivable automation software presents numerous benefits for organizations looking to enhance financial efficiency. Here are some of the key advantages:

1. Improved Cash Flow Management

By automating the accounts receivable process, businesses can accelerate the invoicing and payment collection cycle, leading to improved cash flow. Timely invoicing, coupled with automated payment reminders, ensures that customers are prompted to pay on time, reducing days sales outstanding (DSO) and minimizing cash flow gaps.

2. Enhanced Accuracy and Reduced Errors

Manual data entry is prone to errors, which can lead to discrepancies in invoicing and payment tracking. Accounts receivable automation software minimizes the risk of human error by automating data capture and processing. This increased accuracy not only improves financial reporting but also enhances customer satisfaction by ensuring proper billing.

3. Cost Savings and Increased Productivity

Automating repetitive tasks frees up valuable time for finance teams to focus on strategic initiatives. By reducing the time spent on manual processes, organizations can achieve significant cost savings. Additionally, increased productivity allows finance professionals to engage in higher-value activities, such as relationship building with customers and analyzing financial performance.

4. Better Customer Relationships

Accounts receivable automation software enables businesses to engage with customers more effectively. Automated communication, such as payment reminders and notifications, fosters transparency and keeps customers informed about their accounts. By streamlining the collections process, organizations can maintain positive relationships with clients while ensuring timely payments.

Challenges to Overcome

1. Resistance to Change

Change management can be a significant hurdle for organizations adopting new technology. Employees may be resistant to transitioning from familiar manual processes to automated systems. To overcome this challenge, businesses must invest in training and support to help employees embrace the new technology and understand its benefits.

2. Data Security Concerns

As with any financial software, data security is a paramount concern. Organizations must ensure that their accounts receivable automation software complies with industry standards and regulations. Implementing robust security measures, such as encryption and multi-factor authentication, will help mitigate risks and protect sensitive financial data.

3. Initial Investment Costs

While the long-term benefits of AR automation software are significant, the initial investment costs can be a deterrent for some businesses. Companies must carefully evaluate their return on investment (ROI) when considering automation solutions. Many vendors offer scalable pricing models, enabling organizations to select options that align with their budgets and growth plans.

Conclusion

As we move toward 2025, the future of accounts receivable automation software looks promising. With advancements in artificial intelligence, seamless integration with other financial systems, enhanced user experiences, and robust analytics capabilities, organizations have the opportunity to transform their accounts receivable processes and achieve unprecedented financial efficiency.

By embracing automation, businesses can improve cash flow management, enhance accuracy, reduce costs, and foster better customer relationships. While challenges may arise during the transition, the long-term benefits far outweigh the initial hurdles. As the financial landscape continues to evolve, organizations that prioritize accounts receivable automation will position themselves for success in the competitive marketplace of 2025 and beyond.

Explore

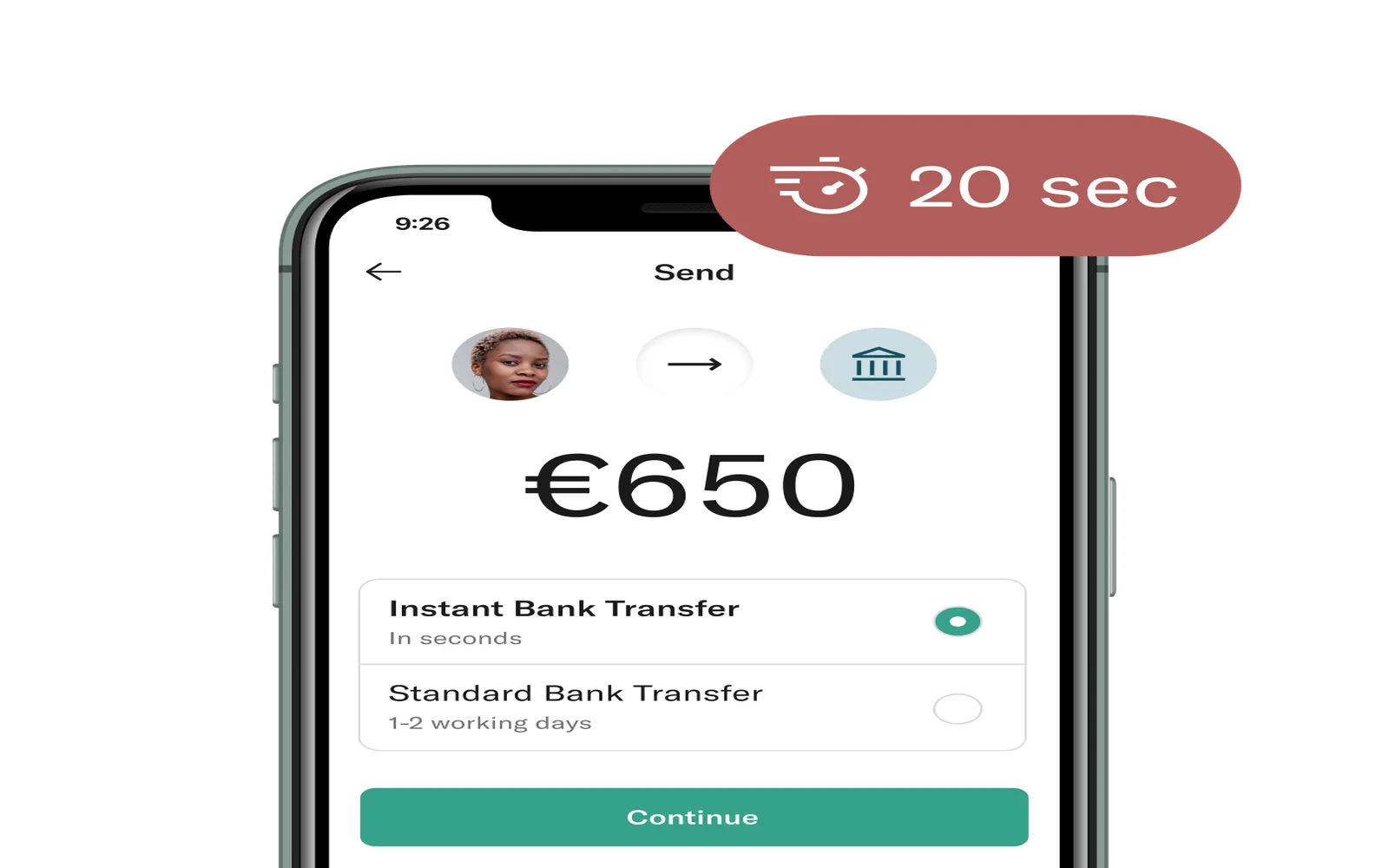

Instant Money Transfers to Bank Accounts: The Future of Fast Payments in 2025

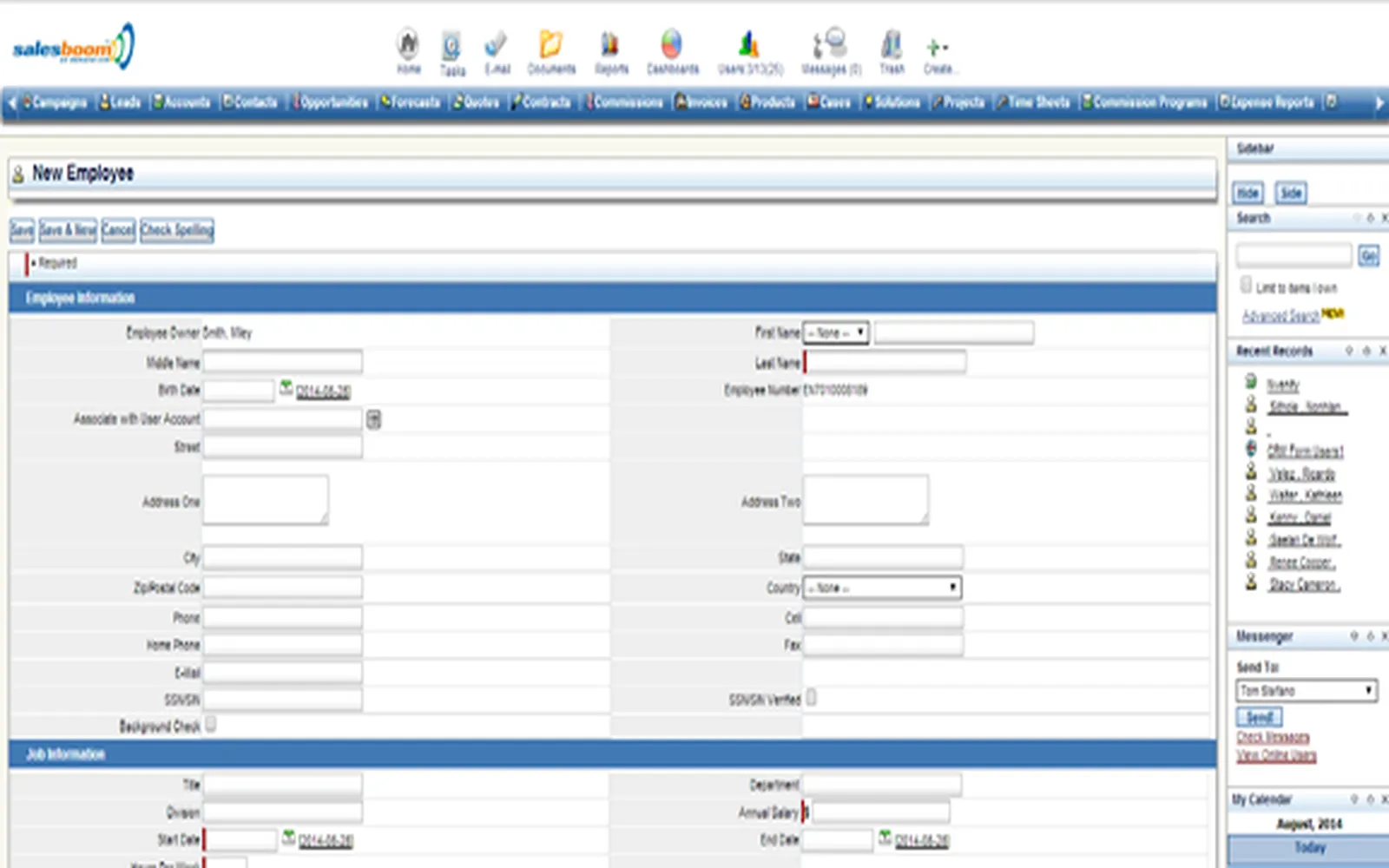

Transforming Employee Management: Top Software Solutions for 2025 and Beyond

The Best Financial Advisors of 2025: Your Guide to Smart Financial Planning

Find Top Retirement Planning Advisors Near You in 2025: Secure Your Financial Future Today!

Zepbound's Weight Loss Revolution: Transforming Lives in 2025

Transforming Mental Health: The Rise of Online Counseling Services in 2025

Transforming Communication: Ooma Business Solutions for 2025 and Beyond

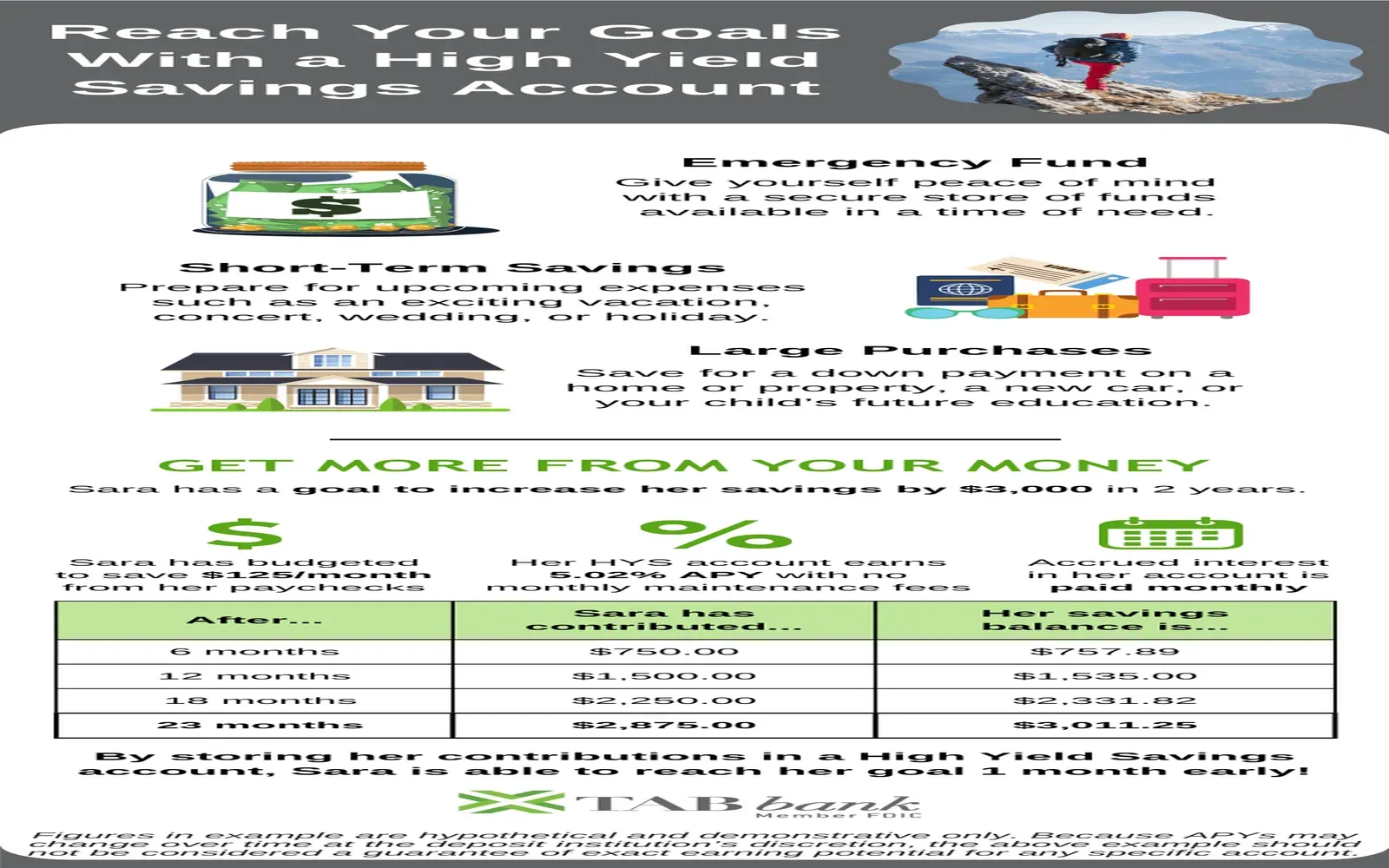

Best High-Yield Savings Accounts of 2025: Maximizing Your Savings Potential